Accounting Irregularities and other shenanigans at SmartRent (SMRT-US)

A closer look at 4Q results and some accounting irregularities that I can't wrap my head around

Two things in this post.

I’ll quickly go over Results/Guidance, but you can do that yourself if you want more detail.

Digging into some more accounting shenanigans at the company.

1 - 4Q Results

4Q results were pretty lacklustre, main highlight being that volumes have continued to decline and losses continue to mount.

Organic Revenue increase 11.2% YoY.

Hardware revenues down -17%.

Services revenues up +19%.

Organic hosted services revenues up +107%.

Note that there was a big jump in services in 1Q/2Q22, and that QoQ growth was much more modest at ~11%.

Unit Deployments declined by -18% YoY, which would imply that hardware price/mix was ~falt YoY. This is an acceleration from -10% in 3Q22. However, it’s hard to draw conclusions as the company’s revenue is so choppy.

Sightplan (acquisition from early 2022) Revenue declined for a 2nd quarter in a row - not great for a SaaS business.

Gross margins in hardware increased to ~15% (more on this in a bit), their highest ever level. Services margins remained signficantly negative such that Hardware + Services still generated a -17% margin in the quarter.

Hosted Services margins increased to 60%, also their highest on record (also more on this in a bit).

Operating costs declined by ~6% QoQ but increased as a % of revenues. For the year, operating costs were ~63% of revenues, or 7,834% of Gross Profits. Even if we assume that Hardware + Services revenues eventually hit break-even on the Gross Profits level, operating costs are still >430% of hosted services gross profits.

Units Booked was -21% YoY, or ~flat QoQ, suggesting that re-acceleration in unit growth in the coming quarters is unlikely.

Adjusted EBITDA remained negative, quite considerably so, at -$14m in 4Q. This excludes stock-based comp of ~$3m. Putting SBC back in, the adjusted EBITDA margin in 4Q22 was -47%.

With all the moving parts, I think that units deployed/units booked is the best proxy for the company’s growth. Ultimately, it is the number of units that it deploys which will dictate its future revenue oppourtunities. With unit bookings stalling and unit installations falling, SmartRent appears far from the high-growth business that management would have you believe it is, and losses continue to mount.

Guidance

The company guided for $55-58m in sales in 1Q23, and $225-250m in FY23. This would imply a ~42% growth-rate for FY23. How, with slowing volumes, stagnant bookings and a rapidly decelerating revenue growth exit-rate of 17% YoY in 4Q22, is the company going to achieve that?

Some accounting shenanigans might help.

2 - Accounting Shenanigans - highlighting a few flags

Flag #1 - change in revenue recogntion to boost revenues and margins

This quarter, the company highlighted a change in its revenue recognition. Previously, as discussed in my original note, Smart Hub Amortization was included in hosted services. As a reminder, the company sells a piece of hardware with its software and then recognizes revenue on it over the life of the contract on an amortized basis. Generally, the company is paid upfront (hence the large deferred revenue) and the hub is amortized over time. The CFO said on the call that it is done over ~4 years.

And the explanation in the 10-k. You can read for yourself, but the other key point is that the Hub will now be recognized as Hardware and not Hosted Services.

This is related to the company’s new ‘Fusion Hub’. You can see that in the past 10-k, the revenue recognition specified that the Fusion Hub would be treated differently as it also has an attached thermostat, which apparently means that it can be used without the company’s software.

The earliest mention of the Fusion Hub was a press release back in late 2019. However, this may simply have been development. By all accounts, the Fusion Hub was only released in 2022. This press release by SmartRent suggests it was released this year. Oddly, the new hub got no press from SmartRent in 2022.

In 3Q21, the CEO spoke about supply constraints with the Fusion Hub.

It seemed to last until 3Q22.

Then, in 4Q22, it appears that they began shipping the new hubs (re-iterating CFO comments from above).

So, it would appear that the Fusion Hub started shipping in late 4Q22. The company also remains confident that supply chain issues are behind them.

What’s the So What of all this? The new Hub revenue, which started shipping in late 4Q and will continue in 2023, will have a significant impact on the company’s accounts. Below is how:

Under the old accounting system, if SMRT gets paid $100 for each hub and recognizes that over 4 years, it would take $100 of deferred revenue, and then book $25/year in revenue (assuming straight-line). It appears not to be straight-line, but for the sake of this example I will assume that it is.

In-fact, in a given quarter, it would book only $6.25 of revenue, and depending on at what point in the quarter the sale was made, even less.

Under new recognition policies, the company would recognize $100 of revenue upfront in the above example when the hardware is shipped, and record no deferred revenue.

Hence, a sale that would have previously generated <$6 of revenue in a quarter will now generate $100 of revenue in that quarter.

This also has an impact on gross margins and signficant impact on EBITDA margins. Hosted Services margin is dragged down by the Hub Amortization, as it is lower margin than software. However, the Hubs have a higher margin than the current hardware line (which is all 3rd party hardware), so it will increase hardware margin. In addition, EBITDA margins will improve as gross profit is added to the income statement with no corresponding increase in fixed costs.

The impact of this change is hence:

Increase revenues quite considerably.

Increase hardware margins.

Increase hosted services margins.

Deferred revenues will fall over time.

No impact to cash.

It’s really hard to quantify this because we don’t know the exact accounting policies and/or margin profile of the current Hub sales. But below is an illustrative example of how it would flow through the revenue line of the PnL in our above $100 Hub example.

The below assumes the following:

Fixed number of sales of hubs per quarter, giving $100 of sales per quarter.

Recognizing that at a straight-line over 2 years = $6.25 per quarter.

in 3QY2, I change the policy to be 100% recognition at point of sale.

The effect of the accounting change leads to a significant spike in revenues, which then gradually declines as the legacy deferred revenues roll-off. None of this has any impact on cash receipts.

It’s impossible to say what the magnitude will be for SmartRent as we don’t know the exact policies, however given that the company claims to amortize the Hub over 4-years, it could potentially be even more significant than above.

The company claimed that it began shipping the new Hub with the new accounting policy late in 4Q, which would explain the spike in margins for hardware and hosted services in 4Q.

This all comes at a time when volumes are slowing, and the company is under pressure to show improvements in operating losses. In-line with this, the company’s tone on calls has changed. First, the company neglected to include units in its guidance this quarter.

One analyst from Deutsche followed up on why unit counts were excluded and the company’s response was less than comforting.

The company is trying to prepare the street for the narrative that revenues can grow considerably without units increasing. This will give it a big short-term sugar hit, wich will give the impression of an expanding ARPU.

What might the impact be? It’s very hard to say, because the company’s disclosure of deferred revenue is poor (see flag #3). It will depend heavily on the amortisation schedule, growth in booked units, etc.

In perpetuity, a fixed straight-line amortization schedule will be equal to the annual amortization amount (this is how depreciation is supposed to work). However, when the bookings number is growing (as it is), then amortised revenues could be under-stated in the short-term, which appears to be the case here.

Between 3Q22 and 4Q22, hub amortization increased by ~$0.7m. If we assume that none of the historic amortisation rolled off, or that the roll-off was very little (the company was signficantly smaller 4-years ago), then than $0.7m addition (if amortised on a 4-year straight-line basis) would imply sales of $11.2m.

There are a lot of assmuptions here, but we can see that this has the possibility to be extremely impactful. In this scenario, the company would have booked $11.2m in hardware revenue instead of $0.7m in Hub Amortisation. There is no cash-impact to the company in this scenario.

Another way to look at it is by grossing up all of the deferred revenue in any given period and adding it back to the PnL. The problem with this is that there is a signficant portion of deferred revenue which pertains to long-term software contracts, and it wouldn’t make sense to do that.

That being said, even if you do complete this excercise, one can see that the company is still unprofitable on a cashflow basis.

Here, I have made a few adjustments. The bottom-line shows the company’s operating cashflow excluding SBC (effectively giving the company a free-ride for $12m/year in expenses) and W.C. (which should is a drag for a growing company). It still burned nearly $40m in cash, even after adding back all of the deferred revenue/cost of the period into the PnL.

This is a crude way of saying that even if we recognized all of the cash receipts throughout the year for Hub Amortization and long-term software contracts, the company would still have a negative operating cashflow margin of ~24%.

Hence, whilst this accounting change will have the impact of increasing sales and improving EBITDA margins, it will have no impact on the company’s cash-economics, which in my view remain severely impaired.

Flag #2 - I can’t reconcile the company’s ARPU and Volumes to Revenue

Something funky is going on with the company’s hardware revenue, I just can’t quite understand it.

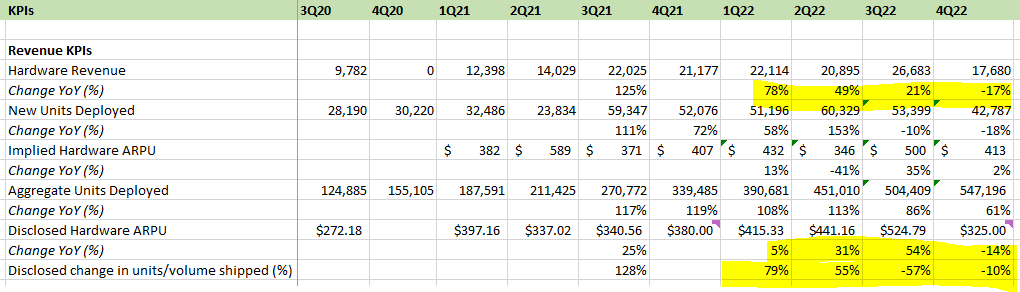

For starters, the ARPU and units shipped simply don’t reconcile with changes in revenue. Below is how the company defines Hardware ARPU as per 10-k. “Units Deployed”, by the way, is different to units shipped, as revenue is recognized in the hardware business when units are shipped, not installed. So units deployed is only useful for a proxy on activity.

Here is a table for the breakdown of hardware revenue from 1Q-3Q22 and FY22. You can go back through the Qs if you want to check-out the raw numbers, but I’ve given one snippet for illustrative purposes.

Something isn’t adding up. ARPU + Units Shipped is significantly higher than revenue growth. For 4Q, we aren’t given quarterly figures. Here are the snips from 1Q, 2Q and 3Q as to how I got ARPU growth and Units Growth.

The biggest discrepancy is 2Q. Revenue growth from units shipped is 55%, and ARPU increased by 31%, yet total revenues were only up 49% YoY. How is that possible?

Then, for 3Q, the company neglected to disclosed unit shipments for the 3-months ended September, but noted that 9-months to September saw volumes up ~10% YoY. This, again, seems impossible. If 1Q was +79% and 2Q was +55%, that would imply that shipments were down in 3Q by -58% YoY. With revenues +21% in 3Q, that would imply an APRU increase of 79%.

If we follow along for FY22 numbers, implied ARPU in 4Q is only ~$325, or down significantly sequentially and YoY. It also implies that shipments were down ~10% in 4Q22.

It’s one thing that shipments are down a lot in 2H22. But I just don’t understand why volumes and ARPU don’t reconcile with revenue.

After a bit more digging, I have one theory. The company’s hardware revenue is mostly non-Hub hardware – mostly 3rd party stuff like locks and thermostats. However, the ARPU is described as “total hardware revenue” divided by “number of hub devices shipped”. This makes no sense – why would you calculate ARPU of the sales of one thing divided by the shipments of another. I assumed that it was just an error, and that actually it means ARPU for hardware devices. I have no idea why the company would calculate ARPU in this way, but if it is the case, then it would explain why the two don’t match up.

The software ARPU is bogus too - it just makes no sense. The company defines ARPU as follows:

SaaS is an ongoing subscription. A true “revenue per user” should be “revenue divided by total users”, not “revenue divided by users added in this period”. Of course ARPU is going to naturally grow every year if you include revenue from past periods with only users of current period. Either this KPI is purposely misleading or the company has some seriously deficient financial folk.

In addition, whilst even the copmany’s defined SaaS ARPU increased by 17% YoY from FY2021 to FY2022, it was not a key driver of organic SaaS revenue. This is relative to organic SaaS revenues which increased by ~125% YoY. The key driver was deployments, not cross-sell as the company might want to have you believe. Unit deployements absolutely are a driver of the company’s revenues.

Flag #3 - There’s something funky going on with deferred revenues

I tried to have a look at the company’s current deferred revenues for hosted services (namely, amortization of Hubs) and work backwards from that (un-amortize it) to assess what the revenue impact would be of the accounting change.

It was more difficult than I anticipated - I can’t understand the accounts. Below is the company’s RPOs, which shows how deferred revenues flows throughout the year.

We can see that it notes advance payments for non-distinct hubs (basically all hubs for this period as shipments for the new hub only started in late 4Q, as I understand it) and advance payments for customers for subscription services. However, when we tally the revenue recognized from balance of deferred revenue + revenue recognized from revenues origiation and deferred during the period, we get a figure much larger than the recognized revenues for hosted services (software + hubs amortization).

Here, for 2022, we have: $41.5m + $25.9m = ~$67.4m of deferred revenue that was recognized throughout the year. However, the company only generated ~$48m of hosted services revenue. In 2021, the company generated $18.3m in hosted services revenue, but according to the RPO note, it recognized $11.7m + $31.3m = $43m in deferred revenue.

Revenue is recognized for hardware upon shipment, and recognized for services on a pro-rata basis as installation work is completed. It makes no sense to me that the company’s deferred revenue recognition in any period is larger than the revenue of the segment where revenue is deferred. The company has to be recognizing some deferred revenue in hardware and/or services. If I were in dialogue with the company, I’d want to understand why, and if so, why they haven’t disclosed that in the footnotes.

I’m not suggesting anything nefarious here, but I can’t see a simple explanation as to why this would be the case. It’s possible that, perhaps, the company is taking payment for hardware and services at the same time when units are shipped, and seeing as there is a lag between shipments and installation work being completed, this creates a deferred component for the services. Still, the company hasn’t disclosed this, even if it were the case.

It’s also somewhat curious that short-term deferred revenue increased considerably between FY2021 and FY2022. Over the period, ST deferred revenue almost doubled, but LT deferred revenue barely increased by 12%.

Is this a result of more aggresive recognition policies? More short-term contracts? Hard to understand what is driving that and no commentary has been given. It doesn’t make much logical sense to me.

Summary

I don’t have a smoking gun on SMRT, but the company’s accounts are a total mess. When you strip back the hyperbole around cross-sell, huge TAM and profitable software transition, what you get is a business which has negative cash-economics, is showing no growth in units (in-fact, the opposite) and has very messy and misleading accounting.