*By continuing to read this article you agree to the disclaimer at the bottom of this page.

APLD released 4Q earnings last night. The stock performed well, +14%. The key highlight was the huge guidance. In this post I will run through how the numbers make no sense.

Unpacking Guidance

The company provided the following guidance:

Below I breakdown the company’s revenue contribution from individual assets to bridge to 2024 guidance.

Jamestown, North Dakota (JT) - 100MW

JT has been operating since 2022. It has ~100MW of capacity and has been running at full capacity over the past two quarters, according to comments made on the company’s 3Q and 4Q earnings calls. Here is a snip for the 3Q call.

So at full capacity the facility generates ~$14m of revenue per quarter. Lets call it ~$60m/year for 100MW. This is running at full capacity now and should contribute ~$60m in revenue in 2024.

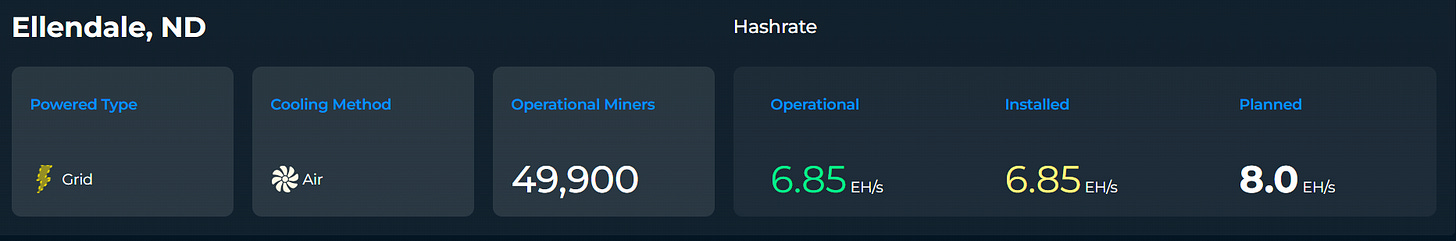

Ellendale, North Dakota (ED) - 180MW

Ellendale was fully energized in the last quarter, though the company didn’t comment on its capacity utilization. We know that this facility has been 100% contracted by Marathon. According to Marathon’s website, they are operating all of the installed units, but have additional planned capacity. So judging from this, the facility appears to be operating at ~86% capacity. I’m not sure exactly what the hold-up is to get more installed. I suspect that the company’s expectation is that it will continue to ramp to full capacity this year.

Garden City, Texas (GC) - 200MW

The GC facility is still not fully operational. Marathon has installed its miners there (reminder, Marathon is taking a bit less than half of the facility - 90MW of the total 200MW available). The company expects that it should energize in the coming days/weeks. Given that the company has a May year-end, we can probably assume that at best the facility will be fully operational for 3 quarters this year if it energizes and ramps in August.

Total Contribution

The company noted on the call that it expects $300m of revenue and $100m of EBITDA (~33% margin) from the three facilities once fully ramped.

My rough math - taking the $60m of JT for 100MW and using that as a basis for the other two facilities - is more or less around the mark.

The EBITDA margin makes sense if you are talking about purely segment margins, because then EBITDA is effectively equal to Gross Profit. Below we can see that GP Margins, ex D&A, are in that 32-35% range running at full capacity.

So given this, below are my forecasts for 2024

BTC Hosting Forecasts 2024

In the below example, I asume the following:

JT runs at 100% capacity.

ED runs at 95% capacity over the year - it is currently at ~86% according to Marathon’s website, so I assume that they switch on additional miners throughout the course of the current quarter, and run it at 100% for the remaining three quarters.

Garden City runs at 75%. I assume that it energizes in the coming week and then ramps up over the course of the August to run at 100% for the rest of the year. Marathon’s equipment is already installed, and presumably their other customers equipment is also.

This gets us to ~$253m revenue and $83m in adjusted Gross Profit (excluding D&A) - which is effectively segment EBITDA.

Now we have to add in overheads for the entire business. I’ve been pretty generous here, and effectively assumed that there is no increase in SG&A from 4Q’s annualised figure, despite the fact that the company is trying to stand up an AI business and hiring for that aggresively.

I’ve also been generous and excluded SBC and D&A.

Annualizing the $6.2m in 4Q adjusted SG&A gives an annual figure of ~$25m.

Working backwards from the midpoint of guidance - $395m of sales and $200m of Adjusted EBITDA, we get the following projections for the AI Business.

So, in order to hit guidance (based on my projections above), the company needs to generate $142m of revenue from the AI business in 2024, at effectively a 100% EBITDA margin. And that’s all without adding a single dollar of cost to SG&A from their 4Q run-rate. So, effectively, no hiring for the AI business.

Character AI, the company’s first AI customer who has just finished onboarding, has signed a contract for up to $180m over 24 months, which is expected to be fully operational by the end of the year. This contract would be worth $90m/year, if it had run at full capacity. Even if they managed to ramp the customer up by the end of next month to 100% capacity, it would still fall short of the required AI revenue requirement by ~50%.

The second “mystery customer” is expected to ramp up later in the year. That customer is worth ~$150m/year. So if we get that fully ramped by the end of November, it can contribute ~$75m for the year. Put those two together, and the company can hit its revenue forecast if all goes to plan.

How, exactly, it plans to hit its 100% EBITDA margin is unclear - especially considering that a large chunk of this revenue will be hosted using Colo facilities, meaning that they need to pay both fees and energy costs to the co-location provider.

Lets not forget that the company’s new AI business model is effectively buying machines and leasing them out. It is a very capital intensive business - the largest cost will be depreciation, and it will need to fund these costs also through interest bearing liablities. Pre-payments is not free money - it must eventually be replaced in the capital structure. It makes no sense to exclude D&A or interest costs and I would urge investors to pay attention to the GaaP economics of the business, not EBITDA. But I digress…

In the company’s investor deck from May 2023 (and even on the 4Q call), they even stated that Colo EBIT margins were expected to be 40%, and next-Gen HPC at 40-50%. Let’s leave aside that this would imply the company is more profitable that AWS for a second.

It shall be interesting to witness the real economics of the AI business as it ramps up - and I’ll eat my humble pie if the company hits its guidance. In fact, I’ll even consider going long if someone can explain the math to me.

Disclaimer

You agree that use of Guasty Winds Management LLC's (“GWR”) research is at your own risk. In no event will you hold GW Research or any affiliated party liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence before making any investment decision with respect to securities covered herein. You represent to GWR that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this site. You further agree that you will not communicate the contents of this report to any other person unless that person has agreed to be bound by these same Terms of Service. If you download or receive the contents of this report as an agent for any other person, you are binding your principal to these same Terms of Service. You agree and acknowledge that the materials, opinions and contents available on this website (or any other GWR social media platform, including Twitter, Instagram, Snapchat or Facebook), are not investment recommendations and are indeed not recommendations of any kind.

This website contains solely our investment opinions. We are invested behind our investment opinions. Material on this website and all statements contained therein are solely the opinion of Guasty Winds Management, LLC, and are not statements of fact. Our opinions are held in good faith, and we have based them upon publicly available evidence collected and analyzed, which we set out in our research reports to support our opinions. We conduct research and analysis based on public information in a manner that any person could have done if they had been interested in doing so. You can publicly access any piece of evidence cited in on our website or that we relied on to write our repots. Think critically about our reports and do your own homework before making any investment decisions.

You should assume that as of the publication date of our reports and research, GWR (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors and/or their clients and/or investors has an investment position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds covered therein (either long or short depending on our investment opinion), and therefore stands to realize significant gains in the event that the price of changes in conjunction with our investment opinion. We intend to continue transacting in the securities of issuers covered on this site for an indefinite period after our first report, and we may be long, short, or neutral at any time hereafter regardless of our initial investment opinion.

Nothing contained on this website is an offer to sell or a solicitation of an offer to buy any security, nor shall GWR offer, sell or buy any security to or from any person through this site or reports on this site. Guasty Winds Management, LLC is not registered as an investment advisor in any jurisdiction. The content and materials contained on this website are provided for information purposes only and nothing contained therein is investment advice nor should it be construed as such. Prior to making any investment or hiring any investment manager you should consult with professional financial, legal and tax advisors to assist in due diligence as may be appropriate and determining the appropriateness of the risk associated with a particular investment. Users of the GWwebsite and any material contained therein shall not use the site at any time for any purpose that is unlawful or prohibited and shall comply with any applicable local, state, national or international laws or regulations when using the site.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Our research and reports express solely our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. GWR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and GWR does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link:

http://www.gw-research.com

or a sublink to a specific report. If you have obtained a GWR research report in any manner other than by download from such links, you may not read such research without going to that link and agreeing to the Terms of Service.

Any links from our site or our reports are provided for viewer convenience. GWR is not associated or affiliated with any linked sites. Independent providers have prepared all information accessible through these links.