Cleanspark Inc. (CLSK-US) - The anatomy of a penny pump

A tale of how incompetent liars make a lot of money

Side note/transparency statement/disclaimer: I am not short this company and will not profit from it falling. I was short it in the past via put options which have since expired. An ex-employer of mine may also have been short in the past but is not currently. I am not aware of anyone that is short. I have not been compensated by anyone to release this work. All of the following is my opinion. Please read the disclaimer at the bottom before reading the rest of the work. This is not intended to be a short-report. It is simply a collection of facts based on publically avaiable information.

Foreword

Unlike other stocks I post about, I’m not short Cleanspark. It has already by-and-large collapsed and since I exited the position, the company has shifted towards Bitcoin Mining. I don’t really understand the Bitcoin Mining business and don’t think there is enough juice to warrant spending my time trying to understand it.

However, I wanted to release this work as I think some may find it interesting. This was an exhausting, multi-month long process of relentless digging. I actually hope for their retail shareholders’ sake that their bitcoin mining operations work out.

In this new-age world of twitter hot-takes, newsletter stock write-ups (ironically, like this one), over-reliance on management conferences, expert calls, podcasts and technologies like factset which kick-out adjusted past-financials, I have come to the conclusion that most people really don’t read filings or accounts anymore.

If nothing, I hope that this is a lesson in the importance of doing proper due-diligence.

Also, quickly, if you enjoy my work, please consider donating. I have a couple of really great write-ups coming soon. I don’t want to put my work behind a paywall, but if I can’t pay the bills, I might have to.

Intro

At some point in late-2020, I stumbled across this company called Cleanspark. It claimed to be a leading “MicroGrid” company but barely had any revenues and was burning cash. I couldn’t find out anything about it online other than a few old press articles stating that the company had won some contracts with the military, so I figured it was legit. I didn’t really know what a microgrid was or how the company made money, but whatever - it’s the military, maybe I’m not supposed to understand it. It was expensive and loss-making, so I just decided to move on.

Then Culper Research wrote-up a short-report on the company. If you guys don’t know Culper, go check them out. They do great work and have a strong track-record. I conversed with one of the guys there once (I have no idea who they are), and they are a really smart bunch.

Culper did some really good work, but they didn’t have the smoking gun. After I read the report, I went back and dug a little bit more. I soon realised that this ‘company’ had some.. lets say, issues. There was much more to the story.

Cleanspark’s origins

The details on the founding of the company are a little shaky. According to the company’s first 10-k, in 2013, Harper Construction Services was awarded a contract to support a microgrid technology demonstration project. CleanSpark was subcontracted to provided design, development, integration, and installation services for the FractalGrid. Cleanspark’s product was a SCADA-based energy management software that ran a micro-grid, and was supposedly reasonably sophisticated for its time. Cleanspark was essentially born out of a grant given by the US Navy base to erect a microgrid at the Camp Pendleton base in California circa 2013 - see here.

Four guys from Harper Construction, who I understand to be Mike Firenze, Bryan Huber, Anthony Vastola and Kevin Pattee, started the business. They then hired software brains to help build the product - Art Villanueva and Jennifer Worral. The software was deployed in late 2014 and was a success – it got a lot of good press. The team grew, and at one point was as big as ~20-30 people.

In 2015, the firm got itself into financial trouble. In late 2015, the company received two offers – one from Edison, and another from an unnamed renewables funding partner. The first offer from Edison on October 20, 2015 was just for the software, meaning that construction management wouldn’t be required to stay on at the business. During due diligence, the company received another structured-debt offer from a ‘private funding partner’ where funding would be offered for projects and allow management to remain in control of the company. This was described in this Cleanspark SEC letter, but I was never able to verify that this offer actually existed.

According to new Cleanspark management, as described in that SEC letter, the ‘private funding partner’ didn’t have ‘sufficient capital’ and wasn’t able to follow-up on the deal, meaning that Cleanspark ‘was left without sufficient capital in May of 2016 and started seeking new offers.’

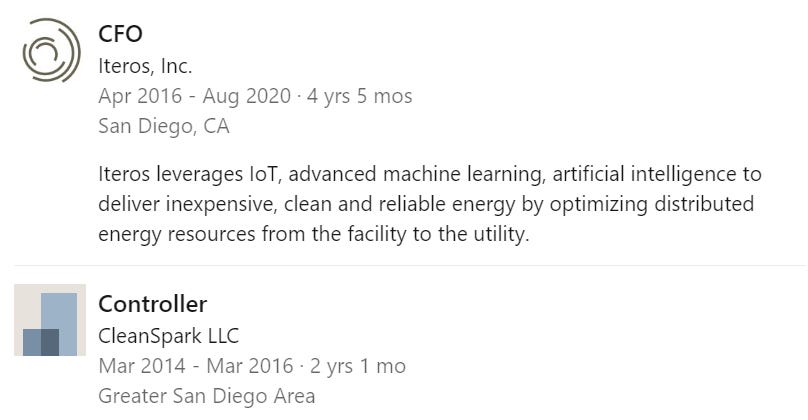

What transpired next is the most important part to understand: The vast majority of key staff left Cleanspark and started a new company, Iteros Inc. Iteros would be an exact replica of Cleanspark.

At this time, effectively ALL of the employees left at the same time to start Iteros. Here are some snips from LinkedIn (anonymizing names, but feel free to go look for yourself - it isn’t hard to figure out) of all the ex-employees.

Whilst Cleanspark had some success at Camp Pendleton, this was not a large-scale enterprise. Also, there was nobody left at the company that could have understood the code. This was a scrappy start-up with an interesting R&D project, not a commercialized product.

According to SEC filings, the first Form D for Iteros was submitted in April 2016 and the company was incorporated in May 2016. Employees left Cleanspark in ~March/April and funding with the ‘private partner’ fell through in May 2016.

None of this is fraud – just a failed start-up. But this context is important to understand what happens next. This provides the background info necessary to understand the next part.

A public company is born - Cleanspark Inc.

Shortly after all of Cleanspark’s employees departed in June 2016 to start Iteros, Cleanspark was sold to a shell company called Stratean, inc. in an all-stock deal, signed off by Michael Firenze. Stratean was a pink-slip shell company with no operations and no revenues. It was controlled by three men – Zac Bradford, Matt Schultz and Bruce Lybbert. Another man, Larry McNeil, was on the board and it is my understanding that he made the introduction to Michael Firenze to complete the deal. These men have vague internet profiles, but I can see that Firenze and McNeil were Facebook friends from at-least 6 months before the deal was officially signed from this post by Firenze, which was liked my McNeil. I don’t know for a fact, but that’s the only link I can find.

At the point of sale, we can see that the Iteros departure had already occurred. This registration filing in July 2016 shows that when Stratean purchased Cleanspark, it wasn’t able to retain any of the employees.

It also discusses past employees that may have had access to remove confidential information from its possessions. This is probably about Iteros.

In fact, the company had no employees at all.

Despite not being listed as employees, a few of the construction staff from the real Cleanspark days stayed on as executives at the company. Those included Anthony Vastola, Jeff Trueblood and Bryan Huber. Their roles included COO, Chief Innovation Officer, Chief Development Officer and Senior Electrical Engineer – the names changed over the years. Despite the fact that Firenze had sold the business and was no longer an employee, he gave this bizarre talk in April 2017 which is full of buzzwords, but there was never any proof that he was officially working for the company. He was listed as the company’s “chief development officer”. Vastola and Huber were made executives shortly after the merger.

In early 2020, Cleanspark fired Vastola and Huber, the last remnants of the old Cleanspark at the company.

I’m not sure if they were retained early on in the hopes that they could raise some money, hire some new software people and actually build Cleanspark into something, or if they were just there to perpetuate deceit. According to LinkedIn, Jeff Trueblood left in 2018.

At the time of the merger, Cleanspark had nothing. It didn’t have a product and it didn’t have any employees other than officers and directors (didn’t hire its first proper employee until mid-2017 with some money that it raised from a convertible which turned into a bitter shareholder battle). Why would Stratean buy a clearly broken company with no employees?

Who is Stratean Inc. and why would they want a company with no employees?

There are a lot of moving parts here and a couple of key actors, some who are still directly involved in Cleanspark and some who had key involvement along the way. It took me weeks of tireless work to tie it all together - the web of shell-companies and ties is deep and complex. I’m leaving a bunch of detail out here to shorten things but if anything is vague I can fill in the gaps.

On February 23rd, 2014, an empty shell appointed a guy named Bruce Lybbert as the sole officer and director of the company – it had no assets and no operations. Next, on March 6th, Zac Bradford was appointed as CFO. On March 13th, Matt Schultz came in as CEO. Approximately one year later on January 5th, they brought in Larry McNeil. These 4 men are the key perpetrators of Stratean.

There is very little information on Bruce Lybbert online. His bio states that he is a ‘wall street veteran’ and founded a company called Tel America which became the largest long-distance carrier in Western US. I’ve been able to find very few records of this company, but it seems to have been a communications roll-up according to this article. The article also states that Lybbert left the company in 1990, and it’s unclear what he got up to in the mean-time. The business was eventually sold in 2005 to UCN. I struggle to find much at all about Lybbert or how he knows any of these men.

Schultz’s bio is similarly vague, but it states that he was formerly the CEO of a company called Amerigo Energy. It turns out Amerigo Energy used to be an OTC listed stock, so I tracked it down and went through the old filings.

I won’t go into much detail here, but basically Matt Schultz, Bruce Lybbert and a guy named Jason Griffith were involved in a number of different shell companies across oil and gas, online gaming and green energy. It’s not clear to me how any of them know of each other, other than running in similar circles in the same towns. Jason is no longer involved in Cleanspark but he’s an important character and I understand that he may have introduced Zac Bradford (current Cleanspark CEO) to Matt Schultz (current Chairman).

In 2015, Jason Griffith’s accounting firm, De Joya Griffith lost its license for deficient audits allowing a huge penny stock pump-and-dump scheme. There are hundreds of shells linked to Jason and Jessica Griffith, including one that dates as early as 2002 with Matt Schultz as well. Zac Bradford also used to work at De Joya Griffith, according to this filing for a listed company that he used to be a director for. He has scrapped De Joya Griffith from all his BIOs, including his linkedin.

The details of their dealings in these shells aren’t so important, other than that they generally were not in any profit generating business – their ambitions appeared to be stock promotion. However, there is one important thing that happened throughout all of this. In 2007, amidst rampant promotion for Granite Energy’s oil and gas business, Schultz announced the formation of its ‘GreenStart’ alternative energy division, which was created through the acquisition of a company called N-Tek, LLC.

N-Tek was a tiny start-up founded by Alan M Neves and Grover R. Brockbank, which claimed to be commercializing gasification technology to turn municipal waste into energy. A textbook unsubstantiated claim from the company stated that it was “up to one thousand times more efficient than currently known technologies”. The release then states that “the potential exists to literally create fuels from municipal solid waste.” The company created a new company, Greenstart Inc., and stated its intention to distribute via a dividend a portion of its ownership. They purchased N-Tek using stock from one of the shells, which was at the time an oil and gas exploration company.

Next, a bunch of really complex transactions took place over a number of years across the shells, which aren’t terribly important. In around 2008, Schultz resigned from all of the shells and disappeared. Lybbert stayed around until late 2010, promoting the gasification technology. The latest press release even included a quote from Bruce Lybbert. The company announced that it was manufacturing the product, and Bruce was quoted saying: "They've been waiting for it. We've taken one of the globe's foremost problems and are creating an environmentally-responsible, perpetual energy solution out of it. Our ability to enroll three industry leaders into our vision stands as proof that something new and potentially paradigm-shifting is in the offing."

Then, they all disappear. The last SEC filing was in May 2010, and last press released in September. As filings stopped, it’s hard to know what happened here, but by the end of 2010 there was no more Lybbert or Schultz – they were gone and the shells were inactive. I can’t find any traces of them online after that.

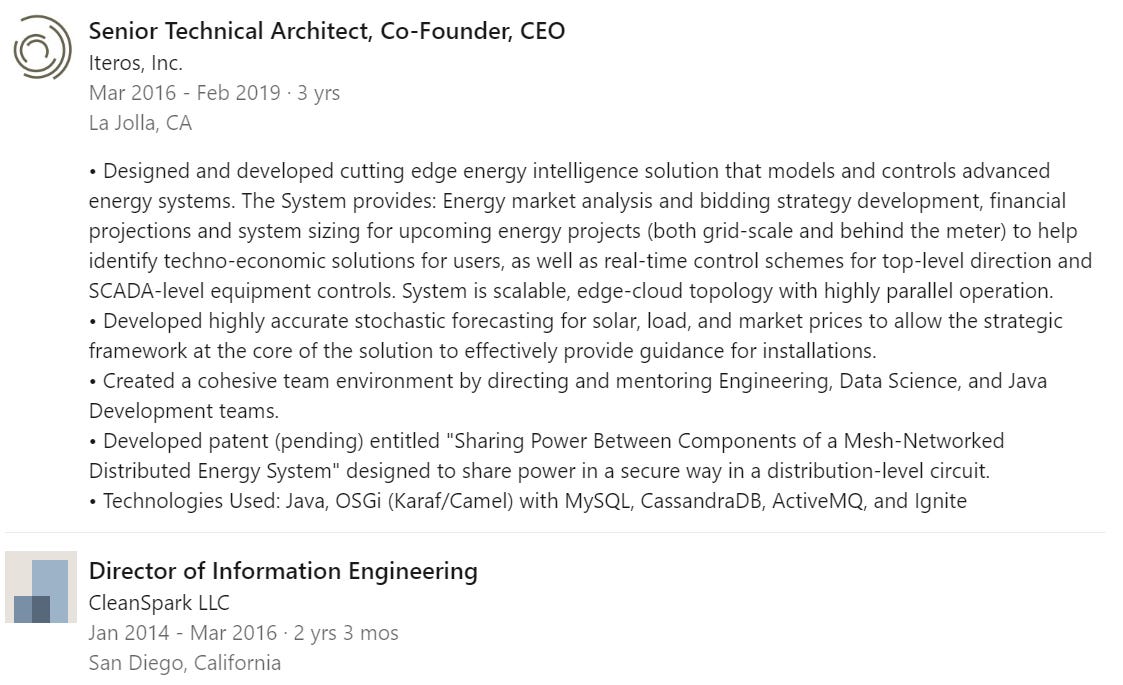

In 2013, things get moving again. Someone named Yuriy Semenov popped up in the Refill shell. What happened next is as follows:

In April 2013, Yuriy appears on the shell in its first filing since may 2010.

Soon after, Semenov resigns and another reverse merger is completed on 26th of July, 2013. Jeremy Roberts was the new CEO and his company is ‘Medical Cannabis Payments’ was merged into the shell. I reached out to Semenov, and he gave me a “no comment”. I couldn’t track down Jeremy Roberts.

3 days later, on July 29th, a company is incorporated named SMS Management Services. Its sole director is Sheree Schultz, Matt Schultz’s wife.

On August 14th, Roberts stated the following in a filing: “We intend to spin our energy business to our shareholders pending regulatory approval. In July, 2013, we formed a new Oklahoma subsidiary to hold these assets.” The patents and prototype, that the company had from Peterson Inc., were still in the old Refill shell.

On August 14th, the same day that to the release was made by Roberts, the patents were transferred from Refill Energy to SMS Management Services LLC.

In the next quarterly, filed 1st of October, the company states: We have declared a dividend to our shareholders of our formerly wholly-owned subsidiary, Refill Energy, and intend to spin it off to our shareholders pending regulatory approval. In July, 2013, we formed a new Oklahoma subsidiary to hold these assets. Historically, Refill was engaged in the business of developing patent rights represented by patent application 12170421, Parallel Path, Downdraft Gasifier Apparatus and Method. which was assigned to Refill pursuant to an assignment recorded on October 20, 2011. However, now, the patent is gone from the balance sheet (previously held at $350k) and no compensation was recorded.

In the 2017 annual filing, the following is stated: The shares of Refill Energy, Inc. have been set aside in the transfer agent records as a dividend to the Company's shareholders, but no distribution was ever made. As of the end of 2013 Refill Energy, Inc. was inactive, and the company has been dissolved. Refill Energy, Inc. is no longer treated as a subsidiary.

What happened here? It looks as though the patents were just given to Lybbert and Schultz.

So much more went on here. I traced the origins of the patent and actually deciphered that the two gentlemen who had published the patents - elderly, hardworking scientists - had passed away in ~2013. A prototype was created by Peterson Inc, and I’m not sure if the company ever repaid its debt, which may explain the constant shell-shuffling.

This brings us back full-circle to Stratean Inc.

Before I move on, I want to flag something else. Throughout my weeks of research digging into old OTC filings for the multiple shells that the guys got involved with, I checked out all of their auditors. Every auditor that touched either Granite, Amerigo or Greenstart (the three main shells), those being: Larry O’Donnell, Seal and Beers, LLC, LL Bradford, Cordovano and Honeck, LLP, De Joya Griffith lost their PCAOB license within a few years of auditing Schultz. Remember Jason Griffith? Yes, he was Schultz’s CFO at Amerigo and he lost his license. At CleanSpark, Schultz would appoint Seale and Beers, who were taken over by AMC, who also lost its license. This happened in a separate dispute, but it was at the fault of the auditor who was directly responsible for Cleanspark’s accounts. They’ve since been replaced by Malone Bailey who just got fined by the PCAOB, and is linked to a bunch of micro-cap SPACs.

And here is a Forbes article linking MaloneBailey to a bunch of questionable backdoor Chinese listings. Yes, they continue to do Chinese listings, such as this Chinese Crypto-mining Rig manufacturer just last year.

Okay - back to Stratean.

Stratean Inc.’s first act

So now we are back to the founding of Stratean. Stratean is born out of a merger between the empty shell and SMS Management Services. Below is the sequence of events:

Once they had the patents for the gasifier, in late 2014, they entered into a services agreement with a few companies to have a prototype tested. By December 2015, that was done, and they begun spruiking it with press releases like this and this. Though they made claims that the technology was performing excellently, by April 2016, the press releases abruptly stopped. In July 2016, a few months later, it announced the Cleanspark acquisition from Michael Firenze. In November 2016, after the merger, it changed its name from Stratean to Cleanspark and never spoke publicly about the gasifier again.

Larry and Schultz are also well acquainted, but again, it’s unclear how. Larry is friends on Facebook with Schultz, his son, his wife and even his mother. Larry McNeil’s background for the last 25 years is also similarly vague, but I can link him to at least one shell from the early 2000s. The stock price of the OTC shell went from $0.16 to $50, and back down again. He resigned in 2002. It doesn’t look like the company ever had a product or revenues.

It’s unclear if the Stratean folk, namely Schultz and McNeil, knew that Firenze’s firm had fallen apart, or if they just didn’t care. Perhaps Firenze had convinced them that they had great technology, and just needed to hire a few software people. Stratean already had a track-record of storytelling to try raise money, as they were doing with the gasifier, and Cleanspark came with some good legacy press that they could (and did) leverage for years to come. Either way, the merger went through, and Cleanspark was born.

5 years of lies at Cleanspark, before transitioning to Bitcoin Mining

What follows is a comprehensive assessment of the company’s press releases, SEC filings and to my knowledge, all of the projects that the company have claimed to have either booked or completed work on from 2016-early 2021 before it pivoted to bitcoin after raising a bunch of money. I assess every dollar of revenue booked and prove that the company never had any real sales. Some small releases, i.e unverifiable product wins with small solar installers, have been left out for lack of relevance.

In Aug 2016 the company announced the completion of a project at Ram’s Hill (see appendix for history of projects). This Project was completed by the old team using v1 software – the press release was just delayed. Even CleanSpark’s own website lists the completion date as 2015, prior to the Iteros departure. It delayed the announce of the press release in an attempt to show the market that it was making progress.

In Jan 2017, the company posted an investor deck. The presentation expected to get to sales of $15m in 2017 and >$100m in the next 5 years (in reality, the company produced ~$500k in 2017). The presentation was riddled with bogus projections, and relied heavily upon promotion of the Camp Pendleton project which was completed before the Iteros departure.

The company presented at a conference in early 2017. The 10-min talk was led by Firenze, and the presentation had no tangible information. It announced that the company had built a relationship with Webcor, who is the now employer (since May 2016) of Firenze. Firenze was spruiking mPulse, which he knew was doomed, and spoke about some potential projects which also never existed.

In May 2017, the company released a press article claiming to have completed the installation of a comprehensive residential microgrid in Southern California, which it had “engineered, designed and installed” and implemented the mPulse software. The 10-Q’s for March and June 2017 give some clues to what happened. For the 6 months to June, 25% of the company’s revenue came from “Firenze”, and 95% of the costs went to Simpliphi (the battery supplier, as per the press release) and CED Greentech, a San Diego residential solar distributor.

As per the talk given by Firenze, he was the company’s ‘Chief Development Officer’. It’s possible that the press release was related to a project on Firenze’s own home (he lives in Southern Cal, as per the release). I don’t want to speculate on what Firenze was buying off the company – its beside the point. Why was he a customer?

In July 2017, the company came out with another press release announcing it had been subcontracted by Bethel-Webcor JV to install a turn-key advanced microgrid system at the U.S. Marine Corps Base Camp Pendleton in a contract worth $900k. Bethel-Webcor was a JV formed between two construction companies. Webcor was the contractor on the Ram’s Hill Golf Course project – a project that was completed prior to the Iteros departure. CleanSpark also announced a strategic partnership with Webcor in late 2015, which would have been around the time of that project. After Firenze sold CleanSpark, he moved to Webcor and headed up the Bethel-Webcor JV – proof here and here. Hence, this was another related-party transaction. Perhaps the company didn’t need to disclose it because Firenze was not technically an employee. This was different to the initial microgrid at camp Pendleton upon which CleanSpark was born, so I was call this Camp Pendleton 2 to avoid confusion.

According to this article, Bethel-Webcor was awarded the contract in March 2016. In the company’s first 10-k filing, Bethel-Webcor was responsible for 100% of its revenue.

Bethel-Webcor continue to show up on the company’s 10%+ customers all the way until the company stopped disclosing it in 2019. It was described in the 2018 10-k that in May 2017, the company completed the first and second stages of a contract for $75k of engineering and design and $60k for optimization and control logic development. The project, however, was unspecified. Whether or not the work pre-dated Firenze is unclear, though the work that they did do for Bethel-Webcor pre-Firenze was not software sales – it was “design, engineering and construction revenues” as per the below snippet from the company’s 2018 10-K.

In August 2017, the company spoke at a Cannabis conference about how advanced energy and control solutions can be applied to the cannabis growing market. Then, in October, the company announced that Green Dragon, an agriculture cannabis company based in California, had contracted Cleanspark as its microgrid supplier. This sparked multiple articles (such as this one or this one, where Cleanspark paid for a promotions firm to write them) labelling the company as a “Cannabis stock”, catching on to the hot trend of the time.

Funding for the project was supposedly secured by a company called Salvenson and Associates of Newport Beach. A comment was given by a man named Kent Salveson, who gave a promotional spiel for the company. Kent Salveson is the CEO of a company called Clear Sun Corporation.

In the quarter ending December (press release was made in October), there was no increase in sales from Green Dragon. Instead, the company had just $18k in sales, about one-third of which came directly from Firenze again, one-third from Condinsine (which is in relation to an ongoing maintenance contract that pre-dates the Iteros departure) and one-third from ClearSun Corp. Green Dragon never came up in the results as a major customer. The information from the press release showed up in the “microgrid developments” section in the 2017 10-k, then it disappeared.

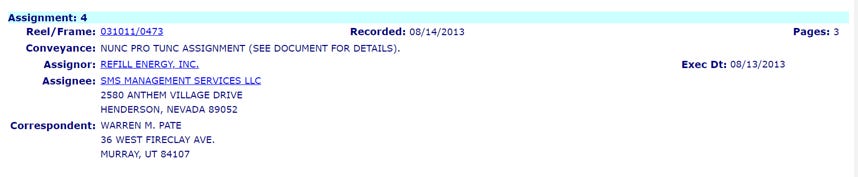

Another Short-Seller, who has written a report on this company contacted the CEO of Green Dragon. The transcript is below:

The Green Dragon project resurfaces again in an SEC correspondence dated March 2018, with details as follows:

This appears to have been entirely fabricated, if we are to believe Green Dragon’s CEO. 1% of $660k is $6.6k, which is exactly equal to ClearSun’s revenue contribution of 36.5% of $18,080 in revenues for Dec 31, 2017 quarter, as stated above. I’m not exactly sure what is going on here, but the company never booked any revenue from the Green Dragon contract. It hasn’t been mentioned since early 2018, and the contract was meant to be completed that year. It would have shown up as a major customer in 2018, as the company’s revenues in totality were less than the value of the contract. It is possible that this was some sort of investment-credit tax-scheme, but again, I don’t want to speculate.

In Feb 2017, the company released an 8-k stating that it was in the running to win a contract with a large REIT (we now know as Macerich). It had won $160k from the design and engineering initiative, and hoped to deploy three pilot grids if agreed upon with the REIT in the future, which could have the potential to generate millions of dollars. In a press article on the subject, Firenze stated that the company had a right of first refusal. These revenues did show up in the company’s accounts for that years.

From this SEC filing in early 2018, CleanSpark claims that it was expecting to win a $18.3m contract after completing this work. According to the filing, the company had presented to the Senior Vice-President in late Dec 2017 and received positive feedback “later that week”, but “was informed that key decision makers had left on vacation after the presentation and would not return until mid-January 2018 and as a result any decision would be delayed.” However, “Based upon feedback given by the Macerich sustainability team both verbally and via text messages, as of January 9, 2018, CleanSpark anticipates that Macerich will approve the project shortly after the decision makers return from vacation.” The company expected the full $18.3m project to be completed by September 2018.

The filing then went on to state “As of March 1, 2018, the Company has not yet executed the Macerich contract for The Pilot project. In mid-February, the Company was informed that Macerich had undergone a round of significant lay-offs at the Corporate level to reduce salaries by approximately 17 Million. This was given as the reason the contract negotiations had been delayed from closing. The Company has remained in contact with its designated point of contact at Macerich and on February 26, 2018 we were informed that the contract is still pending further review.”

In an 8-k released in October, an update was given showing that the project was moving ahead, and that the company had won another $88k of work from Macerich. This would include various consulting duties to be completed in the quarter, though further progress was subject to approval. The document stated that the “notice to proceed is subject to final Macerich approval at conclusion of final design and final pricing reviewed per the Design Build Lump Sum Project”. Despite this, In December 2018, CleanSpark’s CEO Zac Bradford wrote in a shareholder letter than the company had “executed an agreement for an $18.3 million 'Zero Net Energy' Microgrid with an S&P 500 Member Real Estate Investment Trust (REIT)”.

In a document from Cleanspark (Bryan Huber) to the California Energy Comission (CEC), dated August 2018, there are a number of case studies on micro-grid projects in the western state. Cleanspark (Huber, Firenze, Trueblood, Vastola) were trying to get funding from the government. The Macerich project is listed as an example of work that Cleanspark has done, and the following table is listed:

According to Navigant, the total cost of the project was set to be just $7.9m – less than half of CleanSpark’s projected share of the whole thing, even though Jacobs is listed at an E&C partner. Macerich haven’t commented on the project publicly since early 2018, and the company, as a shopping mall REIT, is in severe financial trouble post-covid. CleanSpark never announced the revenues from the contract and the project has disappeared from its commentary since that point. Its unclear what stage the project is at, though it appears to have been abandoned.

Beyond these contracts, the company also claimed a project with an unnamed Ski Resort, Farming Facility, Municipal City and National Storage REIT, none of which ever amounted to revenues but all of which the company was confident on completing during 2018/19. Beyond the above mentioned, the camp Pendleton 2 project given by Firenze and the contracts pre-dating Stratean’s takeover, there’s no proof that the company ever made any real sales.

From SEC filings of 10% customers only, we can put together a majority (89%) of the company’s revenue-generating customers from the acquisition to December 2018, listed below:

As we can see, 65% of sales came from either Firenze directly or Bethel-Webcor, directed by him. 8% came from consulting services to Macerich, which we know about. Its unclear what or whom Daoust is, though it’s possible that this represents a residential project – revenues were in totality ~$70k. Jacbos/HDR was 4.2%, and it is a JV that did work with the navy. Bryan Huber noted in this letter that Cleanspark has a strong relationship with HDR, and we know that Jacobs was the general contractor on Macerich, so it’s possible that this is related to Macerich. In any case, it is just $60k of revenues.

Cintas, at 3.1%, is an individual that was involved in the original CleanSpark – potentially another residential project, valued at ~$40k. ClearSun has been discussed and Sungevity and Condinsine pre-date the acquisition.

That leaves 11% or less than ~$150k of unaccounted for revenues between June 2016 and December 2018. These revenues likely represent a mixture of carry-over into other quarters from the above (that didn’t reach 10% in a given quarter) and consulting services from the electrical engineers. None of these 89% of sales that we have visibility over represent any evidence of software sales.

From 2021 onwards, it becomes difficult to decipher what is the “original” Cleanspark business, because the company went on an acquistion streak and stopped disclosing top customers. Below is a look at three acquistions that they did 2018-2021.

Acquisition #1 – Pioneer Power Solutions, a loss-making troubled-manufacturer

In Jan 2018, the company acquired a segment of Pioneer Power Solutions, a listed US electronics equipment manufacturer. This portfolio included their critical power assets which mostly manufactured and sold switchgears and transfer switches. Concurrent with the acquisition, CleanSpark entered into a Contract Manufacturing Agreement, whereby Pioneer Power would exclusively manufacture parallel switchgears, automatic transfer switches and related control and circuit protective equipment for CleanSpark. The stock purchase amounted to ~$4.5m including escrowed warrants at the time.

The segment had historically been volatile, lumpy and unprofitable. Pioneer wanted to depart with the segment as it wasn’t “aligned” with the company’s financial goals, and shareholders applauded the sale in transcripts. Pioneer also mentioned that its management team personally approached CleanSpark’s to sell the company after it was discontinued and put up for sale – Pioneer was a motivated seller of a cash-burning business.

The agreement as per Pioneer’s 10-k, the manufacturing agreement stipulated that the price for the product payable by CleanSpark to the company will be negotiated on a case by case basis, but all purchases of products will have a target price of 91% of the CleanSpark customer’s purchase order price, and not more than 109% of Pioneer’s cost. Hence, CleanSpark and Pioneer had decided to split the gross profits on an already razor-thin GPM business – in its 2017 10-k and 3Q18 10-Q, the company reclassified the business as discontinued operations, and financials are as follows:

The business had not made money over any period that its financials are available. Even in the most profitable year, gross profits maxed out at 11%, and operating expenses were persistently above 20% of sales, reaching as high as 25%. In CLSK’s latest 10-k, the company discloses its largest supplier as 85% of its direct material cost is from contract manufacturing, with the other 15% accounting for subcontractors and a bit of materials.

The below snippet is from the current Clenaspark 10-k – the first full 12-month period that financials are given:

As per above, however, beyond the GPM level, the company is still deeply unprofitable (as expected).

There were no impairments or write-downs throughout the year – all costs are operating. The business have a very low level of profitability with 15% GPM. Even if it were to somehow keep costs entirely fixed and scale its way to profitability on a fixed 15% GPM, the company would need to grow its sales to over $110m just to break-even – that’s a 12.5x increase for a business whose sales, by all accounts (sales were $15m in 2016, $12m in 2017, $9m today) have been falling. The business is structurally unprofitable and will probably never turn a profit.

Energy accounts for 90% of the company’s sales, with the other 10% coming from a digital marketing agency, of which all of the revenues are comprised of “services and software”. In the consolidated I/S, the company discloses its Service/Software against Sale of Goods.

To add to this, the key electrical engineers that drove the business’ consulting services with Macerich, Michael Firenze (left at some time in 2017), Jeff Trueblood (left in May 2018), Bryan Huber (left March 2020), Billy Gamboa (left Sep 2020), Leon Sokhis (left May 2019) and Anthony Vastola (left Feb 2020), have all departed the company.

Acquisition #2 – p2k labs, a marketing agency and an undisclosed related-party transaction

In June 2019, the company purchased a media agency called p2k Labs. Having utilized p2k labs as a service provider prior to the acquisition, the company “recognized the value of bringing these resources 'in-house' to reduce costs and add talent to our team”. At the time, the CFO of p2k labs was Lori Love, who had 4 months earlier been appointed as CleanSpark’s CFO with little explanation and no software/energy background. Nobody at the company had any energy or (from what I can see) software engineering experience.

Its unclear what synergies a marketing agency has with an energy SaaS company. The relationship between the parties is unclear, though the owner of the digital ads company was brought on as CleanSpark’s CRO (despite having no prior experience in energy markets) and earned $300k/year as per the last 10-k – its unclear what exactly it is that he does at the company.

In October 2019, the company announced the continuation of contract valued in excess of $1m for p2k labs with a company called LAWCLERK.LEGAL, which would have a duration of 16 months. Tadayon, as the new CRO of CleanSpark and ex-p2k labs owner, commented positively on the contract during the press release. When visiting the LAWCLERK.LEGAL website, one will find that Amer Tadayon is that company’s Chief Product Officer. In 2020, p2k labs did approximately $1.1m in revenues, a portion of which (~$120k) was attributable to intercompany sales. If it’s true that the contract was valued in excess of $1m, then LEGAL.LAWCLERK accounts for substantially all of p2k labs’ revenues. This related party transaction is not disclosed in the 10-k, nor the press release.

Acquisition #3 – A previously fraudulent, possibly structurally-unprofitable bitcoin miner

In December 2020, the company announced the acquisition of a bitcoin mining company, ATL data labs for $19.4m in company stock. This caused the stock to rise 150% over the next month.

ATL Data Centers was founded in April of 2020, according to Georgia Business Records, and was incorporated by Gustavo Calderia and Bernardo Schuman, both of whom are co-founders of a company called FastBlock Data Mining, incorporated in July 2020. Both of the men work at Fastblock today, according to their LinkedIns, and Bernado’s name is still listed as the CEO of ATL on its website.

Fastblock acquired these assets out of bankruptcy from a company called VC Mining for $5m in May 2020, which was a subsidiary of Virtual Citadel. VC Mining was a fraud scheme (see here, here and here) that offered bitcoin mining hosting services, which means that you can send your mining machines (ASICs) to the company, and VC will host them for you at a much cheaper rate due to the low energy cost of the facility. VC acquired the assets from SITA, an IT services company, at an undetermined time. SITA used the assets as a data centre.

After Fastblock acquired the assets in may, it attempted to sell them to a listed Bitcoin mining company in the US called Marathon Patent for $22m in August. A month after announcing the deal, Marathon released a press release announcing that the deal had been terminated during the due-diligence process. The following is a statement from the press release:

During its due diligence process, the Company discovered that the Power Agreement pursuant to which Fastblock would provide power at a subsidized rate of $0.0285KwH, would expire in three years. The Company and Fastblock were unsuccessful in attempts to extend the term of that agreement with the power provider to the 7-10 year Window which the Company would need for this acquisition to be economically feasible.

I followed up with the Investor Relations team via email, and they said the following:

Thanks for your interest in Marathon! To answer your first question, yes, you are correct. The term sheet mentioned in that press release was a teaser of the relationship Marathon now has with Beowulf. The primary reason Marathon did not acquire Fastblock and opted to go in a different direction is that there was too much risk associated with Fastblock's electricity agreements. Because of the number of parties involved and the way Fastblock's contracts were structured, Marathon could not guarantee that the cost of electricity would remain at a low fixed rate. There was substantial risk of the price increasing in the near term, which would negatively impact Marathon's operations. By partnering with Beowulf, Marathon is directly dealing with the energy producer who is also a shareholder. The relationship with Beowulf is simpler, the terms are longer and more favourable, and both companies' interests are aligned.

The deal got pulled in September. When reviewing the press release, the company spoke very optimistically about the potential for the facility, so to have pulled the deal, the energy rate hike must have been a big deal. At the time, Marathon was going to pay $22m in stock.

On December 10th, just two months later, a deal was announced with CleanSpark for a price of $19m. Granted, Bitcoin had risen by about 50-60% between September and December, so CleanSpark were getting a better deal than Marathon. Just before the deal, the company was re-branded to be called ATL Data Centers, likely in an attempt to hide its association with Fastblock and VC Mining.

There is proof that Fastblock knew of the power agreement when the company purchased VC mining’s assets out of bankruptcy. Firstly, according to the bankruptcy documents, Fastblock was a client of VC Mining’s prior to it entering chapter 11, suggesting that they knew of the cheap power that it could provide. Also, when the company agreed to purchase VC Mining’s assets (the documents can be found by visiting Georgia Business Records under MLO Holdings I, Inc, titled “business amendment, name change” in May 2020), it had the following clause in the purchase agreement:

Fastblock knew of the cheap power agreement and tried to sell it to Marathon, less than two months after acquiring the assets, without alerting the company to the fact. Then, a few months later, it got sold to CleanSpark. Again, its unclear whether or not CleanSpark did its due diligence on the deal – perhaps it got blind-sided. Given that it had already purchased a few busted businesses in the past, the company might just not have cared.

Why bother with all of this? Zac Bradford and Matt Schultz are now very, very rich

Most of the money to keep the lights on up until late 2020 came from some convertible notes from a particular “investor” which were eventually converted. Other than that, the company really didn’t have much cashflow - it was mostly vaporware. I don’t really know the story here and whether the investor knew what was going on or not.

However, the company’s hard work putting out press releases relating it to cannabis, electric vehicles, clean energy and bitcoin finally got the stock moving, and it closed its first public raise in October 2020. The stock would go on the gain a cult following from retail investors. One should search Cleanspark on Youtube – watch a couple videos and read some of the comments. It is lunacy. The company raised ~$40m through HC Hainwright (largely retail broker). As you can see, the market cap was only ~$20m prior to the raise. Within 3-4 months it was at $1bn.

How did they raise the money? Well, despite the press releases, the company was hard at work at conferences and the like giving projections of huge future revenues. Here is a snip from a presentation in early 2020. We know that in 2020 the company had pretty much no revenues, and the nearly 40% NPAT margin would make it one of the most profitable businesses in the world. These forecasts are bogus.

When it announced that it was buying ATL Data Labs (or Fastblock Bitcoing Mining), the stock shot from ~$10 to $34 in just a few weeks as the bitcoin price ripped in what was near-peak post-covid speculation.

The company capitalized on this with another monster raise of $200m, again from HC Hainwright. It did a few subsequent raises, totaling hundreds of millions.

It was around this point that the company made a full-on pivot into bitcoin mining. I haven’t followed the energy operations since early 2021, but they were recently “discontinued” in the most recent report. For all intents and purposes, it is now a bitcoin company, which raised hundreds of millions of dollars on hype for clean energy.

HC Wainwright did all of the company’s raisings and M&A deals. It isn’t squeaky clean. In late 2022, the company was fined for poor record-keeping. The head of banking and head of research were communicating in texts and calls outside of work, but all were deleted before FINRA could do anything. Atleast 24 employees of the firm were found to have been chatting outside of permitted communication channels, though almost no messages were recoverable.

In the past four years, Zac Bradford has taken over US$5.5m in cash comp out of Cleanspark, in addition to tens of millions in stock comp (which is admittedly worth a lot less now).

Matt Schultz, the perpetrator of the original Gasifier scheme, has taken out US$4.7m in comp in the last four years.

Lori Love, who came across after the p2k labs acquisition, got nearly US$1.4m in 2 years. According to her LinkedIn, she is now semi-retired.

Who knows how much longer this will go on. Unfortunately (or fortunately, depending on who you ask), when you have a mostly retail shareholder base that doesn’t read filings or enforce proper coprorate governance, this will probably continue to go on for some time.

Youtube is full of videos like the following with hundreds of thousands of views. Management sells them a story, takes their money and pays themselves a lot money. The stock is down ~80% from its first big raise, and 95% from the peak. Who is going to stop this?

Maybe the company’s bitcoin operations will work out great - that’s for you guys to decide, not me.

Conclusion

There’s a lot more to this story. The point is not to bash the stock - I’m not short. The point is to show you all that there are flags in plain sight and that it pays to read the fine print.

In fact, in the last 3-5 years, there has been a culture of naysaying against people who flag irregularities or high-valuations for “not getting it” or “missing the point”. I hate this culture. But also, so long as it continues, there will be oppourtunities on the long and short-side for those willing to get their hands dirty and do real work.

I hope you enjoyed my tale.

IMPORTANT LEGAL DISCLAIMER

THIS REPORT AND ALL STATEMENTS CONTAINED HEREIN ARE THE OPINIONS OF GUASTY WINDS MUSINGS AND ARE NOT STATEMENTS OF FACT.

Reports are based on generally available information, field research, inferences and deductions through Guasty Winds’ due diligence and analytical process.

My opinions are held in good faith, and I have based them upon publicly available facts and evidence collected and analyzed including my understanding of representations made by the management of the companies I analyze, all of which I set out in my research to support my opinions, all of which I set out herein. HOWEVER, THEY REMAIN MY OPINIONS AND BELIEFS ONLY.

I conducted research and analysis based on public information in a manner that any person could have done if they had been interested in doing so. You can publicly access any piece of evidence cited in this report or that I relied on to write this report.

Guasty Winds makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use.

We are entitled to our opinions and to the right to express such opinions in a public forum. We believe that the publication of our opinions and the underlying facts about the public companies we research is in the public interest, and that publication is justified due to the fact that public investors and the market are connected in a common interest in the true value and share price of the public companies we research. All expressions of opinion are subject to change without notice, Guasty Winds does not undertake a duty to update or supplement this report or any of the information contained herein.

Recipients of the research report are professional investors who are expected to make their own judgment as to any reliance that they place on the article. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this substack.

You further agree that you will not communicate the contents of reports and other materials on this site to any other person unless that person has agreed to be bound by these Terms of Use. If you access this website, download or receive the contents of articles or other materials on this website on your own behalf, you agree to and shall be bound by these Terms of Use. If you access this website, download or receive the contents of reports or other materials on this website as an agent for any other person, you are binding your principal to these same Terms of Use.

YOU SHOULD DO YOUR OWN RESEARCH AND DUE DILIGENCE BEFORE MAKING ANY INVESTMENT DECISION WITH RESPECT TO THE SECURITIES COVERED HEREIN. THE OPINIONS EXPRESSED IN THIS REPORT ARE NOT INVESTMENT ADVICE NOR SHOULD THEY BE CONSTRUED AS INVESTMENT ADVICE OR ANY RECOMMENDATION OF ANY KIND. FOLLOWING PUBLICATION OF THIS REPORT, WE MAY CONTINUE TRANSACTING IN THE SECURITIES COVERED THEREIN, AND WE MAY BE LONG, SHORT, OR NEUTRAL AT ANY TIME HEREAFTER REGARDLESS OF OUR INITIAL OPINION.

To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. Note that researched companies and insiders, agents, and legal representatives of researched companies and other entities mentioned herein may be in possession of material non-public information that may be relevant to the matters discussed herein. Do not presume that any person or company mentioned herein has reviewed our report prior to its publication.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

It's a bit odd to write all this and say in your conclusion that there are flags but at the same time you're not short ... hummm