What is Latch?

According to Latch’s 10-k, it is an ‘enterprise technology company focussed on revolutionizing how people experience spaces’.

What is it actually? A hardware manafacturer of smart locks, sensors and other connected devices. In addition, it also sells software that sits on top of the hardware called Latch OS. From its filings, websites and investor presentations (and listing valuation), Latch would have you believe that it is predominately an enterprise software company. But it isn’t all as it seems.

Latch is a pretty simple business. It sells its locks and devices to multi-family developers. Once installed, it sells software to the developers. This software is used by both building management and residents to manage devices such as locks, thermostats, package rooms, doorbells, etc. Smart home devices aren’t really anything new, however, they’ve often been silo’d and required a 3rd party software provider to sit on top (for example, SmartRent). Latch is a fully integrated provider of both hardware and software.

Why am I short Latch?

Poor unit economics, possibly structurally unprofitable

Latch makes money in two ways - selling the hardware, and selling the software. Today, almost all of its revenue is coming from selling and installing the hardware, as can be seen below.

Hardware and Services comprise nearly 80% of the company’s revenue. What’s worse is that hardware and services gross margins are negative. That’s to say nothing of the tens of millions of dollars that the company spends on R&D, sales and overhead. The business is, at least at this scale, structurally unprofitable.

This is a brutally competetive industry with lots of large competitors (Google, Amazon, Honeywell, etc.) and lots of start-up competitors. Barriers to entry are low. Real-estate development is not an industry that has historically been price insensitive, either. Hardware is a scale game, and Latch doesn’t have it.

The organization is in dissaray

In the last 6 months, Latch has cut ~50% of its workforce. Source: https://layoffstracker.com/latch-systems-lays-off-37-workforce-115-employees/

Latch has, as of March ‘22, ~$320m of cash/equivalents on its balance sheet, which is more than enough to support continued cash-burn. For a company that is sub-scale, shrinking isn’t the answer. Why are they cutting so many people if they’re seemingly well resourced? Some reports suggest at least 75% of the salesforce has been let go.

Glassdoor also gives an insight into the chaos at the company: https://www.glassdoor.com.au/Reviews/Latch-Reviews-E1597189.htm

Lots of funky accounting

The company has some questionable revenue/bookings recognition policies.

Firstly, the company has historically compensated it’s sales staff on signing non-binding LOIs (letter-of-intent). It then used these LOIs to calculate “bookings”. These were reported as KPIs in the company’s filings as an illustration of their large growth potential.

From 1Q21 onwards, the company decided to stop reporting bookings as its priorities as a firm had changed in 2022 to focus on ‘near-term delivery of software revenue’.

In the March 2022 10-Q, the company then also disclosed that starting in April 2022, it would no longer compensate sales staff based on bookings-related metrics.

Then, on August 10th, it delayed its 10-Q. The company cited that the audit committee had commenced an investigation of alleged current and prior period matters that include, but may not be limited to, certain aspects of the company’s current and historic key performance indicators and revenue recognition practices.

On August 25th, the company released an 8-k determining that the company’s financial statements for 2021 and 1Q22, and possible other periods, were unreliable due to material revenue recognition errors due to ‘un-reported sales arrangements due to sales activity that was inconsistent with the company’s internal controls and procedures’. Read below:

It’s too early to speculate on the outcome. It seems likely to me, though, that the two are related. Sales staff being compensated on non-binding LOIs probably leaves room for manipulaton, especially when it appears that side-letters are present.

Another concern is that the company’s net receivables increased by ~$17m over the course of 2021 on an increase in sales of just $23m. The finishing balance comprised ~60% of revenues. That’s up from 45% in 2020 and 47% in 2019. That’s a pretty big increase in days’ receivable over a 12-month period. What’s more - software contracts are generally paid up-front, evidenced by the large deferred revenue component on the company’s balance sheet. The company stated in its SPAC deck that 97% of software revenues are paid upfront. So really, receivables should mostly just reflect hardware. If we just take hardware revenue, the receivables in 2021 were ~77% of hardware sales, compared to 58% in 2020 and 56% in 2019.

In 1Q22, the company’s revenues declined slightly by ~$1m, but its receivables increased again by ~$3.5m. Receivables as a % of annualized sales from 4Q20 to 1Q22 increased from 27% to 54%. This is an imperfect measure but it illustrates a trend.

Something happened that caused receivables to increase considerably in 2021. This could just be incentives from the company as a competition tactic. It might be related to the errors in revenue recognition as a result of the undisclosed sales agreements. Either way, the quality of the company’s revenue has deteriorated considerably. Days receivables of ~280 days, depending on what portion of software revenue you assume is paid upfront, are very high and it isn’t encouraging. Lead-times are long in this business but it’s a red flag to see it continue to blow out.

The company also largely inflates its software revenues in the income statement.

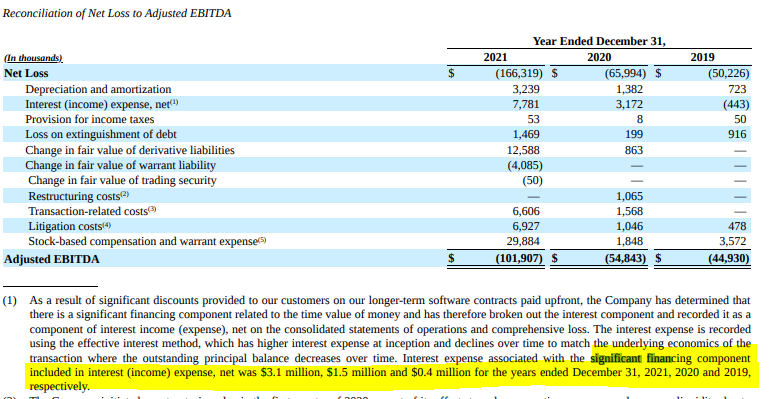

It recognizes a "signficant financing component" as it gives discounts to its customers for large upfront payments on software contracts. That financing component comprised 37% of software revenues in 2021 and 1Q22. If you don’t know what that means (I had to reserach it to understand, too) you can read about it here.

Bascially, in short, what it means is that the company offers discounts for people that pay for 10-year software contracts up front, which is pretty standard. But it doesn’t book its revenue net of discounts. If a contract is $100/year, but I give you a $70/year price for paying upfront, then over the life of the contract, you’ll book $100m in revenue and ~$30 in ‘interest expense’. Effectively, that is the cost that you pay for the money upfront. Its effectively an interest rate as if you are is borrowing the money, for accounting purposes. The math is a bit more complicated than than, but that’s the general premise.

Below are some snippets from the company’s filings.

As one can see, the ~$8.2m in software revenue for 2021 is offset by $3.1m in interest expense. Essentially, the company is overstating it’s software revenues by ~61%, as it only actually earned $5.1m in software revenue after you net out the discounts for upfront payments. The company conveniently excludes the interest charge from its adjusted EBITDA figure - not that it makes much of a difference when you’re loss-making at the gross profit level, anyway. These numbers are small in magnitude as the company’s software component is so small, but large in relativity.

The Tishman Speyer relationship is a bit fishy

Latch’s market comms make lots of reference to an investment by Tishman Speyer, a large real estate developer in the US. Tishman was involved in the company’s 2019 round. In 2021, Tishman raised a SPAC which ultimately purchased Latch to take it public. As a defacto payment for sponsoring the SPAC, Tishman earned itself 4% of the company, which at the time mounted to ~$60m. In total, today, it owns just over 5% of the company.

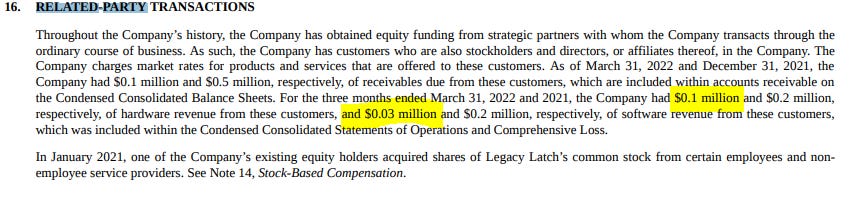

Latch started trading in early 2021. Since then, the company’s ‘related-party’ transactions has almost ground to a halt.

In 2019 and 2020, the undisclosed related-parties (presumably Tishman Speyer) accounted for ~14% and ~13% of revenues. In 2021, those 3rd parties were just 1.5%. In 1Q22, revenue had fallen to less than 1%. Most interestingly, however, was that Software Revenues from those customers had fallen to $0.03m from $0.2m in 1Q21 and $0.5m for full-year 2021. So, effectively, software revenues had fallen to almost nothing. Not only did their related-parties (again, presumably Tishman) stop purchasing from the company after it went public, they also seem to have cancelled their software revenues almost entirely.

One might synically assume that related parties were pumping up Latch’s numbers pre-IPO. One might also synically assume that related parties don’t believe enough in Latch’s products to continue purchasing them. Again, it’s all speculation, but not a good look when your investors stop buying your products for whatever reason that might be.

Conclusion

It’s only a small short because the company has a reasonable amount of cash and securities on the B/S. At at 2Q22 (still waiting for the 10-Q), I estimate that it has ~$280m in cash and equivalents vs a market cap of $190m. It was burning at ~$50m/quarter but after the recent layoffs, it will supposedly be burning much slower. The company estimates Opex + Capex of ~$65-75m/year, and given that it doesn’t make any gross profit, that shall be roughly equal to its cash burn. At that rate, the company has about 4 years of runway.

I remain short despite this because I don’t believe that there is a real business model here, and also as a result of the red flags listed above. I also expect that growth will slow considerably with the recent workforce reduction, which included at least a 75% reduction in the sales team. It also possible that the company’s revenues have been overstated, as we will find out when the Deloitte investigation is complete.

The biggest risk is a takeover. There is presumably some tech, installed base, IP, brand equity here which might be interesting to another company and it is a competetive industry. Given the elevated cash balance, it could be a target. For that reason, I’m keeping my short position small.

Disclaimer

By downloading from or viewing material on this website you agree to the following Terms of Service. Use of Guasty Winds research is at your own risk. In no event should Guasty Winds or any affiliated party be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that Guasty Winds (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a position in any securities covered herein. Following publication of any research, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. Research is not investment advice nor a recommendation or solicitation to buy securities. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Guasty Winds makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets and liabilities. Such statements, estimates, projections and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Guasty Winds’s control. All expressions of opinion are subject to change without notice, and Guasty Winds does not undertake to update or supplement this report or any of the information contained herein. You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner. The failure of Guasty Winds to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

13 Feb 2023 - Latch Notice of Delisting from the NASDAQ