LGI Homes (LGIH-US): A Coiled Spring

Housing affordability remains challenged, but greenshoots are appearing. LGI is well positioned medium-term to benefit from a structural Single-Family housing shortage.

*Disclaimer: This is not financial advice and is for entertainment purposes only. Do your own research.

Stock Price: $119 | M/C: $2.75b | 2024e P/E: ~10x | P/B: ~1.6x | Target IRR: ~20% |

LGI Homes is a founder-led entry-level homebuilder in the US. It has a truly best-in-class track-record of growth and returns that is rivalled by few. The stock has produced a TSR of ~25% since IPO in 2013.

The three key points to the thesis are:

There is significant pent-up demand for entry-level housing caused by a shortage of cheap home construction over the past decade+. Demographics should continue to be a tailwind for entry-level homes as millenials move increasingly into the first-homebuyer category over the next 5 years. The company sells out of ~100 communities today. It should be at 150 by the end of 2025, and has a medium-term target of 240. It had ~10 in 2013.

LGI has a unique model in both sales and construction which has led to industry-best return-on-assets over a long period. Despite efforts, most other public builders have failed to rival LGI in its area of expertise. The company is still founder-led and upper management is long tenured in the business. I have no reason to believe that the company’s best-in-class performance shouldn’t persist.

LGIH has de-rated considerably on a P/B basis relative to pre-covid (2017-2019) mutliples, whilst most of the large-cap builders are ~equal. This is due to (1) mortgage rates have impacted the entry-level builders disproportiantely, (2) the company is digesting some short-term margin pressures, (3) the company is working through some short-term land inventory issues, dragging on asset efficiency and growth. I walk through all points in the note below and don’t believe any are structural. LGI should produce better growth at similar or better ROA than peers. There is room for multiple expansion, also.

I’ve modelled a couple of different scenarios below. Whilst LGI is confident that margins and absorptions will recover (and they have indeed started to do so), I’ve included a more sombre scenario in my base case to account for uncertainty around mortgage rates. With community count at 150 by Dec 2025, this gets us to EPS of ~$23 and BVPS of ~$134. At a constant P/B of 1.6x and under conservative margin assumptions, the company can increase its BVPS by ~80% by 2027, and hence increase stock price by 80% over that period (~17.5% IRR). Under more positive assumptions, including a faster margin recovery to pre-covid levels and a re-rating to ~2x P/B, the stock could perform much better, ending 2027 with a BVPS of ~$146 and a stock price of $290, producing closer to a ~25% IRR. I suspect that high-teens/low-20s IRR is achievable.

Given the company’s medium-to-long term targets of achieving 240 active communities, LGI could produce such returns well beyond 2027.

The key risks and cavaets for the case are:

It’s all about rates, rates, rates. We can make structural arguments for supply/demand until the cows come home, but ultimately LGI is in the business of selling monthly payments. If mortgage rates continue to climb to 7.5, 8%+, LGI’s sales are going to start slowing again. LGI sells cheap, entry-level homes, which are the most rate sensitive, so they will probably slow more than peers. I’ve accounted for this by modelling lower margins in the next few years (i.e. company can use incentives to aid affordability if it needs to) but ultimately the path of rates in uncertain. If mortgage rates keep going up, the stock will not perform well and there isn’t much anyone can do about that.

The positive note is that we are starting from a severe S/D misbalance (pent-up demand) and mortgage credit conditions have been sensible since the GFC, so whilst higher rates will impact demand (see: 2022), it isn’t going to be GFC 2.0. The problem then was artifically high demand + overbuilding. Today we have pent-up demand + underbuilding. When rates went from 3 to 7 last year, it was disruptive, but the company still made plenty of money - it isn’t a case of heads-you-win and tails-you’re-dead; it’s a case of heads you do really well and tails your margins will come under pressure. Also, if mortgage rates actually pull back to 6 or even 5%, there is so much pent-up demand that LGI is like a coiled spring. It had the most amount of leads (inbound interest) in 2Q23 in its history despite having somewhat lacklustre sales absorptions, evidencing the point.

Lets not sugarcoat it - Homebuilding is a shitty business, period. There are some builders, be it through niche market exposures, sales models or scale, that have generated satisfactory returns, and LGI is one of them. But generally, the business model sucks - it is capital intensive, the product is a commodity and you need to use a lot of debt to get an attractive ROE. So, when shit hits the fan, you’re stuck with a huge capital position, funded by debt, which can go down in value and wipe out your equity. Shit doesn’t hit the fan to the point of armageddon very often, to be clear, but you have tail-risk owning a builder (like you do with a bank) that you just don’t have owning an unlevered industrial company, for example.

That said, the stocks have always been dirt cheap and have massively outperformed the S&P as a group (nearly 2x since 2010), suggesting that valuations have more-than compensated for the risks. The returns alrogithm for LGIH is simple: If you can produce an ROE of 15-20% and hold your P/B ratio constant, you should be able to produce stock returns of 15-20%. If better times are around the corner, and LGI can return to an ROE of 25% and get a bit of multiple expansion, then we’ll get paid really well owning the stock. LGI will never be my biggest position (unless the fed goes crazy and starts cutting aggresively), but it is an attractive proposition in the context of a long-term portfolio and history suggests that, over time, you get paid handsomely to take the risk so long as you can avoid the big GFC-style blowups (which I clearly do not think we are facing).

Some have asked: why LGI? My answer is:

I like LGI’s entry-level exposures given supply shortages and supportive demographics. LGI should be able to outgrow its large-cap competitors who are more focussed on trade-up and/or luxury.

I like LGI’s management team and track-record of strong return-on-assets, which I go into in more detail in the note. I also like the differentiated model. Higher ROE at similar P/B multiples should produce better stock-returns.

I like that LGI has de-rated and underperformed peers recently for reasons that I view as mostly short-term in nature. I think the market is especially underappreciating that the company’s bloated land position will turn from a big negative (low asset efficiency) to a big positive (big growth with lower capital outlay) over the next 2 years as communities under development finally come active.

I think one will do just fine buying DHI or NVR given that they also skew towards cheaper homes. LGI will probably be more volatile (upside and downside) due to its exposure to entry-level. But it should be able to grow faster (mostly due to smaller size) and has more room for re-rating, so I think the potential upside is better. It is something each individual needs to consider for themselves.

What am I doing with the stock

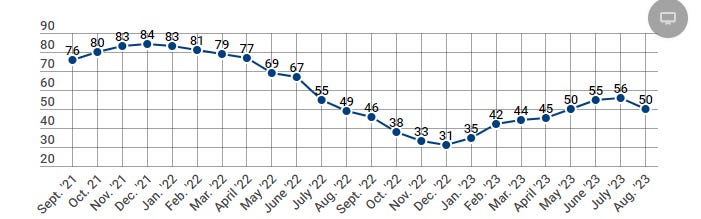

As usual this is not financial advice. I have a small starter position. I am hesitant to take it up too much right now because the builders have had such a big run and 2H23 estimates have come up across the board, but since 2Q earnings calls we’ve seen mortgage rates re-accelerate and the HMI (builder sentiment index which is a pretty important data point) has started to tick down for the first time in ~9 months. So, I suspect that the builders will have little in the ways of positive surprises for 3Q but potential for negative surprise. If mortgage rates start to come back considerably, I’d probably change my thinking. I’ll be watching closely for both weakness in the stocks and mortgage rates before taking the position up.

That said, if you’re a “I buy and don’t check the price for 10 years” type of operator, the current valuation is pretty attractive on a medium-term view, in my opinion. That is, of course, not advice.

Contents

Brief History of LGI Homes and Overview of the LGI Model.

The Entry-Level opportunity.

Short-Term Housing Market Trends and what to watch (hint: rates).

LGI’s recent hiccup, and why it isn’t a structural problem.

Financial Analysis, Forecasts, Valuation, Risks.

Brief History of LGI Homes and overview of the LGI Business Model

LGI Homes, in its original form, was founded in 1995 by Eric Lipar’s father, Thomas Lipar. LGI was originally in the land development business, specializing in acreage home sites located 45-60 miles outside of urban centres. After many years of doing so profitably, Eric had the idea of moving downstream into homebuilding.

"We were selling lots and home sites to other builders and we didn't think they did a great job with sales and the customer experience," said Lipar, especially in the entry-level market.

In ~2003, they started building homes, an initiative led by Eric. The idea of focusing on the entry-level really came from Tom Lipar, who after many years in the homebuilding industry, including through the late 90s housing downturn, had decided that entry-level housing was the most resilient.

Early on, having worked as a used car salesman and later a timeshares salesman, Thomas Lipar instilled the importance of direct-to-consumer selling in his son. He told Eric that he needed to spend the first 5 years of his career as a comissioned salesperson. As Eric led the company’s efforts in homebuilding, he took the idea of direct-to-consumer selling and developed a rock-solid system that has really been at the core of LGI’s success. There’s a great interview with Eric Lipar here, where he talks a little about the founding of LGI and the culture of the company. This should be required listening for anyone interested in the company.

LGI’s unique model largely comes down to two differentiating factors. First is the DTC, heavily incentivised sales model. It’s part culture and part systems, as Eric explains, that enables the company to turn its inventory faster than the competition and ultimately produce a better return on assets.

LGI sells homes to renters in their ~late 30s, early 40s and the name of the game is converting renters to homeowners. LGI often joke that they’re a sales organization that sells homeownership, and they also happens to build homes. LGI’s criteria for a new community is pretty simple: there needs to be atleast 50,000 renters in a 30 mile radius. Once they move in, LGI turns on the marketing machine, bombarding sorrounding areas with provocative fliers and online advertisements generating inbound leads to their closing team. Based on that 50k number, management knows from over 20 years of geographically disbursed history that they can convert enough renters to get attractive absorptions and sell-out a community.

The DTC model (that is, generating your own leads and closing your own homes, instead of relying on realtors/buyers agents) is a true differentiator in entry-level for the simple reason that the company is selling homeownership, not homes. First-time buyers are typically “fence-sitters” when it comes to homeownership - it’s something they’ve maybe thought about, but don’t know much about. Or maybe they have pre-conceptions that it is unattainable. Or maybe they just have no idea where to start. They receive a flier in their mail, which makes them consider the possibility of buying, and then they call LGI. Having a DTC strategy allows you to actively convert the fence sitters into customers in a way that just wouldn’t be possible if you were sitting in the office relying on realtors to bring customers through the community. The same is true for move-up/luxury homes, which tend to be more considered purchases. LGI tried move-up, and it didn’t work so well.

To illustrate the point, >50% of the company’s closings come from its direct salesforce (the rest from realtors) which compares to most builders which rely on realtors for probably 80-90%+ of sales. It is a truly different way of selling homes - something that most builders are just not set-up to do physically or culturally.

The system-selling culture at LGI runs deep. Before starting as a sales person, an employee will do an intensive 100-day off-campus training where they learn about the company, its culture and how to sell under its system. This includes direct training talks from Eric Lipar himself. Across the company, there are 10 large manuals (yes, physical manuals) that explain different roles in minute detail. Some of the details in the sales manual are as specific of where to stand in the kitchen when giving tours and the order at which features should be shown. Eric is absolutely meticulous about having his salespeople follow the manual to a tee. If you enter a sales office in Texas, the Carolinas or California, you’re going to hear an almost identical pitch.

When I met with Eric in 2021, he explained their sales process as a “franchise opportunity.” He guarantees his salespeople (pre-selected for general sales acumen) that if they follow the system, they will succeed. It isn’t an easy place to work - it is long hours and management are strict about the system and demanding on targets. It’s sink or swim, but LGI’s salespeople are the best compensated in the nation. He joked that salespeople often offer suggestions about things that they might change to the manual (which has barely changed since 2003), and Eric responds by saying “when other builders are achieving better absorptions than LGI, then we’ll change to script.” He has a point.

There’s a good article in ProBuilder here (from when LGI won builder of the year in 2016) which does a good job explaining for those interested in going a bit deeper. The article also gives an example of one of Lennar’s poor-performing communities, Deerbrook Estates, that LGI purchased and turned around back in 2013. The absorption rates that LGI were able to achieve after rolling out their system-selling relative to Lennar is pretty staggering and illustrated the difference of their model versus the older, stodgier builders.

As it turns out, building and selling entry-level homes profitably is pretty hard to do. Many of the large public builders shied away from the entry level after the GFC as young buyers got hit hard by the crisis. When the entry level started coming back in 2014/15, most builders rushed to open entry-level communities, but most just couldn’t make it work (see above example on Lennar). DR Horton’s Express brand is the only company that has really posed significant competition at scale. NVR has also done a decent job, but still has a much lower absoprtion than LGI. There is competition, to be sure, but the entry-level has proven an elusive part of the market to operate in profitably. Ultimately, the company says its real competition is rentals, which is true.

I could write pages about the company’s model and why it is really hard to replicate for the bureaucratic volume builders, but really, the best proof is in the pudding. Below is a table of absorption rates in 2022 for LGI Homes and a handful of the largest public builders. I couldn’t get absorption rates for all of the builders as they don’t all disclose community count, but you get the point. You can also see ASPs. LGI sells the cheapest homes in the nation and is simply the best at selling them.

The second factor in LGI’s differentiated model is the construction method and land strategy. LGI builds 100% spec homes - no customization, no frills, no straying from the system. Most builders will build some spec, some semi-customized and some fully customized and try make margin with add-ons. Being only spec and low frills allows for (1) the cheapest materials costs, and (2) the most efficient construction methods (free-flow - no disruption and no variability). LGI builds the cheapest homes in the nation. Also, not only is LGI most often developing its own lots (allowing it to also pick up a lot development margin on-top of homebuilder margin), but it focuses on lots that are typically less desirable. John Burns has often joked that if A lots are in urban areas and B lots are in surrounding suburbs, LGI are buying F lots. Naturally, lower competition for these lots leads to higher returns.

These factors together have allowed LGI to generate a return-on-assets which has been the envy of public builder peers. Below is a chart of ROA for LGIH (light blue bars) vs publically listed peers (mostly the top-10 builders). The only company that has consistently produced a better ROA is NVR, who has a unique asset-light model utilizing optioned lots. You’ll see that ROA for LGIH has dipped in recent quarters below its peers - there are a few reasons for this which are specific to LGI which I will discuss later in the note. I expect that in the future the company will revert to industry-leading returns.

Whilst, yes, on average, LGIH has produced a better ROA than peers, I also want to acknowledge that operating at the entry level has certain risks. Firstly, first-home buyers are very sensitive to interest rates and prices such that higher-value builders (i.e. Toll Brothers) are not. The biggest block in the sales process for LGI is having the customer qualify, and when rates go up, it isn’t just that customers don’t want to pay - it is that they cannot physically qualify.

The other point is that land is far less liquid - getting rid of A and B lots in a downturn, in the case of armageddon, is easier than liquidating F lots. Developing the land themselves, as opposed to purchasing finished lots from developers or using optioned land-banking agreements (see: NVR), also exposes them to more land risk, even though it ultimately leads to higher margins.

Clearly, I think that the S/D scenario, higher growth and higher returns compensate for the risks you take. Higher rates has, and will likely continue to have, a disproportionate impact on LGI relative to peers such as Toll and Pulte, for example. This is part of the reason that the stock, and its ROA, have underperformed recently. It is just something to be aware of.

To summarize, LGI has a unique culture and model which allow it to build and sell homes more efficiently than peers, in-turn leading to a higher absoprtion rate and return on assets. I view this as a structural advantage, and it should persist going forward once recent trends normalise.

The entry-level opportunity - LGI is well positioned to grow for many years

Addressing the US home shortage is a task that goes well beyond the scope of this memo. There has been much written on the topic. For those not really accross it, I’ve collected some reseach that lays out the barebones of it and then you can go and check the data yourself. Though some try to argue against US housing (mostly twitter doomers), there are very few people that have actually seen data and disagree that there is a shortage of homes in the US.

Freddie Mac original study (2018)

Freddie Mac follow-up (2021)

NAR/Rosen Consulting (2021)

I will spend a little bit of time discussing the entry-level market specifically as it is directly relevant for LGI. The point I want to make here is that, due (mostly) to rising costs, the construction of entry-level homes has fallen considerably over the last few decades (but especially post-GFC), creating a pent-up demand for cheap homes. LGI has ridden the tail of this with its low-cost, high-absorption model over the last decade to grow almost 10-fold since 2013. There is still a significant shortage of entry level homes, and LGI is well positioned to continue to grow in the future.

As we can see, starter homes have decline considerably over time.

There are a bunch of reasons for this both on supply and demand side, though it remains largely a supply story. Entry-level homes have been getting more and more expensive to build. NAHB often refers to the issues as the “4 Ls” - Land, Labor, Laws and Lending. Though the latter has generally loosened in recent times (was more of an issue immediately post-GFC), the first three continue to add costs to the homebuilding process.

On Laws, the NAHB has conducted multiple thorough studies (the most recent here in 2021) of the costs going into a new home. It found that regulatory costs account for almost 25% of the price of a home - a staggering figure. I won’t re-hash it, but the regulatory burden has generally increased over time. This burden is even more accute for entry level homes. It has shown little sign of easing recently, despite increasing pressure from industry bodies such as NAHB for governments to re-consider housing policy. It’s an area that is, generally, likely to get more and more attention in coming years as the affordability problem worsens.

Land has also been a big problem. There was a good (yet controversial) WSJ article late last year that examined rising land prices and their impact on the nation’s ability to build cheap homes. The real issue is land-use restrictions and a lack of public investment in roads, rail and other infrastructure. According to the PRI, growth controls, urban growth boundaries, conservation easements and other public policies that forbid or limit development on large tracts of land are the primary culprit. So are governments that refuse to invest in infrastructure for open areas adjacent to booming metros. Lightbox points out the difficulty in solving such zoning issues due to competiting interests, and why it has persisted so long. The Reason Foundation also chalks the problem up to land-use regulations. All have resulted in soaring land prices, well in excess of incomes.

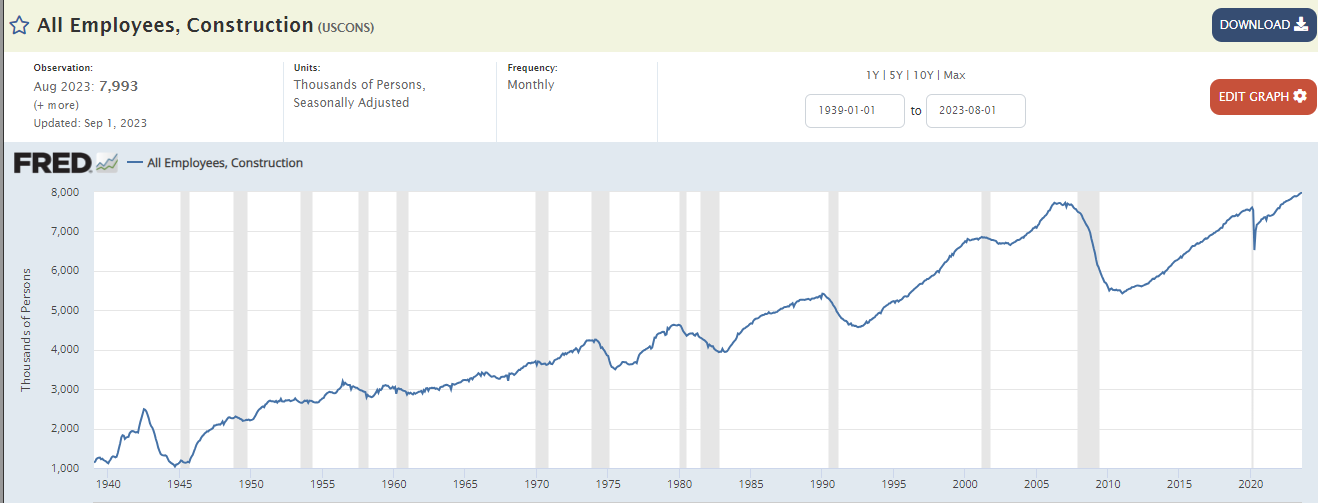

The US also has an extreme labor shortage in construction. Post-GFC, a large amount of construction labor exited the industry due to the low-level of construction that ensued in the coming years. It was slow to come back, and havs only recently reached pre-GFC levels. Unlike manufacturing, which has automated, productivity in residential construction is deplorable. In fact, it is down from where it was pre-GFC in single-family residential construction. It’s been hard to get more labour into the industry, especially with tighter immigration policies and general shortages across the country. It will likely persist as an issue until the builder embrace more offsite automation (which is not happening at a particularly fast rate).

So what?

The so-what of all this is that there is a huge supply/demand imbalance for entry-level homes, leading to pent-up demand. The biggest barrier is being able to build homes cheap enough. Homeownership rates in the typical first homebuying age group have fallen considerably since the GFC and are still below even historic recession levels, despite having picked up somewhat in recent years. Prices for smaller homes have soared, and construction + inventories for cheaper homes have fallen dramatically.

There is also a demographic tailwind as millenials move into the fisrt homebuyer age over the coming few years. NAHB estimates that the average first homebuyer age is ~36 as of 2022, and LGIH’s target customer is generally 38-42. The ‘bump’ in the green bars below shows millenials aged 26-32. Over the coming ~5 years, these millenials will move increasingly into the first homebuying age bracket. This will only add to the S/D misbalance.

LGI has been part of the solution for this issue over the last decade. The differentiated model has allowed it to build and profit on cheap entry-level homes where other builders previously haven’t been able to (note LGIH’s ASP relative to competitors). It has continued to grow from essentially nothing pre-GFC to be one of the top-10 builders in 2021, all in the face of the above headwinds, proving out the potentcy of the company’s differentiation in spite of tough conditions.

To illustrate the growth, at IPO (2013), LGI had an active community count of ~10 (that is, ~10 communities that they are selling homes out of, and they sell on average ~6 homes per community, per month). Today, the company is at ~100, and it peaked at ~115 in 2020. By the end of 2025, it plans to get to ~150, and it has a medium-term target of 240. There is still a significant amount of growth for LGI addressing the pent-up demand of first-time buyers, and as we’ve seen, the need for first-time homes has only grown greater over the last decade.

However, all of that is not to say that the affordability issues won’t make things tough for LGI going forward. The big question-mark for entry-level is, and will always be, affordability. Right now, affordability has never been worse. I’ll address this and short-term trends next.

Short-Term Housing Market Trends - it’s all about Rates, Rates, Rates

There is no shortage of data and news resources out there for getting across the housing market. Two of my favourites are Housing Wire’s weekly housing tracker (who also has a daily podcast which is great for staying up to date on Housing) and Altos Research on Youtube.

Altos’s Youtube is great. They are a data company and do weekly and monthly webinars based on what they are seeing in the field. Below is the most recent update. It will give you a good sense of what’s going on in the US Housing Market with data.

Again, analysing the entire housing market is beyond the scope of this note, but i’ll summarize the last ~12 months in a few key points.

Higher mortgage rates have created significant friction in the housing market. With most of the nation refinanced to a ~3% rate, refi’ing again as a 7%+ rate makes moving homes quite expense. The result has been a huge decline in existing home sales and active listings. Inventory has fallen dramatically.

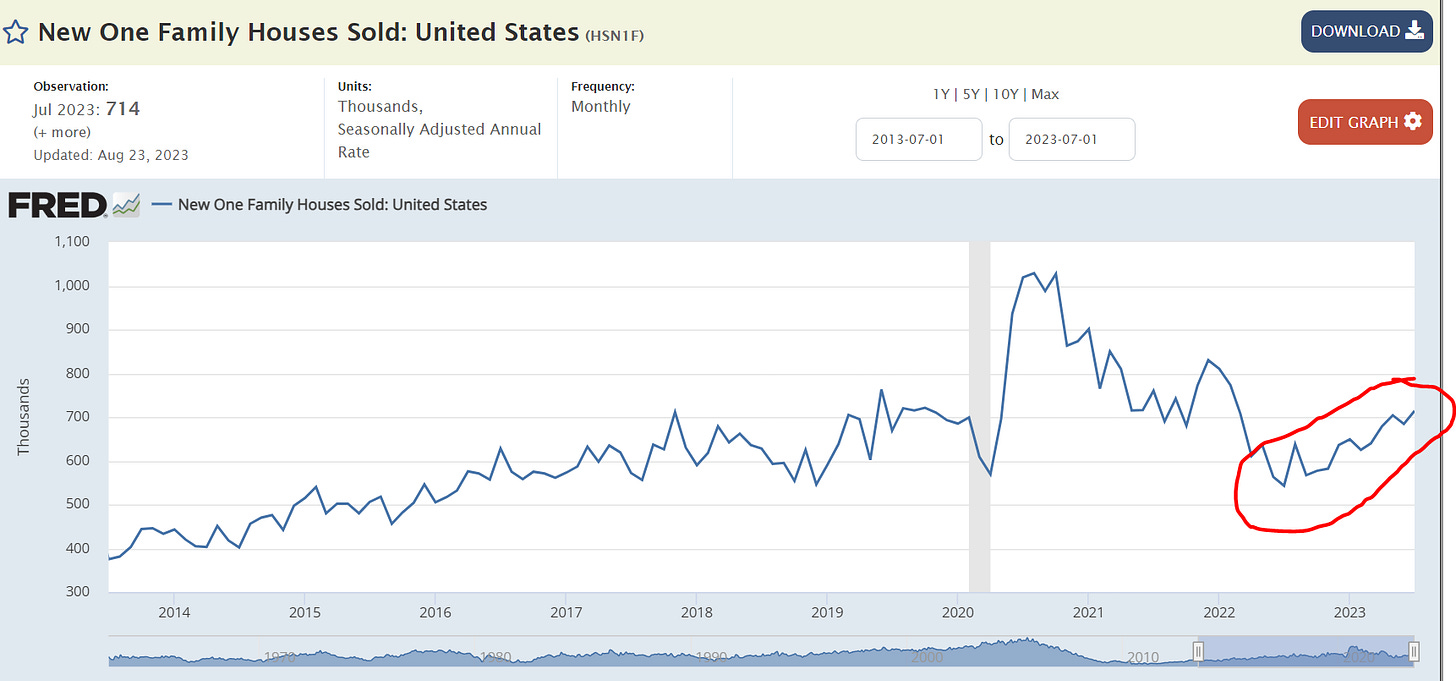

This has created a shift towards demand for new homes. Active listings are so low that there is a real shortage of existing homes on the market. Active listings are ~50% lower than 2019 levels. New home sales have started improving as a result. Homebuilders’ sentiment increased through much of this year and earnings expectations for 2H23 have also risen.

Home prices have reversed their decent and have began to climb again. Homebuilders are still using incentives to bring buyers in, weighing on margins, though recent commentary has been that incentives are slowly coming off and new home prices are sequentially moving back up.

In the last month or so, mortgage rates have continued to climb higher. Some of the higher frequency data, such as mortgage purchase applications, has slowed and the NAHB index has dipped (NAHB HMI is essentially a sentiment survey of builders and is a really good barometer of field activity). This is sign that the recent leg higher in rates is slowing the market again.

Where to from here?

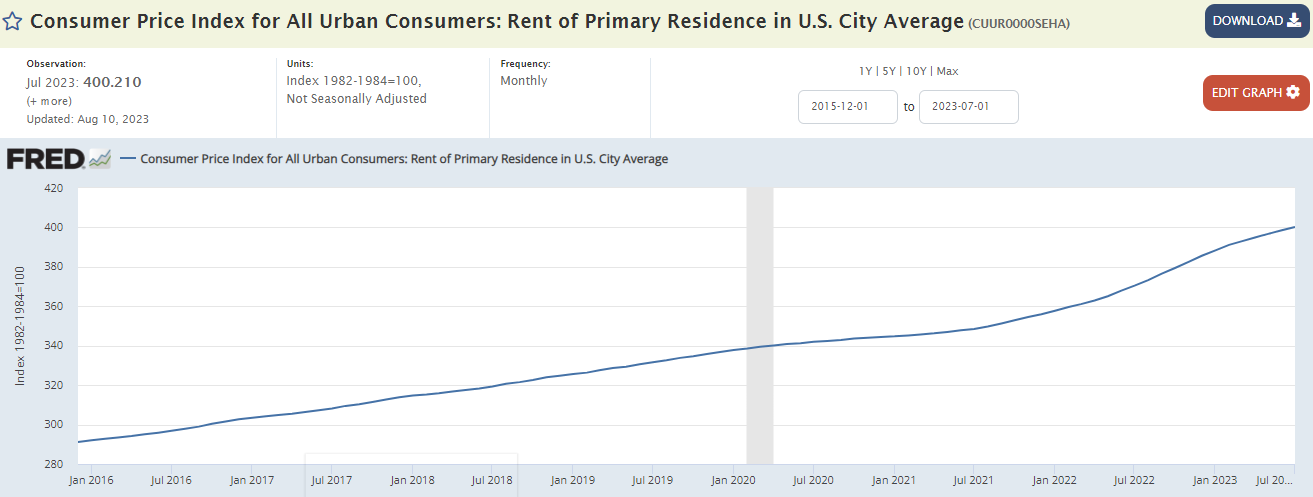

Right now, it’s all about affordability. The price of building homes is unlikely to fall much other than some modest inflation in materials for reasons discussed above, so its really all about rates. Many people just can’t afford the payment right now. The housing affordability index has never been worse, as of June, and rates and home prices have only gone up in July and August, so it is likely to worsen.

The 30-year mortgage rate is the king of all datapoints to watch for housing right now. Ultimately, given affordability is the key bottleneck (and structural S/D remains supportive), the direction of rates will dictate the entire market. Starts, sales, etc. will all be a function of homebuiler and homebuyer sentiment which will ultimately be a function of rates.

The good news is that LGI has proven it can live in a world of higher rates. After the market slowed in mid-late 2022, the company started using incentives (including mortgage buydowns) and increased marketing spend to improve sales. It was effective, and LGI got back to an absorption rate in 2Q of ~6.1 when rates were ~6.5%. Yes, margins took a hit, but that was also partly a result of higher building costs that are flushing through the PnL and should ease in coming quarters. In addition, the company noted that demand was strong enough to start increasing prices - ASPs in the backlog were ~3-4% higher than closings. I will go into this in more detail below, but want to make the point that whilst 8% mortgage rates are going to hurt, we also don’t need to bet on rates going back to 3%.

I will also point out that the housing market has done a surprisingly good job at digesting higher rates in the past - it just takes time. Historically, the rate of change in rates has been more important than the rate itself. Incomes are now growing at a faster rate than home prices, and ultimately people want to own a house (evidence by record in-bound interest levels). Lets also not forget that rents are now catching up with home prices, which will also aid the buy v.s. rent decision. Maybe people have to wait a bit longer to buy, whether it be for the next pay raise, or change their spending habits for 6-12 months to get there, but eventually the economy will balance as it always has and the American Dream of owning a home isn’t going anywhere.

LGI’s recent hiccup - ROA will recover, path of margins will be somewhat dependent on rates

LGI is facing two problems which have weighed on its ROA - bloated balance sheet and lower margins.

On the balance sheet, LGI suffered from a particular set of circumstances through covid. When the market heated up, absorprtions went through the roof. In addition, the company’s order book filled up so much that it began selling houses far earlier in the construction cycle than it usually would. This led to the company running through inventory much faster than it had originally planned which was compounded by the fact that it paused starts/land acquisitions for a few months during covid. It was effectively a “pull-forward” of demand at the same time that supply went down (paused starts).

As the housing market went nuts, finished lots effectively evaporated as every Tom, Dick and Harry was trying to get land to fill the insatiable covid demand for new homes. Builders, both private and public, were buying land anywhere and everywhere because for a brief moment, it didn’t matter where or what you were building - it was selling and you could make a good margin on it. LGI, who is a strictly returns-focussed company, largely stepped away from finished lot deals at this time with the expectation that the market would ultimately cool down and that the short-termers would get burned. This meant that the company was not able to replenish the finished lots that it was pulling forward, and ran out of homes to sell.

LGI did continued to re-fill their land pipeline, but did so mostly with raw, undeveloped land, as that was all that they could get at attractive returns. This isn’t a problem as the company is used to developing its own lots, however, raw land takes 2-3 years to develop, so it wasn’t available to refill the pulled-forward lots in the immediate future. This, compounded by the fact that supply and permitting constraints through covid pushed the timeline out even further for land development, meant that LGI had an air-pocket in its community count. Below is the quarterly trend of active communities through covid. You can see it took a big dip in 2021/22.

Communities peaked in 2020 at ~117 and proceeded to decline through to early 2022 on abnormally high absorptions. This was not only a drag on sales, but also on return on assets. The company’s inventory position bloated out considerably, but was comprised mostly of non-revenue-generating raw land. As you can see below, the company’s inventory years increase considerably as you had increasing inventories and lower sales.

We can also see that the company’s lot count was heavily weighted towards unfinished. Finished lots declined from 2020 onwards, even though total lots more doubled through to 2022.

This is entirely a short-term timing blip, and the trend is finally coming to an end, with communities being released in 2H23 and ramping into 2024 and 2025. The company expects to be at 115-125 communites by the end of this year, and expects to grow community count by 20-30% in 2024. As the investment into land has already largely occured to support these communities, volumes and sales should increase considerably in the coming two years wihtout much investment needed in the land bank. As you can see above, the company’s inventory years was at 15 at the end of 2022, relative to an average of ~9-10 throughout the past. With a roughly ~50% increase in community count coming in the next 2.5 years, there won’t need to be a considerable amount of investment in inventory to grow into that number. This is a big part of the reason why the company’s ROA has been poor in recent periods, and should subside in the coming periods.

The other thing weighing on the company’s ROA is margins. Prior to covid, gross margins had typically been in the 24-26% range. This increased to ~28% through covid, peaking intra-quarter at 32%. This was a result of rapid price increases and also lower spending on sales and marketing (the company effectively stopped marketing because homes were just selling themselves).

When the market slowed, these factors swung back the other way. Home prices moderated an in-fact started falling with rapidly rising rates, and sales/marketing spend not only increased back to normal levels but also beyond as the company began training for the coming growth community count + needed to hit marketing harder than usual given the poor demand environment. The increase in SG&A and decrease in GP Margins at the same time caused operating margins to fall considerably.

The SG&A issue is mostly temporary. As community count expands in the coming 1-2 years, LGI will absorb the extra investment in sales staff that have been hired and trained recently, and I expect that will return to pre-covid levels in the coming 12-24 months.

The Gross Margin point is a bit of a tougher one. GP fell off a cliff in 4Q22 from ~28.5% in 3Q22 to 20.7% in 4Q22. This was mostly due to the company using incentives (effectively, a fancy way for saying they were cutting prices). In early 1Q, the company noted that it found an absorption rate that it was happy with, and began to slowly raise prices again. From the 1Q23 call:

Throughout 2023, gross margins have already begun to move upwards ahead of mgmt’s original expectations. Incentives are slowly being lifted and ASPs are moving up, and construction costs have eased somewhat. In 2Q23, the company reported a gross margin of 22% and called for another 100bps of improvement in 3Q23 to 23%. Its FY23 guide implies 22.5% at the midpoint, calling for a 4Q23 gross margin of 24% (another 100bps sequentially). That exit rate of 24% would imply a healthy gross margin in FY24.

There are levers that the company can pull beyond price incentives to aid affordability. One of them is building smaller homes, which they’ve been doing. And that has been working. Between 2Q21 and 2Q22, houses <1,500 SQFT accounted for 19% of sales compared to 27% in 2Q23. These homes are cheaper for the consumer but the company makes a similar gross margin (lower ASP and gross dollars, but same margin). It has evidently been working.

Ultimately, the big question mark, again, will be rates. LGI will use sale incentives to target an absroption rate of ~6, and increase prices beyond that. The good news is that LGI has proven the demand is there when they can get the affordability piece right. In fact, in 2Q23, the company generated the most amount of leads in its history, proving that the pent-up demand is there. This is why I think LGI is a coiled spring. The level of pent-up demand/shortages are real and staggering. If we do get a normalisation and/or even easing in mortgage rates, LGI is going to absolutely shoot the lights out, but it should continue to do well even if rates hang in around where they are.

Financial Analysis, Forecasts, Valuation and Scenario Analysis (risks)

First, a quick high-level on the company’s financial history. The growth is truly something. ROA is lousy compared to most industries, but it has consistently run at HSD/LDD through time (good for a homebuilder), and with leverage, ROE has consistently exceeded 20% since 2015. If you are able to re-invest all earnings (they do), then ROE of 20%+ is pretty darn attractive.

ROE is an important figure for homebuilders as investors typically look at them on a P/B basis. So, if you can hold your P/B ratio constant, the stock return will be ~ROE. On that basis, you can also see why a 20%+ ROE is attractive.

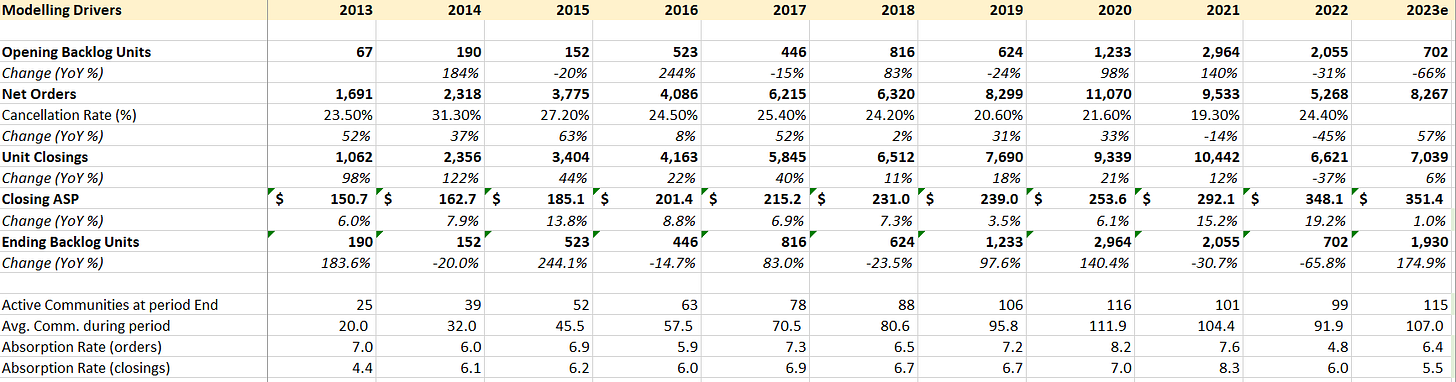

Here are my key modelling assumptions:

Community Count: This is how many communities are actively selling homes. The company has guided to this and it’s a pretty high-visibility number, seeing as these communities have been under development for 3+ years. I have 120 at the end of this year, increasing 25% YoY and then up again to 150 in 2025. This has been more or less guided to. The company wants to get to 240 in the medium term, so I’ve grown communities at +15 in 2026 and +10 in 2027, which is fair relative to history of ~15/20 per year.

Absorption rate: The right way to think about LGI is that they have a bunch of regional communities surrounded by a certain amount of renters, and they close a certain amount of renters per month in each individual community. Hence, I model homes sold (closings) using the number of communities open in a period multiplied by the absorption rate. I have used 6 going forward, which is at the lower-end of what the company has achieved historically (~6.5 is a pretty decent year historically). I think it is fair an a touch conservative. In better times the company should outperform 6. In 2023, they will do ~5.5 to give a sense for what a bad year looks like.

ASP’s: Grow at 2% per year. That is conservative versus history (implies negative real house price appreciation). It is probably too conservative but I think most would expect home prices to be pretty benign in the next few years. Ultimately margins are way more important to profits than ASPs so I don’t view it as a key input.

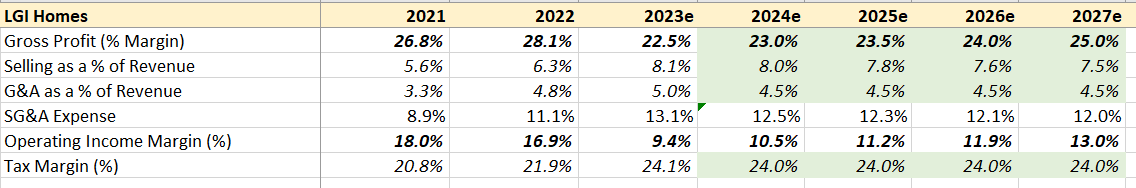

Gross Margin and SG&A: Below are my assumptions for GPMs and SG&A as a % of revenues, and you can see those versus history. There isn’t so much science in the GP margin - just a gradual recovery back to a historic level by 2025 for the sake of conservatism. Actually, given the company’s guidance for an exit rate of 24% in 4Q23, my FY2024 estimate of 23.5% is probably conservative.

SG&A, similarly, remains elevated before normalising to 2025. In 2025, the company’s operating margin is ~in-line with historic averages, if not slightly below. Ultimately, it’s going to depend on rates. If they keep going up, the company will need to use incentives and gross margins will drag. If they stabilise or fall, the company should be able to recover historic margins faster. If absorprtions are healthy, then SG&A will come in line faster.

And this is how profits shake out:

I’ve kept the debt-to-cap ratio at ~the middle of the company’s guidance and used any excess profits to repurchase stock. I might also add that the average communities at the end of 2027 is 170. Given the company’s target is 240, the cpy. can still probably continue to grow beyond 2027. This gets us to the following multiples, based on $115 stock price.

So, if we assume that the stock holds its P/B ratio, stock returns should be ~roughly equal to growth in BVPS (book-value per share). Below you can see BVPS growth, as well as ROE and ROA. The difference between ROE and BVPS is that there are some share buybacks in there as well, but they are roughly equal.

My forecasts are pretty conservative, as you can see from the fact that the company’s ROA going forward is much lower than the past. I’ve also been a bit conservative on the debt-to-cap ratio, which would juice the ROE if I were to bring it up to the low 40s (company guides to 35-45). Under this scenario, stock returns should still be mid-teens at a constant P/B. If we actually assume that the company’s ROA returns to 10% at a 40% debt-to-cap, returns will be low 20s (that is my more optimistic base case).

And, if we assume that the P/B ratio returns to prior levels of >2x (see below), we could see particularly strong returns in the mid-20s. Actually, in better times such as 2019, the stock traded with P/B multiples in the mid-2s, and even up to and above 3 when the market got really excited, so a re-rating to >2x is really not such a big ask. The current P/B multiple is actually consistent with prior downturns, such as late 2018 (it was a pretty bad time for housing). The market is discounting permanently lower returns and growth for LGI and I clearly disagree.

So, in a conservative case, we make mid-teens IRR and robust base case we make mid-20s. In a bullish scenario (god forbid rates come down - lets not forget that current forecasts are expecting cuts) where we get a re-rating, LGI can be a really, really good stock and do 30%+ returns if, for example, we re-rate back to 2.5x. Pretty good upside.

What’s the downside? Well it depends how bad the economy could get at any given point. The lowest level the stock ever got to was 1.15x book in 2022 when mortgage rates were going crazy. Given the situation in the housing market right now, it’s hard to imagine how the company could get itself into a position where it has to impair its book. Also, the LGI has, even in trough year 2023, an operating margin of ~10%, which is a huge amount of cushion for ASP that it can give away before it becomes loss-making. The world would really, really need to fall apart for LGI to lose money.

So, if we trough at 1.15x book, downside from here is ~30% (which doesn’t include armageddon). I view that as a particularly attractive R/R given that we’re playing for 20%+ IRR. If it works, LGI could produce 20%+ returns through to the end of the decade as it races towards its 240 community count target. LGI has been a serious multi-bagger, but it still has to potential to add another couple of bags through to 2030.

why is it falling so hard?