Short Idea: AURC-US (Better Mortgage)

AURC is set to De-Spac on/or about 22nd of August which will increase freefloat by nearly 1,300x. I expect the DeSpac to be met with significant selling pressure.

*By continuing to read this article you agree to the disclaimer at the bottom of this page. This is not financial or investment advice. Do your own research.

I am short AURC (Aurora Acquisition Corp), the SPAC that will be bringing Better.com to market next week. I think the fair value of the company is ~81 cents - it is currently trading at $32.

Yes, borrow is hard to come by - but it does exist in small quantities. When the DeSpac occurs next week, if the stock doesn’t collapse 98% on day one, then borrow should be accesible.

Here is the thesis in a few key points:

Better CEO/founder Vishal Garg has a long history of bankruptcies, deception and fraud accusations. He is currently involved in mutliple lawsuits in relation to a CDS scheme where he supposedly defrauded investors out of tens of millions of dollars. Garg has been accued of blatantly lying to Better.com investors about prospective profitability (by a former close associate), and lied on multiple occasions about MRU Holdings (his first company) being acquired by Merril Lynch. In-fact, SEC filings show it was money-losing with negative equity and voluntarily filed for bankruptcy after it defaulted on loans. Vishal has a long history of deceiving others in the pursuit of enriching himself.

Better.com is an uneconomic dumpster fire headed for bankrputcy. It’s financials make WeWork look like Microsoft. The cpy. has cut 91% of its workforce and loan activity has fallen from its peak by ~97%. If not for a lifeline from Softbank that was personally guaranteed by Vishal himself, it’d have most likely gone bankrupt already. Better lends out money at a significant loss which has been funded by debt and equity in a business model which would be best described as a Ponzi. The spectacular losses show a -365% operating margin in 1Q23 (excluding restructuring, impairments and one-offs). Prospects of reaching profitability appear little more than fantasy.

The SPAC recently ran to $50 on a short squeeze due to low outstanding freefloat on the back of almost maximum redemptions. The sponsors voted the transaction ahead due to their significantly-conflicted position of being on the hook for potentially millions in expenses if the transaction didn’t go through. The company has a PF book value of ~$200m as of March 2023, and did ~$21m of revenue in 1Q23 (upon which the company lost $90m). The current valuation at $32/share is ~$24b, or ~120x P/B or 286x 1Q23 annualised revenue. The current stock price is utter nonsense. Rocket Mortgage trades at ~3x book - applying the same multiple to Better.com gives us $0.81, or ~98% downside.

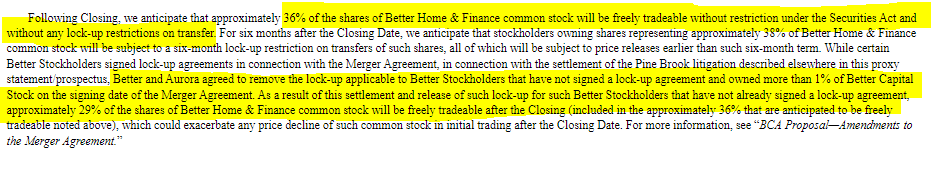

An immediate catalyst to bring the stock back to reality is coming. The vote was passed on Friday, 11th Aug to go ahead with the transaction and the De-SPAC will occur on or about August 22nd. The significance of this is that following closing, ~36% of outstanding stock will not be subject to lock-up restrictions and will be freely tradeable. That means that of the ~743m shares outstanding in the new entity, ~267m will be tradeable. On an estimated current AURC free float of ~212,000 shares, we will see a roughly 1,260x increase in freefloat on or about Aug 22. Post closing, the extra liquidity should bring selling pressure and ease the artifically inflated stock price.

I want to drill-home the fact that Better.com has been a total shitshow on-par with if not worse than WeWork. At the current stock price, early investors are now sitting on significant unrealised gains in a company which they probably thought would never see an exit. Better has totally blown up, but the valuation has increased by ~3x from where they thought they’d get exit liquidity in 2021 when the company was at the peak of its powers - volumes has since shrunk by ~95%. These should be extremely motivated sellers at the current stock price, or really any stock price above $1 (representing ~4.5x BVPS).

Yes, there are a lot of stocks at stupid valuations out there, and I wouldn’t short a low-freefloat stock on valuation. However, I think that this situation is unique given the imminent catalyst of increasing freefloat in the coming few days.

Point #1 - Vishal Garg has an embarrassing corporate history

Vishal Garg is famous (or infamous) for his erratic behaviour, such as firing 900 employees on zoom in late 2021, calling a investor ‘sewage’, calling employees dumb dolphins and telling his old business partner and best-friend during a court disposition that he’d ‘staple him against a fucking wall and burn him alive.’

Less-know are Vishal’s dealings in other companies prior to founding Better.com. Here are just a few.

Vishal Garg has consistently lied about the success of MRU, which was in reality a total failure. He also lied about selling it to Merril Lynch

His first company was an online student lender called MyRichUncle (MRU Holdings - UNCL-US) that was founded in 2000. It went public in 2005 and started operating as a student lender in 2006. It was supposedly one of the largest private student lenders in the country at the time. It went bankrupt in 2009 during the credit crisis as losses mounted and the funding taps turned off. In a similar fashion to Better.com, the company never even came close to any sembalnce of profitability. Vishal Garg was the CFO, and showed a clear disregard for unit economics.

Not only was MRU a total shit show, but Vishal has repeatedly lied about the fate of the business. In an interview with Alejandro Cremades, Vishal lied about the profitability of the business and the bankruptcy situation. Read the following.

In reality, the company was severely loss-making from 2005-2008 (main years of operation).

And by June 2008, there was already a hole in the balance sheet to the tune of ~$5m (more if you exclude intangibles). The company had grown whilst accumulating significant losses, funding them with equity and debt.

Also, it filed a voluntary petition for bankruptcy as a listed company after defaulting on secured notes that it had issued to Longview Marquis (Viking). From what I can tell, Merrill never acquired the business, and the claims that BofA made them shut the business down due to competitive fears are totally baseless. Merril was, however, the company’s main funding partner.

Vishal even goes to far to lie about this on his linkedin.

This wasn’t the only money-losing lending company that he was involved with. In the Alejandro Cremades article, Garg also claims to have been a co-founder in Future Finance Corp, ‘Europe’s largest private studen finance company'.

Audited accounts from 2019 show that Future Finance was similarly severely loss-making.

The great thing about lending is that if you want to give money away cheaper than others, you can grow very, very quickly. And as long as you can keep raising money, you look like a rockstar. I suspect that Better.com may face a similar fate to MRU and Future Finance.

The CDO Servicing Scheme - accused of defrauding investors out of tens of millions of dolars

In January 2011, Vishal Garg and some business associates began to approach investors with a new investment oppournity, as it set out in complaint andrew black et al v. phoenix cayman ltd. et al. Effectively, Garg told investors that they would raise money from investors to buy some underperforming CDOs and enact change to improve the performance. In reality, he created a scheme whereby the company would get involved in litigations for toxic legacy RMBS transactions and keep part of the collections.

There’s so much to the story, but without going into too much detail (you can do so yourself - the court documents are public, and my word it is a fascinating read), Garg is being accused of siphoning off funds that were supposed to be for investors into accounts owned by himself. Garg did this in a number of different ways to a number of different entites.

Firstly, the partnership paid over $13m to an entity owned by Garg for ‘consulting services.’ The entity is called Phoenix Asset Managers LTD - it sits outside of the partnership. The LPs, who are the platintiffs in this case, claim that they have ‘been provided with no proofs other than related party invoicing to show what services and the actual costs to provide any of these services are.”

They scheme also involves dealings with accused fraudster Thomas Priore (who sold Garg the CDOs). The partnership paid him up to $5m in consulting fees for no identifiable reason. The LPs have disputed these payments as diversions.

In another case, the company earned revenue from a settlement of one CDO into an unrelated entity that was owned by Garg and sits outside of the partnership called Phoenix Advisors and Management, LTD. Garg claimed that this was due to an inability to open a new bank account under the partnership in the Caymans as one of its members was convicted of securities fraud (and subsequently sent to prison). This $6.5m was never returned to investors, and it is alleged by the Plaintiffs that, according to bank statements provided during the trail, the cash was siphoned off to entities owned by Garg, including Better Mortgage.

The ‘expert’ who was summoned by Garg’s entities in the case said that part of the $6.5m was paid out to PSD (Thomas Priore) for consulting services of ~$2.5m, and the rest was paid out as “bonuses to key individuals.” The auditor was unable to verify the payments in the general ledger. It further states that the bonuses + fees in the entity offset the $6.5m of revenue it earned. Their defense is that the articles of assocation permitted payments, including bonuses to individuals and entities, who performed work for the Partnership. Given that Garg was being paid directors fees and consulting fees, it’s unclear what he did to earn extra bonuses, and it is further unclear why those bonuses were paid into accounts owned by Better Mortgage.

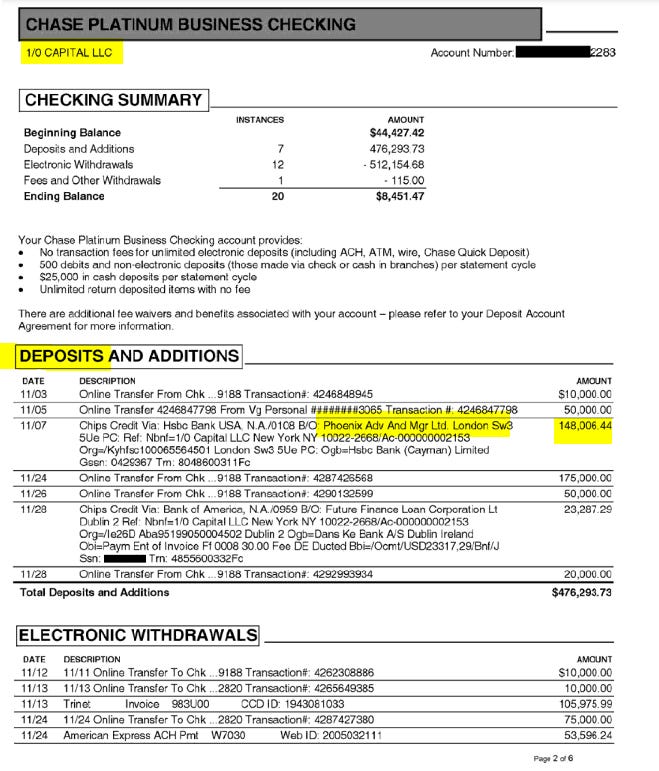

The statement of facts found evidence on at least one occasion that money from the above entity, Pheonix Assets and Managers LTD, was transfered into the bank accounts of 1/0 Capital in November 2014. 1/0 Capital is Vishal Garg’s venture capital fund. Unfortunately, the bank accounts of PAM and Better Mortgage were redacted, but the statement of facts clearly stipultaes that they also received payments from the entity.

Garg’s personal bank statements also show that he received millions of dollars payments from different entities in the partnership, presumably for “directors fees.” The total amount of diversions from the partnership that are being claimed by the Plaintiffs is in the tens of millions.

For years, the Phoenix partnership refused to show financials to the LPs. When they were finally forced to by a court order, the auditor disclaimed providing an opinion citing that they were “unable to gather sufficient and apprporaite audit evidence” including “lack of sufficient evidence of all cash transactions (meaning the inability to test basic accounting transactions.”

The litigation is still ongoing, but it is clear that through a mix of ‘directors fees, consulting fees and employee bonuses’ Garg siphoned off funds for himself. This has all only come to light recently through a lawsuit, but from ~2014 the company completely ignored LPs requests for audited financials and refused them an audit. It would appear that they are now reverse-engineering a case for why LPs money has been diverted away, with the explanation generally being “bonuses” and “directors fees.”

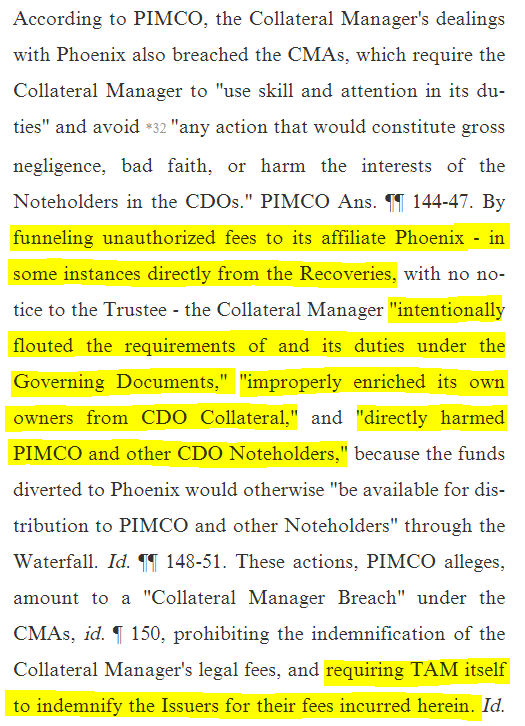

What’s even more interesting is that entities owned by Garg are also being sued (in connection to the same scheme) by PIMCO (holder of the CDOs). This gets a bit confusing, but effectively the company was improperly paying itself fees for collections that PIMCO claims not to have agreed to. Further, the trustee states that the entities were siphoning off cash from the collections without first sending it to the trustee for distribution (a HUGE no-no). Both were a clear breach of the indentures. Again, I urge you to read the case - the evidence is pretty damning.

In-fact, one large settelment (~$18.25m - the settlement over which the dispute arose) is still being held in escrow by the trustee, awaiting resolution of the suit, which has been going since ~2018.

PIMCO alleges that Triaxx has “improperly an intentionally retained tens of millions of dollars that belongs to the CDOs and distributed them to its related entity Pheonix.” PIMCO further stipulates the following:

In-fact, PIMCO is claiming that not only did the company improperly siphon off funds from collections (to where, is unclear), but that the Pheonix partnership has been improperly earning fees the whole time. Given that 100% of the investment partnership’s revenue came from services that were supplied from Phoenix to the CMA, PIMCO is claiming that the partnerships’ whole scheme was improper from day 1 and is seeking damages. The litigation is also still ongoing.

Lastly, Garg also being sued by a 3rd party in relation to this scheme - his former business partner and best friend Raza Kahn. In 2013, Khan commenced an action against Garg for fraud, breach of fudiciary duty, conversion and corporate deadlock. They key dispute in the case was that Garg had unfairly cut Khan out of joint business dealings with a company called Pheonix Real Estate Services (Pheonix). See below.

It is worth reading yourself, but in short, Khan and Garg owned a company called EIFC which did mortgage analytics, which was part of the scope of the service that Phoenix was supposedly supplying to the CDOs. This company was originally earning consulting fees from the Phoenix partnership, but in 2013, the two fell-out and Khan claims that Garg unfairly cut him out of business dealings by terminating the contract and re-assigning it a day later to an entity entirely owned by himself.

In summary, Garg is being sued by three different parties in relation to the same scheme that allege he improperly earned revenue for investors, and then improperly kept a large portion of it for himself. It’s worth noting that many of his business partners in this venture, such as Nicholas Calamari, are also involved with Better Mortgage. Nick Calamari is Better’s CAO.

Better Mortgage has been conducting related-party transactions with entities owned by Garg, one of which is rather suspect

According to the Exhibits in the S-4, Better Mortgage is involved in transactions with multiple related parties. These include paying fees to employees from his venture capital fund 1/0 Capital (for reasons unclear), data and analytics fees to TheNumber (a company majority owned by Garg), data and analytics fees to Truework (an entity in which Vishal Garg is an investor), rent expenses for a floor of office space in Manhattan from Embark (Vishal’s wife is CEO and they collectively own ~26%).

Though odd, none of the transactions were large amounts and could reasonably be explained as genuine business dealings. However, the Notable Finance transaction does raise a red flag

Notable is a home improvement finance company which is majority owned by Vishal Garg’s venture fund, 1/0 Capital (which is majority owned by Vishal Garg). Effectively, Notable provides white-labelled consumer lending on Better.com, for which Better pays a fee. In January 2022, the company set up a Trust (Better Trust I), a subsidiary of the company, to purchase up to $20m of unsecured home improvement loans from Notable right as the economy was starting to turn and rates were rising. As at March, 2023, it held ~$8m of such loans on the balance sheet at fair value, most or all of which seem to have been purchased during 1H22 2022.

There is no logical reason for the company to be buying hold-to-maturity unsecured loans - it is out of the traditional scope of their business as a gain-on-sale lender. It’s worth noting that this occured just one month after the company required accelerated financing from Softbank - it is suspicious that the company decided a good use for some of those funds would be to purchase some unsecured home finance loans. Thought ultimately not that material to Better’s balance sheet (only represents ~4% of equity), it likely would have been material to Notable and hence Vishal personally.

Accused by former employee of lying to Better investors on multiple occasions

In a lawsuit brought by former executive Sarah Pierce, multiple claims were made of purposeful deceit by Garg.

The lies include misrepresenting the amount of direct traffic on the site….

… and misrepresenting the timeline to achieve profitability to investors.

The suit ultimately turned into a bitter dispute between the two executives and led to an SEC investigation, which was ultimately dropped. Subsequent to the SEC investigation, Barclays, Citi and BofA all resigned as financial advisers.

Point #2 - Better Mortgage is not even close to a semblance of profitability

If you already know the business/story, skip the following dotpoints. But here’s a quick overview of how we got to this point for those who haven’t been following.

Better starts to make headlines with a $160m round at $600m valuation in 2019. It had revenues of just $24m, but was growing fast in the mortgage space. In late 2020, amidst perhaps the biggest mortgage boom in US History, the company raised another $200m at an astonishing $4bn valuation. It really made mainstream headlines when just a few quarters later in April 2021, it received a $500m softbank investment at $6bn valuation. A 10x improvement in valuation in less than 2 years - not bad.

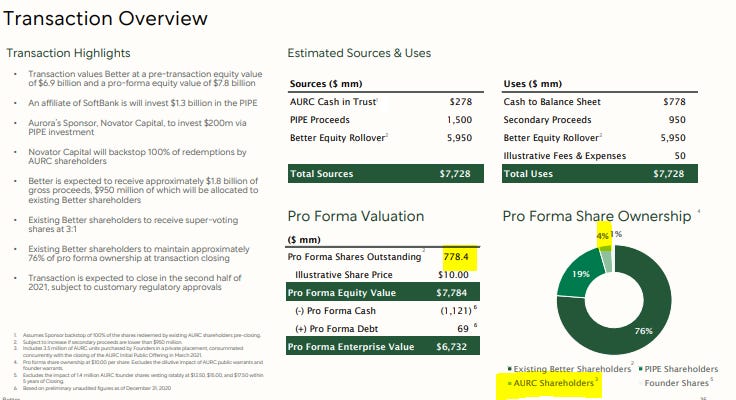

In May 2021, just one month later, the company announced that it would be going public via SPAC in late 2021. The post-money valuation was earmarked to be $7.7bn. Softbank doubled down with a $1.5bn PIPE investment (there was also $200m to be commited by Novatar Capital, the sponsor).

In December 2021, as rates began to creep up, it was announced that the PIPE had been ammended so that half of the $1.5bn ($750m) would be paid upfront instead of waiting for the deal to close. A spokesperson said that “the money will help the company double down on existing businesses, continue to build out “a custom-first home purchase experience” and launch new products and services.”

One day after, the company announced that it would lay off ~9% of its nearly 10,000 people staff. Vishal laid these employees off on a group zoom meeting, immediately after which their computers were shut off. The press lashback was vicious, and in the wake of it, the head of PR, Marketing and Communications all quit within a week. After the layoffs, there were an increasing number of reports about Garg’s tyrannical behavior.

Garg soon apologised, and then took a leave of absence after more details of his behaviour emerged, including berating one of his own investors. Surprisingly, he did not step down - in fact, he returned after a month in Januray. The reason is most likely because Softbank gave Garg their voting shares. Reports soon started to leak in early Feb that employees were ‘leaving in droves’ in protest of his re-instatement. In the same month, it was reported that the EVP of sales and operations and SVP of capital markets and growth both resigned. This came after two board members quit in mid-January. In late feb, three more executive including the VP of Finance, head of real estate, GM of purchase and head of sales left.

In early March, as the refinance mortgage market collapsed on higher rates, the company laid off ~50% of its then 8,000 staff (at its peak, it was ~10,000). Shortly after, the CTO stepped down. In april, they fired another ~1,500. It was then revealed that the accelerated $750m from Softbank was personally guaranteed by Vishal Garg. It was also reported that the company offered voluntary seperation agreements to its employees in India, and a reported 90% put their hands up, and the company had to cap how many could leave. In June, it lost 3 more execs - GM of Better+, SVP of sales and ops and VP of sales. In Aug, the 4th layoff came, which affected ~250 of more. It included the entire real estate team.

Last week, the pending SPAC transaction finally went to a vote after ~2 years of delays, and the transaction was approved.

Financial overview

Better Mortgage was in the right place at the right time in 2020, as Covid led to a (1) huge shift to online dealings as bricks and mortar locations closed, and (2) mortgage refinance applications due to historically low mortgage rates at 3%. This not only led to a boom in Better’s business, but also profitability. It makes money via a gain-on-sale model, so falling interest rates allows the company to sell the mortgages for more than they were originated for, giving the company a huge tailwind. In 2020 and early 2021, the company made a ~$250m operating profit compared to a huge loss in 2019. In 2021, the company fell back into big losses as the mortgage rate tailwind went away. 2022 was brutal.

I am not a financials specialist and yes I know that gain-on-sale models are confusing, and no I have not conducted a forensic analysis of the company’s accounts. But I don’t think you need to be an expert to see that the company is losing insane amounts of money.

As we can see, the gain on sale margin was 3.45% in 2020, compared to 1.88% on 2021 and 0.93% in 2022. Gain on sale margin is calculate as the difference between the amount fronted to fund a long and the amount received via sale (predominately to GSEs). Though not listed below, it was ~1.7% in 2019. In fact, in 2022, the company actually made a loss-on-sale of loans which was offset by a gain in interest rate lock commitments and forward sales agreements (hedging). You can also see below that the company’s growth has been historically fuelled by lower-than-average rates, subsidised by significant losses. The idea that the company is able to provide better rates due to its tech-stack or better underwriting is utter fantasy, given that it has incurred significant losses doing so.

I use this simply to illustrate that 2020 was a blip in profitability caused by an extreme event. Ex-2020, the company has been (and continues to be) extremely loss-making. It is not realistic to look at 2020 and expect that to re-occur, and outside of 2020, the company has been setting money on fire.

Given all the layoffs, the company has shrunk from a 10,000 person organisation to ~950 people - a reduction of ~91% in 18 months. This has been met with a reduction in funded loan volumes falling ~90% YoY in 1Q23 relative to 1Q22, and even more from their quarterly peak in 2021. A decline in refinance loans has been culprit for this, with ~99% of the nations mortgages now sitting below 6%. At 7%+ rates, that refi volume is not coming back. In 2021, ~81% of the business was refinance. However, it isn’t just refinance that has declined. Purchase volumes are also down considerably. Industry volumes are certainly not down so much, meaning that the company has pulled back on lending due to a lack of resources.

In 1Q23, the company made a gain-on-sale margin of 1.88%, which is ~roughly in-line with where margins were in 2019 (in-fact, a little bit better) before the mortgage market went insane. In similar fashion to 2019, the company is still losing significant amounts of money. In fact, it is losing substantially more money today, and is running at much lower scale. In 1Q23, the company only generated $21m of revenue, and lost $77m at an operating level when excluding restructuring. In 2019, it generated annual revenue of $89m at a similar gain-on-sale margin, but only lost $65m for the whole year.

Gross margins have turned negative - in 1Q23, the company had cost-of-sales for originated mortgages (platform revenue) that were ~2x the size of revenues (in 2019, it was ~0.8x). It seems highly unlikely that the company will ever turn a profit again, given that the 2020 situation was truly a once-in-a-lifetime scenario. The only thing that might help the company is if mortgage rates fall back below 3% - a seemingly unlikely outcome.

Book value has also deteriorated considerably, and the coming remains capital constrained. Below is the company’s pro-forma balance sheet.

Better currently has a negative book value to the tune of ~$700m (mostly reflecting the pre-closing convertibles which will become equity upon closing). It will have a pro-forma book value (March 2023) of ~$200m after the transaction is complete which accounts for an injection of capital from Softbank. It has a decent amount of cash (~$600m) which will keep it alive for a little while, though it is likely and in fact possible that the convert will be triggered, leading to further dilution. If you’re really interested, you can go and read the S-4 yourself because I don’t think that an in-depth analysis of the balance sheet is really that important. The fact of the matter is that the book value is $200m and that’s all you really need to know. Even if you write the convertible off to zero, the book value would be $700m versus a market cap of $18bn.

So, this company is losing substantial amounts of money with a book value of ~$200m. Rocket Mortgage has a book value of ~$8bn and trades at ~3x book. Rocket has a different model, but it’s not totally relevant. Times have also been tough for Rocket, who has not been immune from mortgage market volatility and slumped to losses. Rocket, however, was profitable in 2019 and 2018, and returned to profitability in 2Q23.

Point #3 - The valuation is from Fantasy Land

Post-Domestication, current shareholders are expected to own less than 0.1% of the outstanding equity. That is due to the fact that most SPAC investors (~93%) redeemed. In fact, the copmany will only receive ~$21m in connection with the transaction. The company will be owned predominately (78.4%) by existing better holders, Softbank (15.7%) and the sponsor (5.9%). As per S-4/A below:

Upon merger, one AURC unit will be converted on a one-for-one basis for Better Home and Finance Class A Common Stock

As of March 2023, on a pro-forma basis, there were ~743m shares outstanding. AURC shares are equal on a one-for-one basis with Better Home and Finance. Book value per share, as of March 13, 2023 (pro-forma), was $0.27. The current stock price is $23.

Originally, AURC shareholders were meant to own ~4% of the company, as per the below SPAC deck.

However, given that the vast majority of holders have redeemed, they will now own <0.1%. Current shares outstanding of AURC is only ~212,000.

The terms of the original transaction were never amended, meaning that the $10/share original SPAC price represents the original Pro-Forma equity value of $7.7bn - $10 x 778m shares oustanding. Given that the shares outstanding have declined somewhat due to redemptions to 743m, the current valuation is $32 x 743m = ~$24bn.

This is a terrible deal for AURC shareholders, but there really aren’t many left - and there aren’t enough left to vote against the sponsor. Given that the sponsor owned most of the voting stock in AURC, the vote went ahead. Of course, it is in the sponsors best interests to get the deal done. They even list it as a risk factor in the most recent S-4/A. I urge you to go read the risk factor - it is 3 pages and very entertaining. Effectively, the sponsor’s warrants will be worthless if the combination does not get completed by Sep 30, 2023.

Additionally, in such event, the 4,573,372 Aurora private placement warrants purchased by the Sponsor and certain of Aurora’s directors and executive officers (or their respective affiliates) simultaneously with the consummation of Aurora’s initial public offering for an aggregate purchase price of $6,860,057, will also expire worthless. Certain of Aurora’s directors and executive officers also have a direct or indirect economic interest in such Aurora private warrants. The 6,950,072 shares of Better Home & Finance Class A common stock into which the 6,950,072 Aurora Class B ordinary shares collectively held by the Sponsor and certain directors of Aurora (or their affiliates) will automatically convert in connection with the Mergers (including after giving effect to the Domestication), if unrestricted and freely tradable, would have had an aggregate market value of $72,072,247 based upon the closing price of $10.37 per public share on Nasdaq on July 19, 2023, the most recent practicable date prior to the date of this proxy statement/prospectus.

They’ll also be on the hook for expenses and liabilites of AURC if the transaction doesn’t close.

And of course they did not seek out a third-party valuation.

If we give Better Mortgage the benefit of the doubt and say that they should be valued at 3x book, the same as rocket, then we get to a value per share of $0.81. The current share price is $32. Hence, I believe that there is 98% downside in the stock.

Point #4 - De-SPAC will provide a catalyst for selloff on August, 22

The reason that the valuation is so stupid is due to the low freefloat and difficulty in shorting the stock. That will all change when the business combination is completed. Freefloat will increased from ~212,000 today (as noted above) to ~216,000,000, representing >1,200x increase, as ~36% of all oustanding stock of Better will be freely tradeable post-closing.

I was originally only meant to be 7%, but due to litigation from Pine Brook, the merger agreement was ammended to remove lock-up for shareholders that own more than 1%. Clearly, investors were motivated back then (in 2021) to sell the stock. So I wonder what their motivations are today.

I expect that this increase in supply of the stock will restore some semblance of rationality to the company’s stock price.

Disclaimer

You agree that use of Guasty Winds Management LLC's (“GWR”) research is at your own risk. In no event will you hold GW Research or any affiliated party liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence before making any investment decision with respect to securities covered herein. You represent to GWR that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this site. You further agree that you will not communicate the contents of this report to any other person unless that person has agreed to be bound by these same Terms of Service. If you download or receive the contents of this report as an agent for any other person, you are binding your principal to these same Terms of Service. You agree and acknowledge that the materials, opinions and contents available on this website (or any other GWR social media platform, including Twitter, Instagram, Snapchat or Facebook), are not investment recommendations and are indeed not recommendations of any kind.

This website contains solely our investment opinions. We are invested behind our investment opinions. Material on this website and all statements contained therein are solely the opinion of Guasty Winds Management, LLC, and are not statements of fact. Our opinions are held in good faith, and we have based them upon publicly available evidence collected and analyzed, which we set out in our research reports to support our opinions. We conduct research and analysis based on public information in a manner that any person could have done if they had been interested in doing so. You can publicly access any piece of evidence cited in on our website or that we relied on to write our repots. Think critically about our reports and do your own homework before making any investment decisions.

You should assume that as of the publication date of our reports and research, GWR (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors and/or their clients and/or investors has an investment position in all stocks (and/or options, swaps, and other derivatives related to the stock) and bonds covered therein (either long or short depending on our investment opinion), and therefore stands to realize significant gains in the event that the price of changes in conjunction with our investment opinion. We intend to continue transacting in the securities of issuers covered on this site for an indefinite period after our first report, and we may be long, short, or neutral at any time hereafter regardless of our initial investment opinion.

Nothing contained on this website is an offer to sell or a solicitation of an offer to buy any security, nor shall GWR offer, sell or buy any security to or from any person through this site or reports on this site. Guasty Winds Management, LLC is not registered as an investment advisor in any jurisdiction. The content and materials contained on this website are provided for information purposes only and nothing contained therein is investment advice nor should it be construed as such. Prior to making any investment or hiring any investment manager you should consult with professional financial, legal and tax advisors to assist in due diligence as may be appropriate and determining the appropriateness of the risk associated with a particular investment. Users of the GWwebsite and any material contained therein shall not use the site at any time for any purpose that is unlawful or prohibited and shall comply with any applicable local, state, national or international laws or regulations when using the site.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO.

Our research and reports express solely our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. GWR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and GWR does not undertake to update or supplement any reports or any of the information, analysis and opinion contained in them.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link:

http://www.gw-research.com

or a sublink to a specific report. If you have obtained a GWR research report in any manner other than by download from such links, you may not read such research without going to that link and agreeing to the Terms of Service.

Any links from our site or our reports are provided for viewer convenience. GWR is not associated or affiliated with any linked sites. Independent providers have prepared all information accessible through these links.

A mind blowing article Guasty... appreciate all the hard work!

Are the shares in the new company registered? Typically, most de-SPACs dont have the shares/warrants registered on day 1 after closing