Short Idea - BigBear.ai (BBAI-US)

Saddled with debt, loss-making and the equity is probably worthless

Another smallish one, but EV of ~$500m (bigger than PRST but still illiquid b.c. low free-float). Equity is probably not worth much more than $0.

I’m not short this yet, because I fear that management still has some fight left in it to ride the AI-hype. I want to get my timing right. It is a heavily shorted stock which has been the victim of squeezes multiple times in the past. And I don’t much fancy getting my head ripped off.

BigBear.ai is a roll-up of 5 businesses. The equity is very overvalued at best, worthless at worst. Unlike PRST, SMRT, CLSK and LTCH, which I think were structurally unprofitable businesses from day 1, the underlying businesses of BigBear do (or did) have some value and have illustrated profitability in the past before the roll-up began. I don’t, for that reason, think the businesses are worthless.

However, the company has ~$200m of debt yielding 6% ($12m), which is substantially all of the profits that the company could make even if it returned to its former glory in my estimation. I do not think that the collection of companies is worth much more than the debt. And I hence think that the equity is effectively worthless. The business is stuck in a debt-trap.

It’s on my watchlist and if it squeezes again, I’ll be waiting to press it back down.

Know something about BigBear? I haven’t had much luck contacting ex-employees. Hit me up guastywinds@gmail.com or twitter @guastywinds.

What is BigBear.ai?

BigBear wants you to think that it is a revolutionary AI/ML start-up for government services which is breaking into the commercial market. It is, in fact, a roll-up of four different government services providers. A large swathe of the business is low-margin time + materials contracts, which hasn’t grown in 4 years. Part of the business has a software component which is higher margin, and whilst it had a bright past, growth has slowed and there has been a mass exodus of talent.

The company has tried to push into the commercial market, which has been a total failure. Here’s the story.

Background on BigBear.ai

In 2020, a Private Equity firm called AE Industrial Equity embarked on a roll-up strategy in the government data-analytics sector.

First, they bought a company called NuWave solutions in June 2020. This article from 2017 was the best I could find for info on the company, as it has since been folded into BigBear and the brand’s website/marketing materials no longer exist. My understanding is that it was a government contractor/software provider that helps organizations like the U.S. Army pull data together into a single platform, where it can be managed (including analytics tools). NuWave is a relatively old company, founded in 1999.

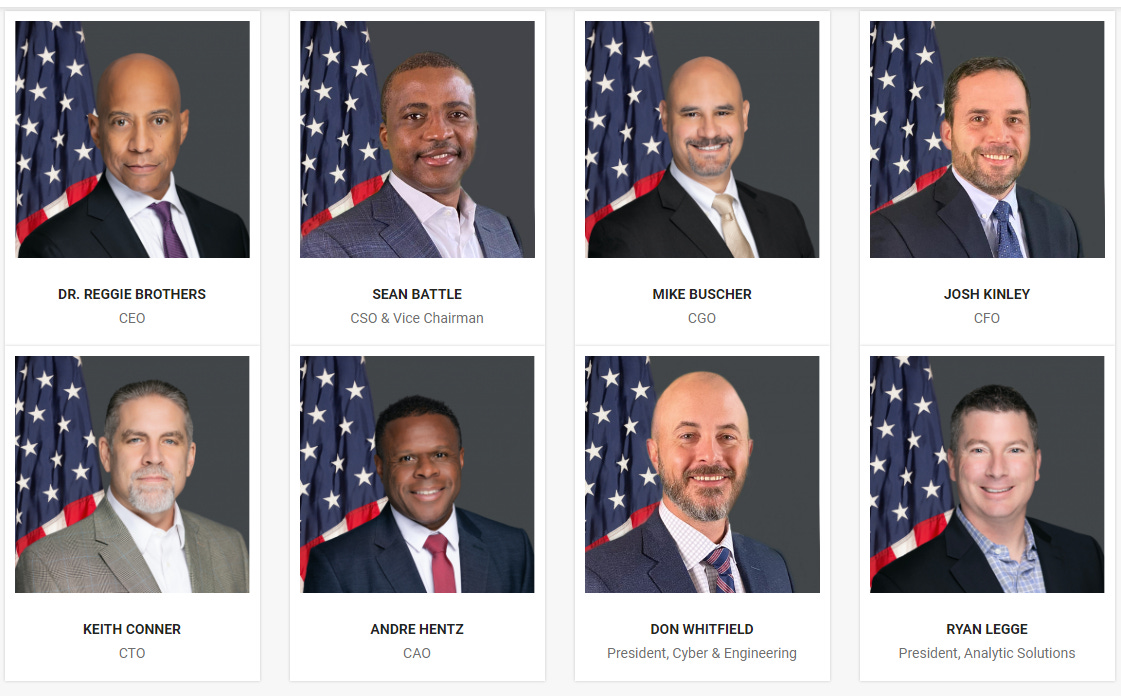

At the same time, AEI put in its own management team. Dr Reggie Brothers (CEO) and Mike Buscher (Chief Growth Officer) were installed at the helm. They both come from Peraton, where Reggie ran strategic planning and M&A. AEI stated that NuWave would be a new standalone platform to expand into analytics and intelligence. NuWave was to be the base for a roll-up strategy.

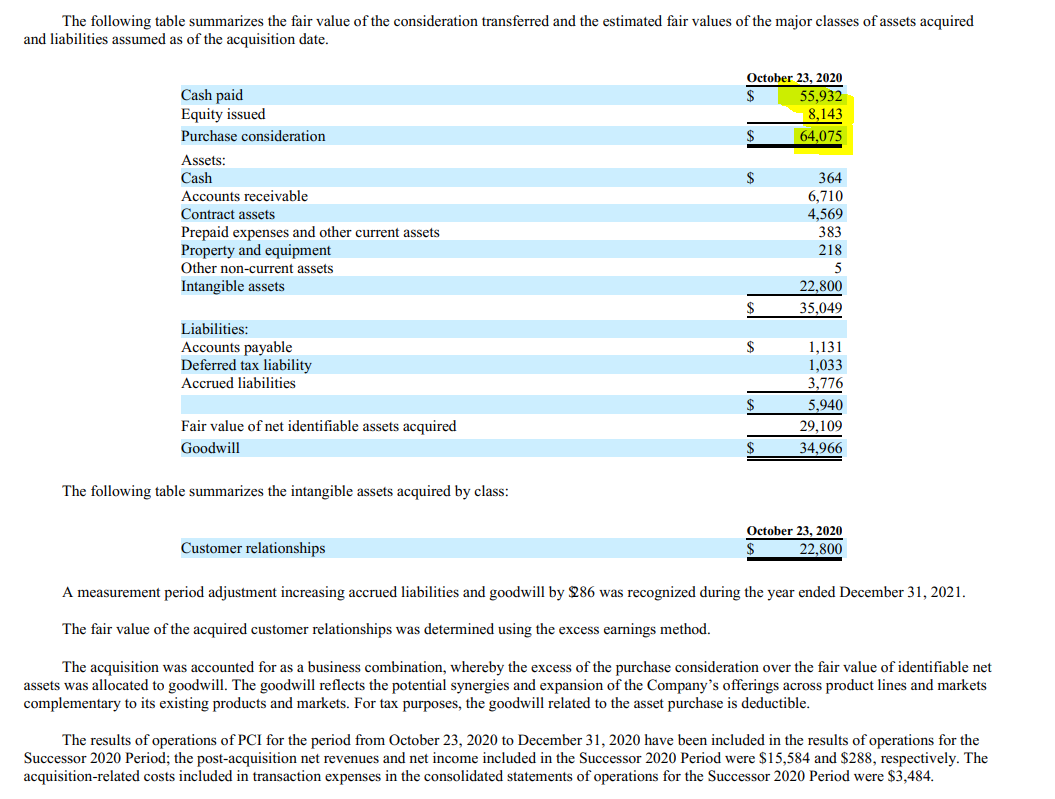

In October 2020, just a few months later, AEI acquired PCI Solutions. PCI was a ‘cybersecurity and computer networking’ services company that did contract work for government agencies. In other words, a niche low-margin body shop that does IT consulting for the government. It was founded in 2008 by Sean Battle, Don Whitfield, Josh Kinley, and Vance Mitzner. Sean was made CSO, Don came on as president of Cyber and Engineering, Josh stayed on as CFO, and then corporate development officer. I can’t seem to track Vance Mitzner, so it’s unclear if he’s still with the business or not.

In December, NuWave acquired a company called BigBear.io, a leading provider of ‘cloud-based big data analytics solutions’ to the U.S. Government. BigBear was founded in 2008. The press release was pretty vague on exactly what the company does, but it seems to be a cloud environment that helps pull, clean and analyse data from dispirate sources, which has specifically been built for use by the government sector. It was previously known as Open Solutions Group (OpenSGI Inc.).

According to this article in 2016, the company had long been a provider of ‘geospatial data services’ to the Department of Defense. And it seemed to be doing pretty well. This article suggests that the company grew at 220% in 2017 and ~50% in 2018 - off of what base exactly is unclear. It’s hard to find information on the company, but given that it was largely a government contractor, it probably didn’t have a big need for mass-media PR efforts.

Later that month, NuWave purchased ProModel’s government services business, a leading provider of analytic software to the government. Pro Model was a 25 year old company which had a custom model-based software solution to visualize complex and dispirate data. It was also a contractor to the federal government.

Shortly after, in Feb 2021, AEI pulled all four businesses together and merged them into a new company called BigBear.ai. Reggie was made CEO and Sean Battle was made the Chief Strategy Officer (formerly CSO of NuWave).

A few months later, in June 2021, the company announced its Merger with the GigCapital4 SPAC. The company had been dressed up as a AI/ML start-up. It was announced that proceeds from the merger would be used to build a product for commercial markets. Concurrently, the company raised a $200m convertible note from a large investor, with a strike at ~$10.

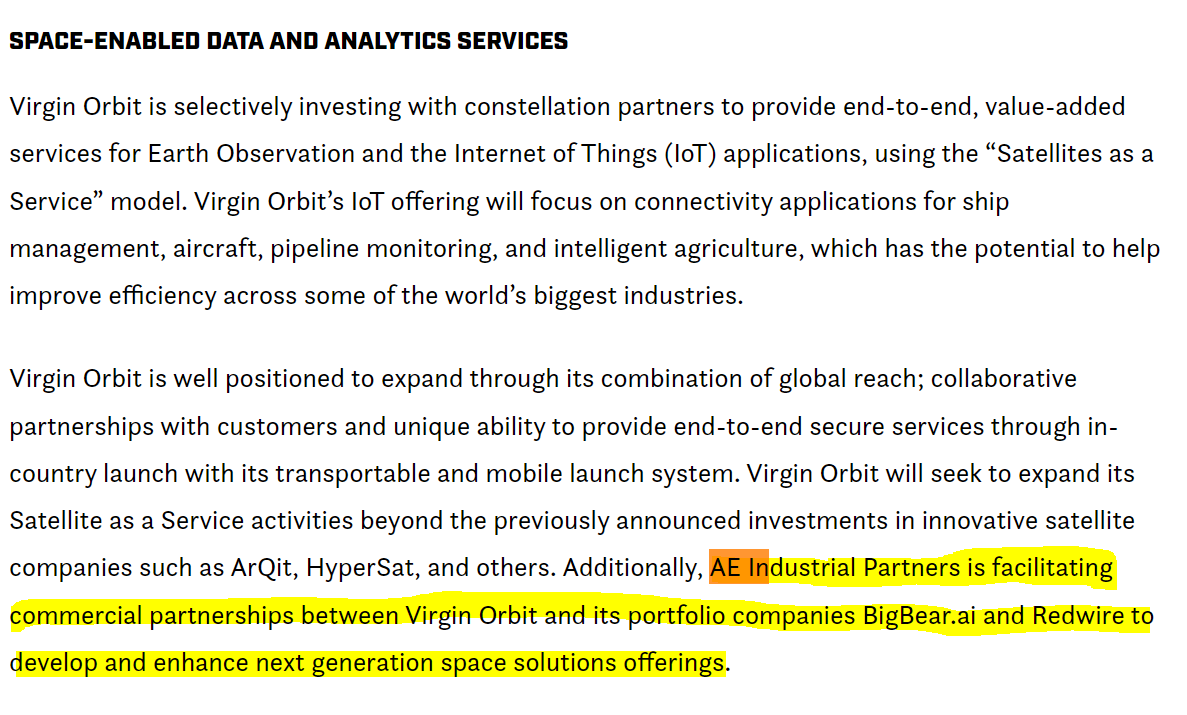

By the way, AE Industrial did this more than once. Redwire is another one of their quick roll-up SPAC-exits, which is loss-making and saddled with debt. They also SPAC’d Virgin Orbit, Terran Orbital and there were rumours of taking FireFly public too. Remember these names.. it will be important later.

The valuation for BigBear was astonishing. The company was expecting to raise $330m to its balance sheet at a valuation of $1.57bn. Check-out the SPAC deck here. In 2020, the company did pro-forma $43m in gross profit. That puts the stock on 60x gross profit. It did ~$17.5m in pro-forma adj. EBITA. That puts it on ~90x EV/EBITA. And it did ~$138m in revenue, putting it on 11.5x EV/Sales.

This is not a hyper growth company, and should not be comped against high-growth software - it grew revenue by 14% in 2020, 5% in 2021 and organically by ~3.5% in 2022. AE had effectively increased the EV by ~8x over the course of ~12 months, by doing nothing but rolling up some businesses and sticking them together. Perhaps I should have gone into in private equity…

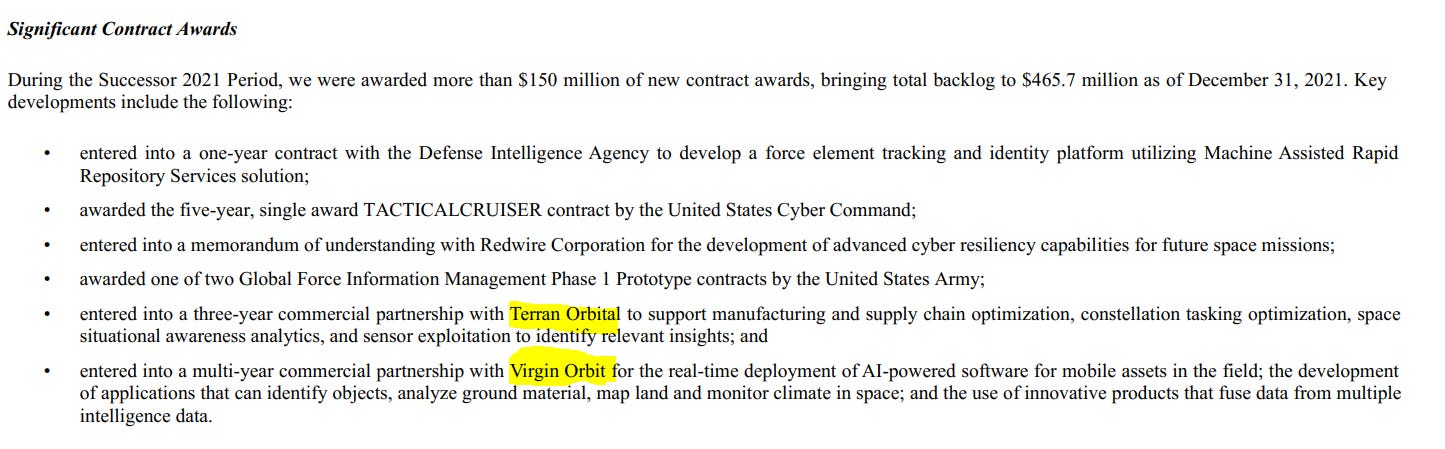

The two case studies in the SPAC deck were Virgin Orbit and UAV Factory. Both are portfolio companies of AEI. They also used a slew of other portfolio companies to pump up “project awards” leading up to the De-Spac, including this with Terran Orbital, this with Redwire and of course this and this with Virgin and UAV Factory.

Whilst the terms of their prior acquisitions were never disclosed, they appear in the notes of the S-1. In total, for the four businesses that made up BigBear.AI, AE equity paid ~$200m including $185m in cash and $15m in equity. It included $30m for NuWave, $64m for PCI, $63m for BigBear (Open Solutions) and $43m for ProModel. See below.

NuWave

PCI

BigBear Inc. (Open Solutions Group)

ProModel

We also get a peak into the Pro-Forma sales and earnings of the company in its first 10-k. It isn’t complete but gives us a sense for gross and operating margins as standalone businesses. NuWave and BigBear were quite profitable, with nearly 20% operating margins, and ProModel was very profitable with a ~30% operating margin. The problem is that these businesses were quite small and niche. PCI was much lower margin (8.5% operating margin) and made up >50% of revenue at IPO. Taking out transaction expenses and amortisation (highlighted), the company did ~$17.5m in EBIT in 2020.

At IPO, the company organised into two segments - "Cyber and Engineering” and “Analytics”. The former was effectively the PCI business, whilst the rest were included in Analytics.

Looking a little closer, you can see that PCI, which makes up ~half of the company’s revenue, has not grown in 4 years. In fact, it has gone backwards.

The analytics business has grown well, and it has a better gross margin profile, but it isn’t all SaaS. It has an adjusted gross margin of ~45% (though the company doesn’t disclose how it arrives at that adjusted margin - it has a GaaP gross margin of ~33-35%). The reason is that whilst it has a software platform, it is still involved in consulting/billable work. In the company’s first 10-k, you can see that most of it’s revenue comes from time-and-materials. The fixed price contracts likely includes some software, but it is the minority, not majority.

The risk-section explains the software part a bit better.

The big pitch at the IPO was that the company was going to take its niche government “software platform” into the commercial sector, which provided huge oppourtunities. You can read about it in the SPAC deck, and here are some snippets from the S-1 about how they planned on doing it.

The sales and earnings estimates were astronomic. It valued itself in the SPAC deck on 2022e forward sales multiple, and used the forecasted $277m (they did organic $152m, missed by 45%). It forecasts $173m for 2021. The projections were made mid-2021, when 1H sales were locked in, and still only did $145, missing by 17%.

Other than the SPAC deck being a huge misrepresentation of the business, what went wrong? Let’s dig in.

Cometh the hour, cometh the downgrades

It wasn’t long before the lofty expectations were missed.

At 4Q21 results (just a matter of months after the company de-spacc’d with forecasts of $270m for 2022), it released 2022 guidance of $175-200m in revenue, and positive adjusted EBITDA. It expected a $20m contribution from commercial businesses.

The stock got whacked by ~30% after results, and then somehow ran up ~100% from $6 to $12. It appears that the stock was targeted by a short-squeeze, with only a small amount of free-float available and high short interest. As of writing, the company has nearly 50% of its free-float short.

The big concern, other than revenue growth being moderate-at-best, was that the backlog was declining. In the S-1, it was described as $485m, and in 4Q21 it had declined slightly to $465m. On the 4Q21 call, Reggie gave an explanation for the big revenue downgrade and fall in backlog.

Government’s fault. And Covid. Then the CFO chimed in with more.

In the 1Q results update (in May) is when the wheels really fell off for BigBear. The stock dropped from $10 to $5 in a week, and proceeded on a long-and-painful bleed down to 70cents over the next 6 months. Revenues were weak, losses mounted even on an adjusted basis and the backlog declined further to $459m. Once again, it was the government’s fault, according to the CFO.

Then, in 2Q, it was Ukraine that screwed them, according to Reggie. Backlog fell further to $325, but that was apparently due to a change in how they recognize projects in backlog.

As the CFO (now new CFO) would go on to explain:

In Q3, the backlog fell again to $288m, and this is what the CFO had to say:

Then, in 4Q, it fell again quite considerably to $222m.

RPO’s, as per the company’s Q’s and K’s were as follows (don’t have the 4Q22 number yet as the 10-k hasn’t been released).

Revenues have slowed considerably and backlog is deteriorating. But there’s more to the story.

Mass Exodus/turnover

BigBear.ai has suffered from a mass exodus of talent since the mergers came together. Exactly what has caused all of this is unclear.

Let’s start with the founders of the orginal businesses.

NuWave co-founder Mark Keyser stepped down in mid-2020 when the original NuWave acquisition was completed by AEI, and was replaced by Reggie Brothers. Mark became an advisor to the company. Howard Block and Rob Castle, the other two co-founders, can’t be tracked.

PCI’s founders Sean Battle, Don Whitfield and Josh Kinley all originally stayed on with the company. Sean Battle was the CSO, but stepped down in Dec 2021. He is still on the board. Don Whitfield left in April 2022 - he was the president of the Cyber and Engineering business (PCI). Josh Kinley was BigBear’s CFO, and he got shuffled off to ‘corporate development officer’ for a new CFO in June 2022 when the company decided it needed to tighten the belt on costs. He got bulleted in Jan 2023 by the new management team. Vance Mitzner I can’t track down.

From the original BigBear.io, there were three key execs - Frank Procelli (CEO), Brian Levy (president/CTO) and Thuy Le (VP/CFO). Frank is still around, Brian left in Jan 2022 and Thuy Le left in Dec 2020.

Now, remember that when BigBear.ai was formed, AEI brought in Reggie Brothers as CEO and Mike Buscher as CGO. Mike Buscher went in Dec 2021 and Reggie resigned in October 2022. This was the team as of Feb 2021 (according to the Wayback Machine).

Reggie, Sean, Don, Josh and Mike are gone. Keith seems to be gone (can’t track him down but doesn’t seem to be involved). Andrew is still there, as chief administrative officer, but he only joined in July 2020. Ryan Legge is still running the analytics solutions business, and he is one of very few legacy guys still left in upper management (he was EVP of NuWave).

Brian Futchey was the CTO after Keith Conner left (unclear when), and he got bulletted in September 2022.

There’s been a bunch more turbulence beyond just the founders. In November 2021, the company appointed Sam Gordy, Jeff Dyer and Claire Morse as COO/President of Federal, President of Commercial and Chief HR Officer. Claire finished up in Dec 2022, Sam Gordy left in August 2022 and they just shot Jeff Dyer last week. Jeff was the head of commercial, and “A replacement for Mr. Dyer's position will not be pursued at this time” according to the 8-k filing.

In Jan 2022, they brought in Carla Fitzgerald as CMO. She didn’t last a year - gone in Dec 2022.

In Feb 2022, they announced Todd Hughes as SVP of Technology and Research and Dan Jones as SVP of Products. Todd Hughes was gone in Sep 2022. Dan Jones was promoted to Chief Product Officer in Sep 2022, and then gone by December.

In May 2022, they made Tony Barrett head of the Cyber and Engineering sector (old PCI). He was ex-PCI and is one of the few legacy guys left. In just a few months, that got changed to GM of Federal Markets.

A bunch of other high ups have bitten the dust since the company went public, too. They included:

Tom Ruo, SVP of National Intelligence Solutions (Sep 2022)

Jeff Trent, Growth and strategy (March 2023)

Rob Hardie, Director of Strategic and Technical Partnerships (Sep 2022)

James Hornage, VP of educations (Aug 2022)

Rob Wedertz, VP of Defense (Jan 2022)

Joseph Moore, VP of National Intelligence Programes (Sep 2022)

So who is in charge now?

Her name is Mandy Long. She’s from IBM. Mandy is 36 and she’s pretty eccentric. The company made this little playlist called “Meet Mandy”. It’s pretty funny. This one was my favourite.

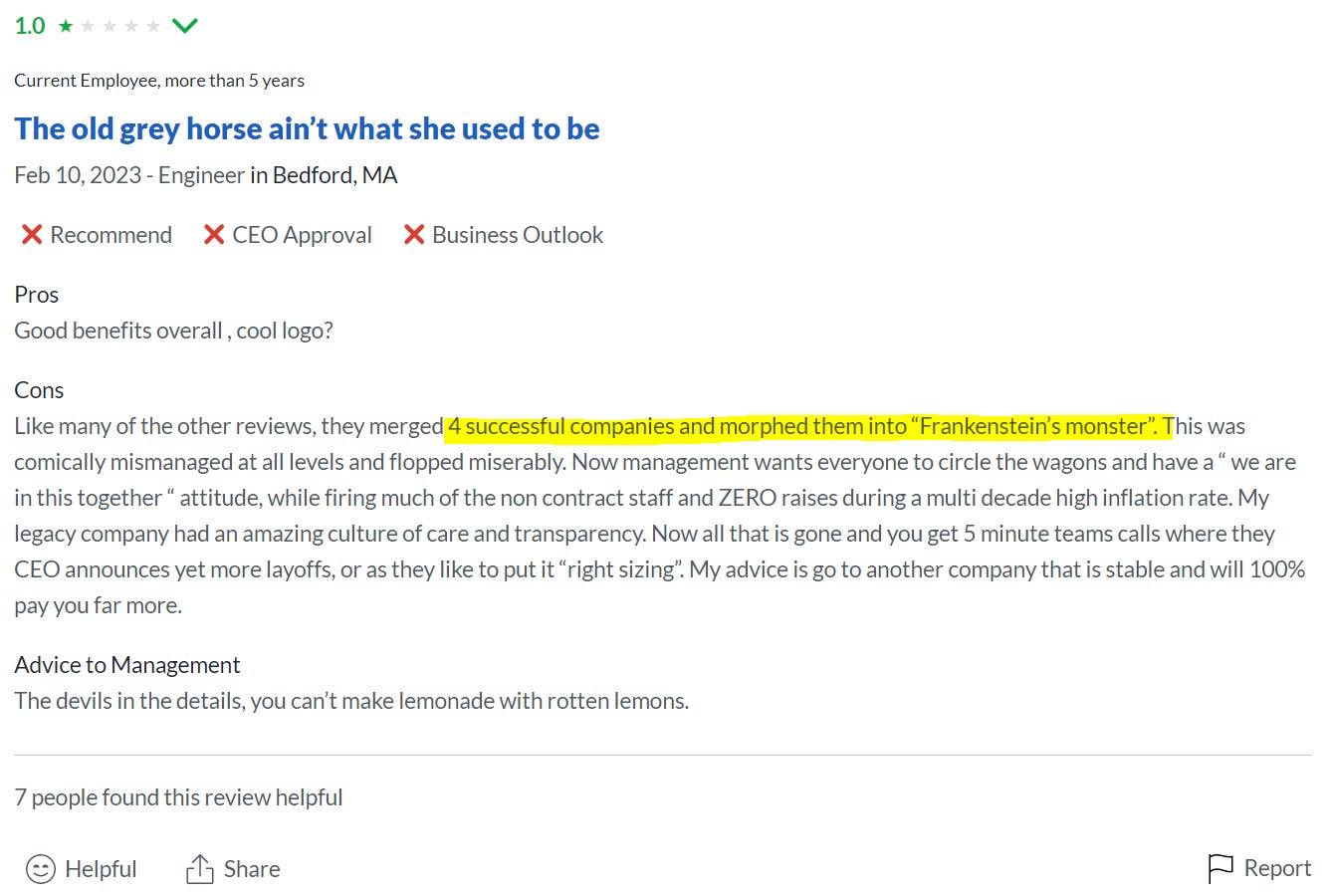

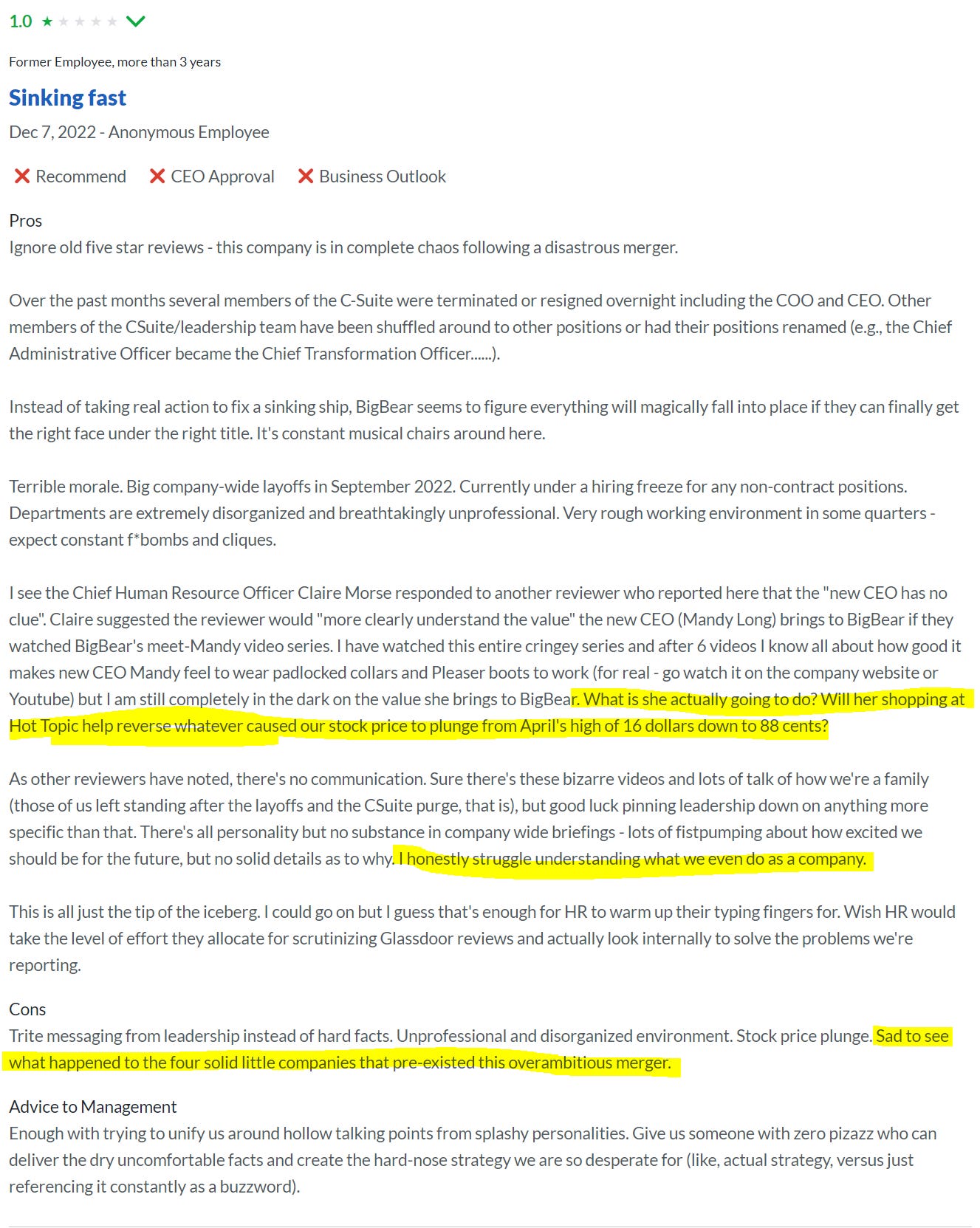

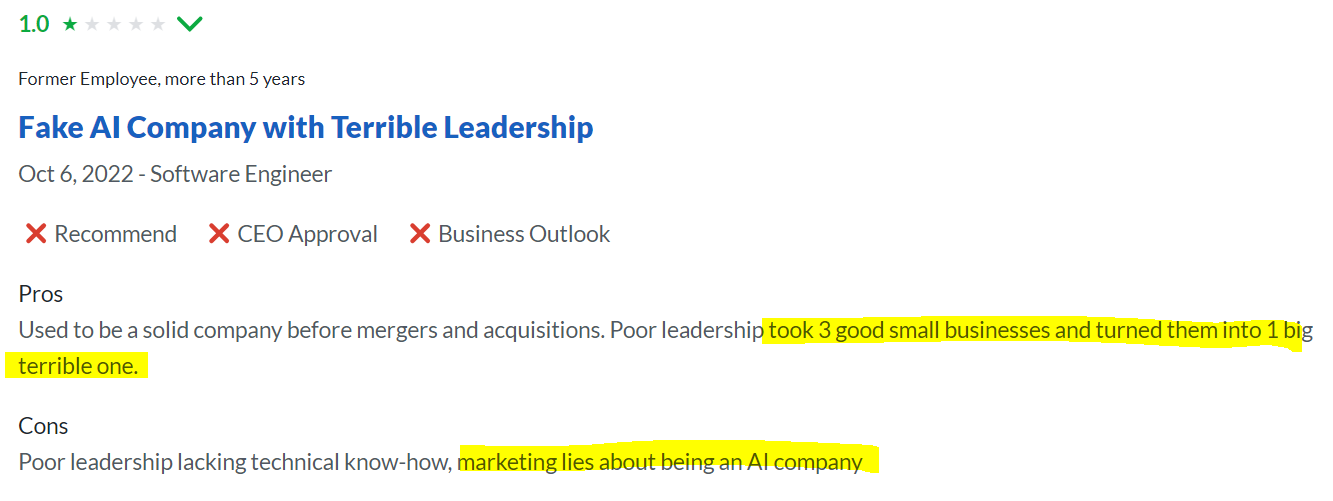

Glassdoor has some pretty scathing things to say about the company’s current state.

I get that people get pissed off when they get fired, so can’t put too much weight on it all. But I will note that many are current employees.

Other than incompetent management trying to mash four dispirate businesses together to create one and totally messing it up, I don’t really know what happened here. I do know that something happened though, else this many people wouldn’t be leaving.

The company’s original IPO strategy to push hard into commercial, pioneered by Reggie and AEI, might have something to do with it.

The commercial business was a total failure and the company won’t admit it

The big plan at BigBear’s de-SPAC was that the company was going to make a big push into the commercial market. That dream seems to have fallen apart. The company spent >$10m in the last two years trying to develop a product for the commercial market. But it appears to have nothing at all to show for it.

But I’m going to take a quick detour first, because it is important.

Remember back to earlier in the piece when I talked about how the company signed contracts with Virgin, UAVFactory, Orbital and Redwire for the commercial business. In the 4Q21 call, Reggie leaned heavily on the company’s progress on the commercial side with these companies as evidence of progress.

Remember - all four of these companies were AE Industrial portfolio companies. Oddly, whilst counting Virgin and Terran as contracts in the 10-k an press releases, they were ommitted from the Related-Party Transactions section. Also, it’s worth noting that Redwire’s chairman (and now CEO) Peter Cannito is also chairman of BigBear.

Snippet from the 4Q call:

Related-Party Section in the 10-k:

Why did the company not disclose these two clearly related-party transactions? Or is it that the press releases were hot air?

And let’s pause and have a look at these contracts a little closer. Firstly, UAV factory was an MOU, and it was never confirmed if it led to revenue or not. I suspect it did not, as it was never mentioned again.

The same goes for Redwire - MOU. When you read the Press Article released by Redwire, you realise that this is a Redwire product, and BigBear is helping to develop ‘tools and technologies to perform vulnerability research’. It seems that after a while, Redwire and BigBear did release a product called SpaceCREST.

Apparently, the product will be used by another space company called Mynaric, in this press release from Dec 2022. Mynaric is a european space company - it did 25,000 euro in revenues in 1H22 (last available reported period). Yes, 25-thousand. Check for yourself.

As a reminder, Redwire’s CEO (as of November 2022) is Bigbear’s Chairman. Surely there’s something a little bit more newsworthy than helping a related-party build a product which they apparently sold to a company which made 25 thousand euros revenue in 1H22. Maybe not. I guess BigBear and Redwire both needed some good news, desperately.

With Terran, the press release states the following:

So apparently, they were still in the ‘planning’ phase of pioneering AI solutions. It was obviously never mentioned again.

In fact, with a bit of digging, I found this press release from Virgin Orbit which stated the following:

AE Industrial was ‘facilitating’ commercial partnerships between Virgin and BigBear. It was also facilitating transactions between Redwire and Virgin. This is, at best, fishing for good PR. At worst, something more nefarious. They also released partnerships between Redwire and Terran. I understand that business people make introductions to one another, but it seems a bit suspect that a government data contractor would be able to suddenly add a significant amount of value to an array of different spacecraft component manufacturers and orbit companies.

Anyway, i’ll never prove whether these were arms length transactions or not. And maybe I am wrong and they were very at-arms-length. In any case, I don’t think it is okay in any circumstance to omit Virgin Orbit and Terran Orbital from the related-party transactions section. But I will let the SEC decide that.

I mean, there is not even an aerospace product on their website - only Academia, Manufacturing, Healthcare and Government. There is no mention of Aerospace, at all. Zilch.

I don’t point this out simply to show that the company has undisclosed related-party transactions. I point it out to show that the company has no commercial sales other than those made under related-party transactions.

Infact, prior to April 2022, it’s not even clear that the company had a commercial product. When you use the wayback machine to checkout the website, there was no commercial products listed, and on the 4Q21 call when asked about the use-cases for commercial, it very much so sounded like the company was still in its planning phase. Here’s a comment from the company’s then head of Commercial.

Then, on April 6, 2022, the company purchased ProModel. There are two ProModels - in early 2021, they purchased the company’s Government Services business, and then they purchased the commercial business. Here’s a snip of Reggie talking about the ProModel on the 1Q call.

So I went back with the Wayback machine to check out ProModel’s product line-up.

Surely enough, it matches BigBear.ai’s product page today. Exactly the same products.

Try find a case study on BigBear’s resources page that isn’t a ProModel product. I’ll wait…

The only non-government-related, non-ProModel-related product case study on the website is SpaceCREST - which is a Redwire collab product, that they ‘helped’ build. It’s not even a BigBear product - it’s a Redwire one. Why not showcase all the great work that they did with Virgin, UAV Factory and Terran? Maybe it doesn’t exist.

In fact, I went through all of the company’s press releases and website case studies. Other than legacy work from ProModel and related-party transactions, I can find no evidence of them winning any commercial work of substance, ever. Maybe I missed something, but I don’t see why the company wouldn’t have talked about it on an earnings call or with a press release if it did exist.

It’s possible that they built a good product and won some work, and chose not to tell us.. and left it off the website, and out of the case studies. But given their bar for press-releases is as low as Redwire’s SpaceCREST relationship with the 25,000 euro revenue cash-incinerating germany micro-cap laser company, I’d have thought it would make it.

The nail in the coffin for me was the firing of Jeff Dyer (head of Commercial) last week, and not looking for a replacement. Yet management still has the guts to get on the 4Q earnings call and tell investors that they are ramping up commercial efforts.

A suspect press release and a lifeline raise

In December 2022, it looked like BigBear.ai was going to the grave with $200m of debt and only $12m of cash on hand. It burned ~$50m in 2022, and it would have been worse if they didn’t stretch out their payables.

Management was desperate for cash, and on Jan 12, they released a press release about securing a 10-year multiple award $900m IDIQ contract with the U.S. Air Force. Read the fine-print. Multiple-award means the award of multiple contracts to more than one bidder. IDIQ means indefinite delivery, indefinite quality, and the $900m is a maximum limit number (the minimum is $1,000). It is not a $900m contract to BigBear.

They have not won anything yet. They still need to compete for task orders.

Actually, this contract was awarded on Dec 12, and there were proposals from 94 different companies on there (hence, multi-award). This is the document for the contract - NuWave Solutions LLC is BigBear.ai. See here too. I don’t know why the company waited until January 12th to release the news.

However, the news was obviously well received by the market at a time when AI was gaining hype, and the stock increased 260% in a single day helped by a high short-interest and low free-float. Orchestrated attempt or accident? That’s unclear.

The press release went out on Thursday 12th of Jan. Tuesday the 17th, the company announced a $25m private placement and got it away within a couple of days. Who else would run the book but HC Hainwright! Cleanspark’s favourite little dodgy broker. By the 19th, it was done. I don’t know this for a fact, but I suspect that most of the money came from retail investors, knowing HC Hainwright’s background with Cleanspark.

That $25m probably means that the company isn’t going to the grave. With stock-comp and the signficant headcount reductions, and what looks to be scrapping of the commercial business, BigBear will probably just survive.

Where to now? Probably a slow grind to $0.

Let’s summarise.

The company has a collection of businesses, all of which were purchased for a total of ~$200m. There has been a mass exodus of talent, growth has gone negative in the PCI business and slowed considerably in NuWave and BigBear. The backlog has declined considerably, also. I think it’s probably fair to say that the businesses are not worth that much different to what they were paid for 2 years ago. I find it hard to say that they are worth a lot more.

The company has a market cap today of $285m, so EV of nearly $500m. It will do gross profit of ~$45-50m this year. That’s an EV/GP multiple of ~10-11x. That is more expensive than a lot of high-growth software companies, include Palantir (to use a company in a similar sector). And BigBear grew sales organically at 5% and 4% in the last two years - it isn’t high-growth. Guidance expects organic growth of MSD at the mid-point for 2023e.

In 2020, the combination of businesses made $17.5m of pro-forma EBIT. Now, you probably have a couple $m’s of public company costs, D&O insurance, directors fees, etc. that you didn’t have before. And now you have a $200m convertible charging 6%. That is $12m of interest costs.

Put that $12m together with a few million from public company costs, it is substantial. Even if BigBear can restore itself to its former glory, there isn’t much pre-tax profit left, if any - at most, a few million bucks.

Management can’t just liquidate the four businesses unless they think that they are worth a lot more than what they were purchased for - that would only be enough to cover the $200m of debt, so the risk of a break-up/takeover/asset sales seems very low. And unless the current management team turn the business around to make it considerably more profitable than it was before this mess (seems unlikely), the company appears stuck in a debt-trap - most of its cashflow will go to servicing debt, and when that debt comes due in 2025, it is likely to be at much harsher terms than the 6% it received in late 2021 when money was free.

Hence, I think that the equity in this business is effectively worthless, in a best-case scenario worth $50-100m. It is a farcry from the current mkt. cap of nearly $300m.

Summary

Management haven’t given up yet. And they’ve already shown that they are willing to pander to retail investors’ AI hype to get the stock moving. I suspect that they will continue to do that, as their only way out of this is to get the stock price up and raise more money.

I will continue to wait, but this will be a magnificent short one day, I suspect.

And it will feel good to make money betting against AE Industrial.