This is a small one, EV is <$200m. I found it by accident looking at OLO. It isn’t super liquid and has ~15% borrow cost so I will keep my short small. And for a similar reason I will keep this post short.

I expect that, without outside financing, the company will fail within 12 months. Unlike Latch and SMRT, this company was late to the SPAC race and didn’t manage to raise much money. It was on the brink of bankruptcy, and barely managed to get the raise away. But it wasn’t enough, and they’ll need money again soon.

I expect that the company will lean into the Chat GPT AI-Hype to try raise some money from unsuspecting retail investors, just like Big Bear AI (BBAI-US) did a few weeks ago. Hence, I will keep my short quite small. If they do get the stock moving and raise some money, I’ll take the pain and do some proper work (if the EV gets high enough to warrant it). If not, and the stock trickles towards $0, then I’ll take that. I consider it a nice hedge for my longs.

This was basically the culmination of half a days’ work. I went through the S-1, latest 10-Q and listened to a Tegus transcript with a prior customer. This isn’t a full-fledged thesis but there’s enough here to warrant a small short position. I could be dead wrong, but I kinda doubt it.

What is Presto

Presto touts itself as an AI restaurant tech company. In reality it is a significant loss-making hardware company. It has recently been spruiking its AI product - which has had 1-2 customers pilots - but even then, Presto is just white-labelling a 3rd party product.

Unprofitable business with no proprietary technology

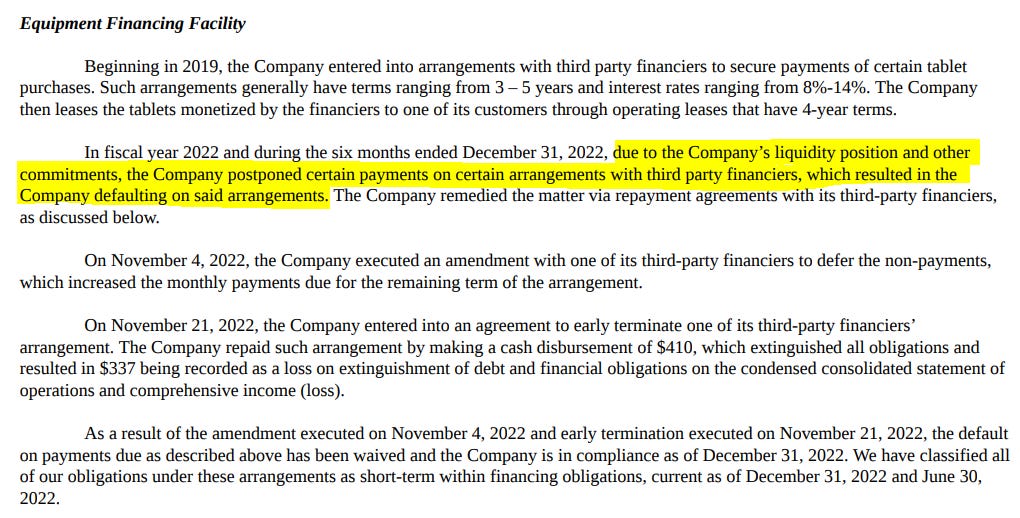

This company has been around since 2008. It has never made money. In fact it has burned >$200m since inception, which has been funded by external capital and rolling bank loans. The company de-SPAC’d in late 2022 and subsequently fell 80% in the course of a few weeks. Just before it de-SPAC’d, the company was on the brink. It had debt coming due, had no cash, and even had to default on some obligations. This is not a healthy, growing next-generation AI business.

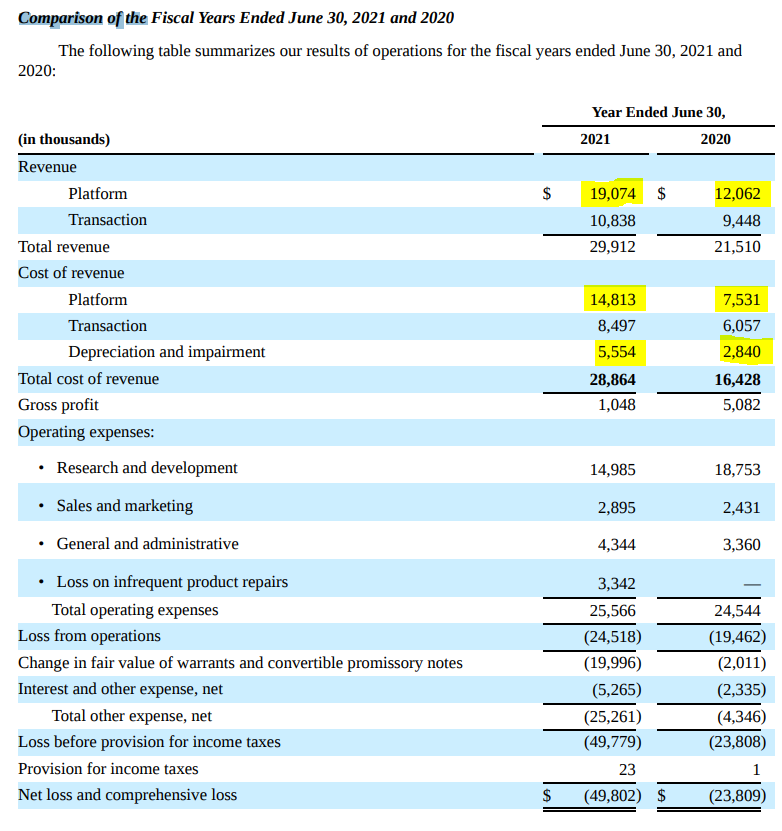

The numbers are ugly. The business sells touch-screen tablets to restauarants for menus and ordering. The tabelts also have games and movies for entertaining kids, which parents can purchase. Platform revenue pertains to the sale of hardware, transaction revenue pertains to gaming revenue.

There is barely any gross profit in this business - and it is structurally so. The gaming revenue is structured such that ~80-90% of the proceeds are shared with the restaurant. It explains why transaction revenue gross margin is ~12-13%. This item won’t scale.

The platform revenue is just re-sold hardware. They don’t make it themselves - they get it all from a single-supplier in Hong Kong.

The hardware business used to be more profitable in 2020. It had a 14% GPM in 2020 and ~8% in 2021 (you need to take out depreciation, because it is for leased units so it is a real expense). In 2022, as we saw above, it fell further to -3%. In the last quarter, it was -9%.

What caused this? It seems to be sweetheart deals. During 19/20, they signed a big deal with Red Lobster, and then ramped one with Brinkler (Chilli’s) in 2021. There’s a transcript up with an ex-employee from Brinkler on Tegus which alludes to sweetheart deals.

So the company chased after some bad business, and its profitability has been clearly declining. It raised some VC money in 2019, so maybe it needed to show some revenue growth.

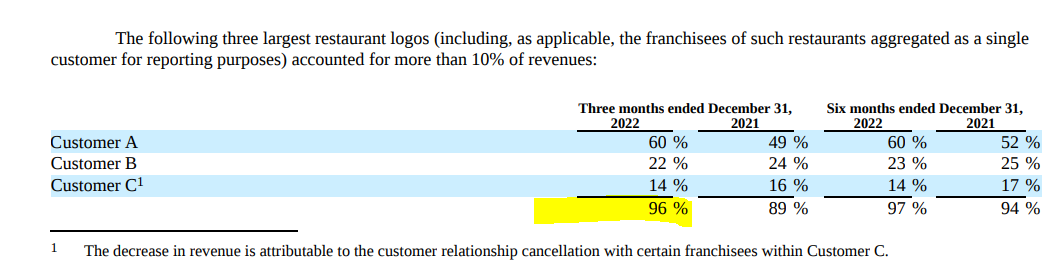

By the way - 96% of its revenue comes from just three customers.

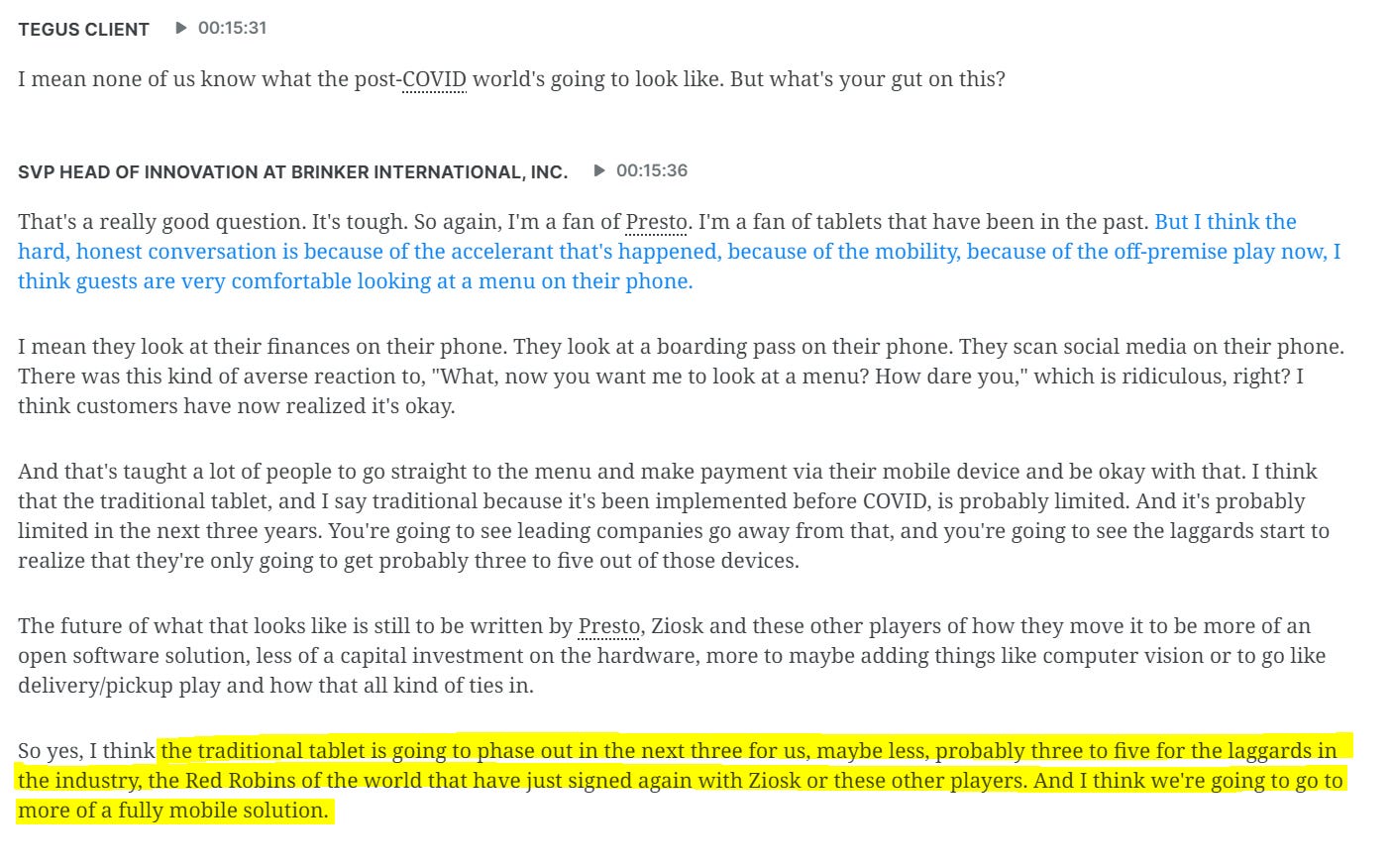

I’m sure with a big of digging we could figure out who is who. But anyway, point is - this company is barely break-even on gross profit, and isn’t in a business that scales. Its core business - tablets at QSR restaurants - is structurally challenged by QR codes which are way cheaper to maintain and implement. Why would someone splash out $10ms when they can just put a little sticker on the table? They probably won’t. The tegus guy even kinda alluded to this.

So, you’ve gone one of the company’s largest customers saying that tablets probably aren’t going to be a part of their strategy going forward. Hmm.

The company is also slipping with an existing customer.

I don’t know what the story is here. It might be Red Lobster, and might have something to do with the fact that the old CEO of Red Lobster was on the Presto board. That CEO exited Red Lobster in late 2021 (after Presto was rolled out) and has since left the board. I don’t want to speculate.

It’s all not a good look. Most of their arrangements are multi-year and coming up for renewal this year. So we will see who renews and who doesn’t.

The company’s earnings quality is also dogshite. In the last two years, the company recorded platform revenue of $39m. ~$35m of that came from deferred revenue accounts. Additions are not even close to matching recognitions, suggesting that customers are not renewing (doesn’t mean that they won’t). The company’s costs are also deferred, however, so they kind-of net-out in the CF statement. The point is that their revenue is not cashflow, and the deferred revenue balance is getting very low - it’ll run out this year.

There is no cashflow in this business. In-fact, quite the opposite - it is burning a crap-ton of cash. It’s burning at a rate of ~$15m/quarter and showing no signs of slowing down.

What about AI??

The company is touting itself as an AI company. It originally had two products - voice and vision. The voice product was voice recognition for ordering in the drive-through, and vision is supposedly some sort of machine vision which can track cars in the drive-through lane.

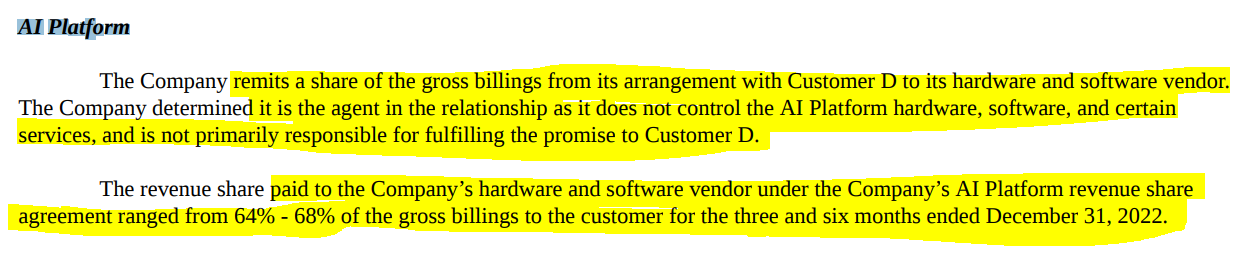

The point is not to debate the technology. The point is this - despite claiming that the company has ‘proprietary AI', as it did on its last earnings call - it doesn’t have a product. The ‘AI Platform’ is white-labelled. Check the notes in the 10-k.

So actually, it is reselling hardware and software on a rev-share agreement. It is so-much-not-involved with the product that it had to change its revenue recognition in the Dec 10-Q towards being an agent.

Working backwards from that fully grossed $422 in sales, if we use 66% as the share-agreement, then the company produced ~$200k in sales in 3Q for its AI product. It has stated at AI revenues are immaterial. You can also see that the company gave away warrants to the customer (which are included as a contra to revenue). I have no doubt that this Pilot is a sweetheart deal for Checkers (who I believe to be Customer D).

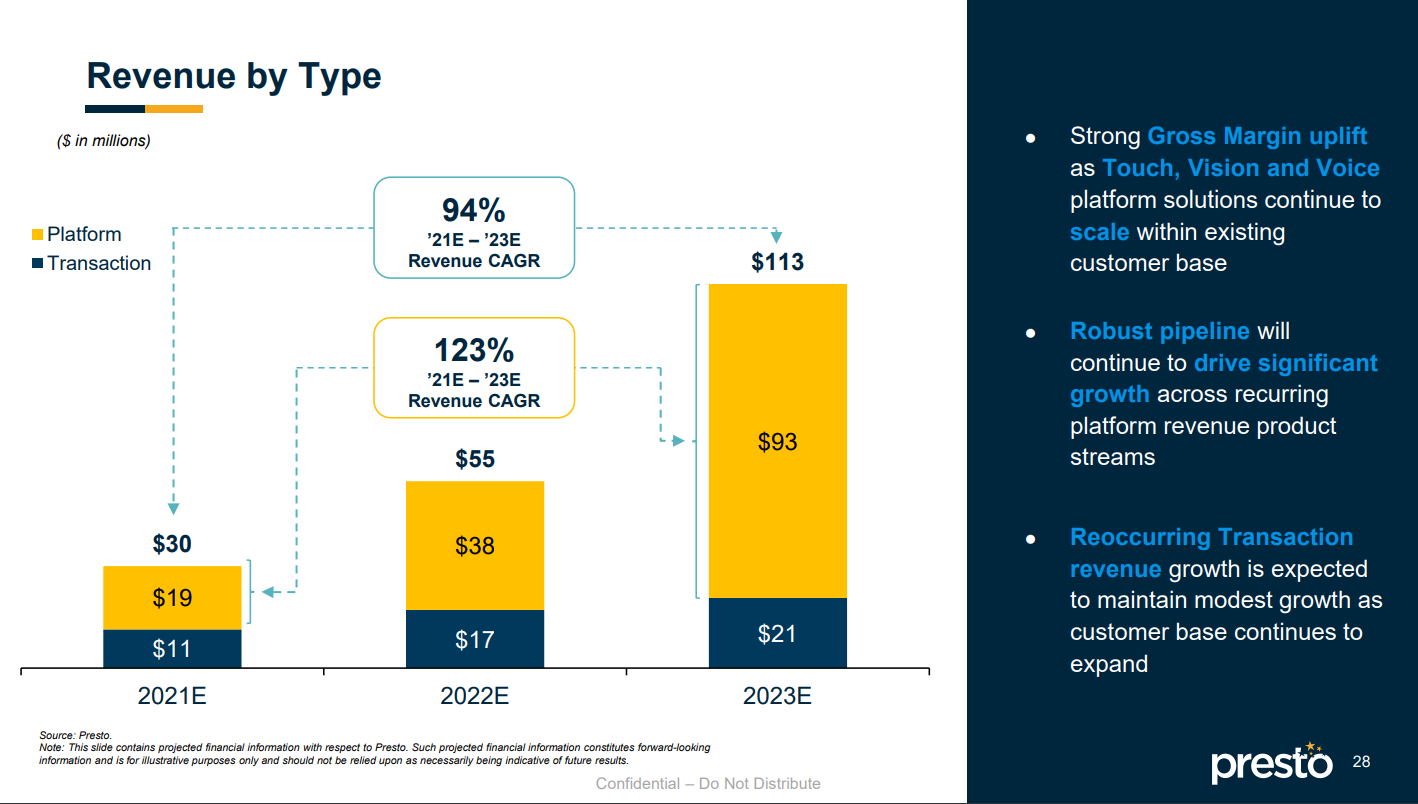

The SPAC deck projections are bogus. In fact, the whole SPAC deck is pretty funny. You can read it yourself. Here’s a snip. They said they’d do $55m in revenue for 2022 - they did ~$30m (missing by 45%).

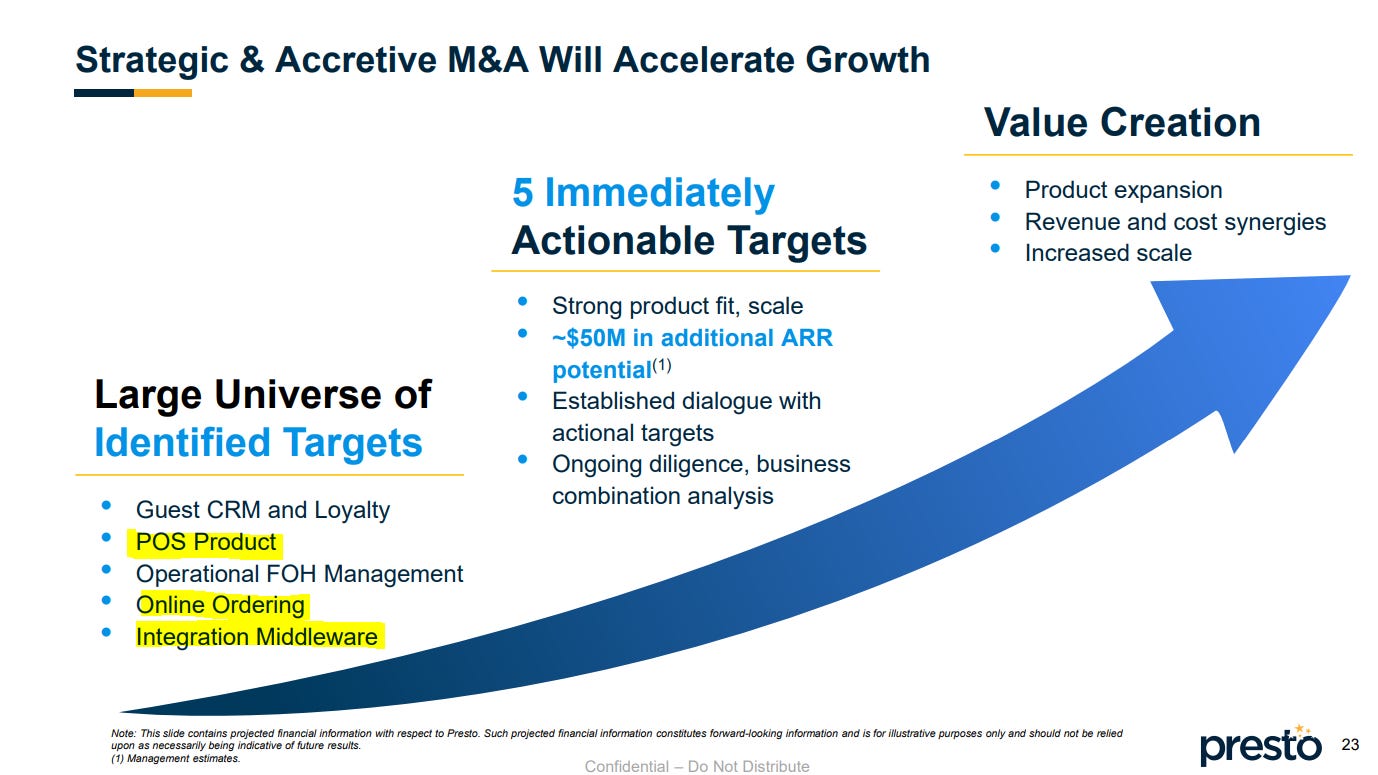

And any banker SPAC deck wouldn’t be complete without a roll-up strategy slide. Presto, the little tablet company, is coming for the restaurant stack! Beware, Toast.

Or a super inlfated comp table.. I cannot BELIEVE that this company listed with a multiple of 7x forward revenues (and, by the way, it missed that forecast by 45%).

Balance Sheet Woes

It’s probably a flag to see a high-growth AI company with 15% bonds. AI companies get money from VCs, not from 3rd rate lenders at 15%. It is especially concerning to see a high-growth AI company with an interest expense higher than its gross profit. But I digress….

As we know, the company was on its knees before the SPAC. It had ~$3m of cash in June 2022.

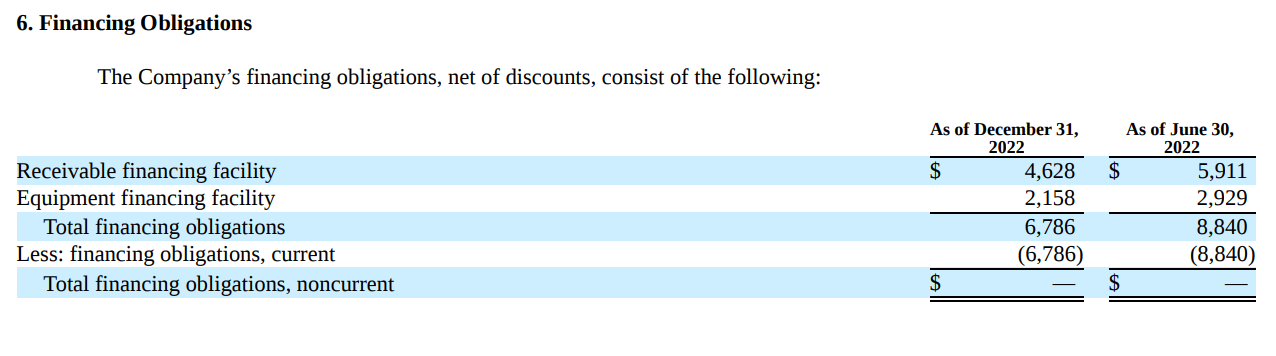

The SPAC gave it a lifeline, and it now was $38m of cash on the balance sheet. It has ~$6.7m of financial obligations (mostly receivables financing, and equipment financing tied to its leasing programe).

And then it has ~$52m of Term Loans. This is the credit agreement.

So they are borrowing money at 15%. It isn’t due until 2025, which is the only positive for them, unless they trip the leverage ratio or minimum cash covenant. The bad news is that the company will burn through its current cash balance in ~6-9months at the current rate. It will need further financing, and it will probably need to raise equity. Perhaps this explains why the CFO stepped down to take a different job in January.

Actions of other insiders also don’t instill confidence. Other than the ex-CEO of Red Lobster leaving the board, they recently announced a new Chief Accounting Officer - he is from Skillz. Not exactly squeaky clean, as Wolfpack Research points out. The CRO, Dan Mosher, has been selling shares.

I mean, cmon guys… the company has a damn going concern warning in its S-1. WHO is buying this shite? And WHO is paying 7x freaking EV/Sales for this shite?!

Summary

I don’t really know all so much about this business, but I’ve seen enough to decide that this it isn’t a good business and things aren’t going well. I think without that last-ditch SPAC, it’d have died.

If they prove me wrong and build a great AI enterprise, I’ll eat my hat and graciously take my losses. Until then, I’ll keep my little short on.

Disclaimer

Not financial advice. You should assume I have a position in all securities mentioned. All is opinion and not fact. Do your own research. I’m not a registered financial adviser.