Short Idea: SmartRent (SMRT-US)

Expensive, structurally unprofitable and a serious misalignment of incentives

This idea is very similar to Latch and in fact I found it reseraching Latch. This one doesn’t have as many accounting irregularities as Latch, but it has some other misaligned incentives and I think it is just as broken as a business.

This might be a bit short and messy because I don’t have enough time now that I have a real job again so apologies in advance. I have more detail so if you wanna chat about it, email me at guastywinds@gmail.com.

Point 1 - Structurally unprofitable business

SmartRent is similar to Latch. It is a “smart home SaaS” business. In many ways it’s actually worse because it has no proprietary products other than some middleware that ties 3rd party hardware together. It barely breaks even at a gross profit level, with a significant loss after operating expenses.

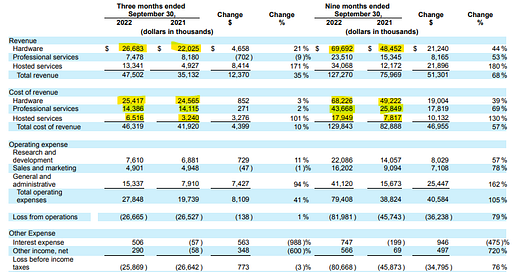

Gross Profits on hardware are ~roughly $0 give or take in a quarter - it is mostly reselling google/amazon. Gross margins on installation are roughly -75% to -100% depending on the quarter - they lose money on services. Hosted services (the “software”) is profitable on a gross level with ~50% margin, which is pretty crappy for software. The reason is because it’s not all software.

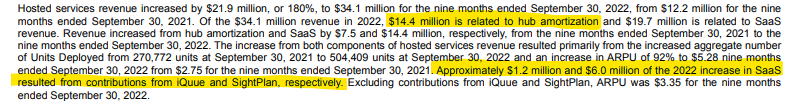

~40% of the hosted services is actually “hub amortisation” – which is the hardware box that you need to buy from them to get their software to work (it has the costs/GP of a piece of hardware). Also, the second highlighted point - ~$7.2m of the ~$20m in SaaS revenues is coming from some acquisitions that they did in early 2020. Whilst it may look like SaaS revenue has grown well in recent years and gross profit has expanded, it’s largely been driven by some high-priced acquisitions.

The other part is – almost all of their software revenues (similar to Latch) seems to be paid upfront (large deferred net revenue component of ~$90m on the balance sheet), so this ongoing software revenue isn’t actually cashflow, the cash has already been earned. So it’s not as if the company looks really unprofitable because it has costs upfront to win a long tail of profitable software cashflows. If they were to stop selling hardware and enter harvest mode, I suspect that they would have almost no cashflow at all.

Not all contracts are long-term so this is a little imperfect, but even if you add all of the deferred revenue in any given quarter to their booked revenue, the company is still unprofitable - suggesting that LTV to CAC is <1. It needs to keep growing to generate cash from software, but is burning cash faster than it can bring it in even when it gets large amounts paid upfront. Look at the deferred revenue in any given quarter:

In the last quarter, the amount of ‘revenue deferred during the period + revenue recognized from revenue originated and deferred during the period’ was the lowest that it has been in 8 quarters, suggesting that software deal closes are slowing considerably.

If the company slows its growth and takes costs out of the business, that doesn’t really help, as there is close to no cashflows from their software revenues. I’m 95% sure the business is just structurally unprofitable at a time when multi-family is coming under pressure and inflation + cap rates are causing developers to drag a fine comb over their costs. And by the way – it isn’t even really growing that fast. Revenues have been flattish in the past few quarters give or take – they’ve blamed supply chain, but even the backlog has been growing at just ~2-4% QoQ.

Point 2 - Follow the smart money! They’re running for the hills…

I’m reminded by a Munger quote - show me the incentive and I’ll show you the outcome.

All of SmarRent’s major customers are LPs of a Venture Fund called RET Management LLC, which owned 13% of the company as per Sep-22. RET even state here that 23 of SMRT’s customers are LP’s of their firm as of April 2021. In 2019, over 80% of SmartRent’s revenue came from just 2 customers - both LPs of RET.

According to the SmartRent Case Study from RET (dated April 2021), 82,000 of their installed units were brought by RET LP’s - that’s around 45% of all installed units. RET was even quoted as being instrumental in helping SmartRent grow by the CEO.

It’s interesting that Customer A and Customer C, who together made up ~40% of the company’s revenue in 1Q22 and ~29% in 2Q22, were both absent from the signficant customers like in 3Q22. We noticed a similar pattern with Latch, where key customers (who were also investors) began to stop purchasing, who we suspect was Tishman Speyer. It would suggest that both Customer A and Customer B’s revenue on a dollar basis declined by 30-50%+ over the course of two quarters. This decline could not be explained by customer concentration falling due to growth as it declined on a dollar basis.

It’s even more interesting when you consider that it coincides well with RET dumping its stock. Were RET selling because their LP’s no longer believe in the product, or were the LPs no longer buying the product because RET (indirectly, them) were exiting the investment? Cynical view from me? Yes. Coincidence? Possibly. Feels unlikely.

In fact, many of the company’s original backers have sold significant amount of stock - the biggest three being Bain Ventures, Spark Capital and Lennar who together owned ~25% of the company at IPO, and now a year later own 0%. They all seemingly dumped their entire stakes in 3Q22 after the 1-year lock-up finished. The above RET Ventures case study also quotes that Lennar invested “to scale its smart home technology for homebuilders and homebuyers.” Perhaps they have decided that it is no longer scalable.

Back to RET. They have a partnert on the board, his name is Frederick Tuomi. RET was a >17% owner in Sightplan through its venture fund. SmartRent bought it shortly after going public.

In early 2022, SmartRent paid mostly cash for the deal, and RET Ventures netted $22m. Tuomi also had a personal investment in some unsecured convertible notes. $135m was paid to RET Ventures for a company that did <$2.5m in revenue in the quarter than it was acquired. Not a cheap deal.

I’ll lay out the conflicts here and let the reader draw the conclusions:

The company’s investors, through RET, were indirectly responsible for almost 50% of its revenue, and they were influenced to use the product by RET. This is an obvious conflict. I’d imagine the conversation goes something like this:

“Hi, you now own this company called SmartRent in your venture investment with us. You should start using their product.”

“Oh, and by the way, they’ll sell you the hardware and services at a significantly negative gross profit”

RET, who was represented on the board and the majority shareholder, purchased another of its own portfolio companies in an almost all-cash deal, despite the fact that SMRT’s stock price was wildly over-valued at the time. They paid ~13.5x ARR + an earnout for it. In 3Q22, Sighplan’s revenue actually declined by ~7% QoQ which is very rare for a fast-growing SaaS business unless something is going wrong. They raised money from external shareholders in a company that they were a majority owner to acquire another company that they were also a majority owner of. This isn’t neccesarily nefarious, but there’s certinaly some incentive misalignment for the investors.

Okay Guasty, stop being so cynical and read the following excerpt from SmartRent’s recent disclosures:

Ahh, it’s all good - RET does not exert any control or influence on its LPs, so they don’t need to be disclosed as related-parties. Got it. But wait, from the April 2021 deck, wasn’t RET’s value-add that it added 23 strategic investors as customers?

So, here’s the huge misalignment of incentives, or what Charlie Munger would call the Lollapalooza effect - ‘a confluence of psychological tendencies in favor of a particular outcome.’

RET is incentivised to maximise their investment in Smart Rent.

RET’s LPs are incentivised to maximise their investment in Smart Rent. RET’s LPs have direct influence over SmartRent’s sales - some of which have very signficiant influence, as we’ve seen single customers accounting for 20-30% of sales in a given quarter. RET’s LPs are incentivised to buy SmartRent’s products. RET’s LPs are double-incentivised to buy SmartRent’s products becuase SmartRents sell them 3rd party hardware and installation services for less than it costs to procure.

The stock-market/investors/management teams are incentivised to maximise the valuation. Investors in tech businesses have been valuing companies on sales growth alone. Management is also incentivised (with annual cash comp) to maximise volume deployements, and there is no TSR incentive.

NOBODY. Yes, NOBODY - in this whole value-chain (atleast in the short-term) - is incentivised to make profits.

RET has created the perfect win-win-win machine.

You, as a start-up founder, get access to lots of customers instantly.

You, as an LP, get access to investments where you can influence the sales growth and ultimately your own investment outcome as a related-party.

You, as RET, get a high valuation and some juicy management fees by increasing the company’s sales.

Who loses? The retail investors who are holding the bag on the stock which will never make money because it was structurally unprofitable from day 1, but lack the skills neccesary to discern that. Also, the venture investors that didn’t get out quick enough because the market decided that it no longer only wants sales growth.

I don’t know if this was an enrichment scheme from day 1, or if management were genuinely trying to build a profitable business and just couldn’t get it to work. But it seems almost certain to me that this won’t be a large, profitable business.

Note - this is what happens when stock markets don’t actually incentivise anybody to make profit, including the shareholders and management.

Summary

Anyway, this is getting a bit long, so to summarise, you have:

Hardware sales, which make no money.

Services sales, which lose 50-100% at a gross level.

SaaS ARR of ~$32m (~35% comes form some small acquisitions they did recently of proptech start-ups, which saw sales decline in 3Q).

Then, you have ~$25m in operating expenses quarterly, or roughly $100m every year, for R&D, S&M and G&A.

Some pretty shady incentive systems that will probably lead to bad behaviour.

The company has a market cap of $570m. It has cash of $215m and no debt. So an EV of ~$350m. That puts it on ~11x EV/Sales of just the software business, and of course the company is losing substantial amounts of money from its installation services and operating expenses. It’s one of the most expensive software companies on the Nasdaq on those metrics.. and it loses ~$3 at the bottom line for every dollar of software revenue that it has.

In 2022 it will lose >$100m NPAT and burn over $100m in cash (unfavourable payment terms and inventory drag despite getting paid software mostly upfront). I suspect they’ll have to announce some cost cuts at some point. With only $215m in cash (will be ~$190m at Dec-22), the company has ~2 years of runway left at current burn. It seems increasingly likely to me that this either goes to zero or they need a big dilutive raise.

It’s a classic example of a frothy 2021 SPAC and the company should have never listed.

I think this it is worth $0 and I am short.

Are you sure that RET was selling shares and not just distributing them to LP's?