Accounting Shenanigans (SMRT-US)

Don't be fooled by the accounting gimmicks

Before reading, as I know I have a lot of new subs, I will refer you to my last post on SMRT for context. In it, I talked about the revenue recognition policy change that would lead to significant revenue growth in the coming quarters. That post is assumed knowledge for this update.

Accounting Irregularities and other potential shenanigans at SmartRent (SMRT-US)

Q1 Result

The significant revenue growth came through as predicted. Revenue grew by 74% YoY in 1Q23. However, when you dig deeper across the three revenue segments, you realise that the growth was predominately driven by revenue recognition changes to the new Hub. Underlying KPIs such as units deployed and units booked continue to be lacklustre.

Hardware Revenue

Hardware Revenue grew considerably both YoY and QoQ. When you look at the notes in the 10Q, you see that volumes increased 10% YoY (new units shipped), and ARPU increased by 56%. However, this isn’t price increases - it is all revenue recognition of the new Hub.

Actually, underneath the surface, growth is far more benign. Units deployed was just +8% YoY and Units shipped was +10%. On a forward looking basis, things look worse. Units Booked were -3.5% QoQ and -29% YoY. The business is not growing anywhere close to as fast as management wants you to believe.

Corresponding with the large increase in revenues, Hub Amortization in the hosted services line showed no growth QoQ as expected, and should decline in the coming quarters/years towards zero.

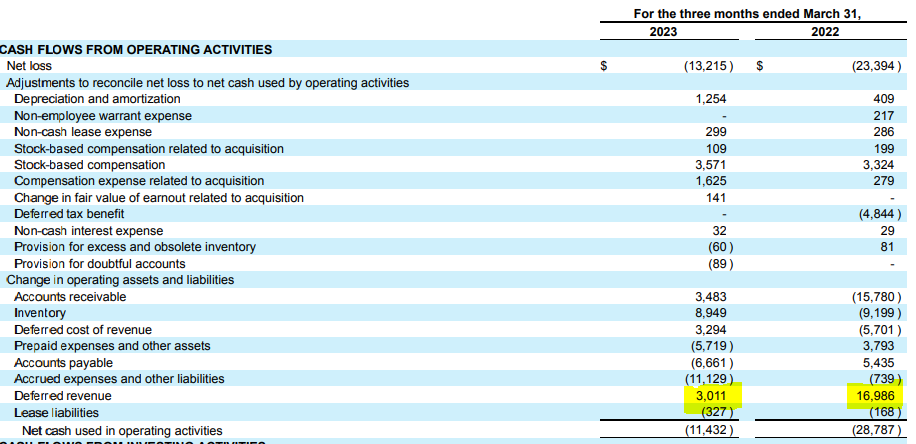

And as this is a purely accounting-related trick to show revenue growth, the cash impact for the company of this growth has been nil. As you can see below, the deferred revenues in the cashflow statement declined from ~$17m in 1Q22 to just $3m in 1Q23.

If we take the operating cashflows and exclude the impact of working capital, other than deferred revenues, the cash-burn from 1Q22 declined from ~$6.4m to $3m in 1Q23. We expect that the burn would decline some, given the headcount reductions that the company has made. The company would have to believe that it has increased profitability considerably with its huge YoY improvement in adjusted EBITDA.

I make this point to illustrate that this growth in Revenues and Edjusted EBITDA is nothing more than an accounting trick and has no impact on the company’s cash earnings or unit economics. It’s simply shifting revenue from deferred accounts to the I/S and has no impact on the CF statement. The slight improvement in cash-burn that we have seen has come from headcount reductions.

Professional Services Revenue

The professional services revenue isn’t really worth spending much time on. The GP fluctuates a lot with labour utilization and pricing. It improved some in 1Q23, which the company explains as better utilization and “customer mix”. I suspect that some customers get really cheap installation and some pay more. Ultimately the line is still seriously money-losing.

Hosted Services Revenue

Hosted Services Revenue increased just 6% YoY. As a reminder, this is amortized hardware (legacy, it’s now being shifted to hardware line) and the software business.

As expected, Hub Amortization was flat QoQ. Organic SaaS continues to grow roughly in line with units deployed. However, in my calculated ARPU, I see no signs of growth. I calculated ARPU by SaaS revenue divided by total units deployed in the field. It has been flat/declining in the last few quarters. Sightplan and iQuee remain flattish, showing little growth.

Total ARR is now $36m. So you have $650m of market cap, $450m of EV for a company with $36m in software ARR and losing money on the hardware/installation. And the ARR is only growing at the rate of hardware instalations, which are slowing. The idea that huge cross-sell is going to enable the software business to grow signficantly just isn’t playing out in the numbers.

Guidance

Rev Guidance for 2Q23 is $50-55m, which suggests a sequential decline. Below is the snip from the press release. The company has been volatile in the past, so it might well just be a timing issue.

Annual guidance remains unchanged.

Summary

I closed the short a few weeks ago heading into the print as I knew that this accounting gimmick was coming as outlined in my last piece and I didn’t think that the market had picked up on it.

Listening to the call/press release and looking at the 10-Q give you completely different perspectives on how the company is performing. Management’s accounting tricks are giving the impression that the company is accelerating and scaling, but really it is stagnating and still burning cash.

I will look to get back into the short, but I want to make sure I’m there once the cookie-jar benefits of accounting gimmicks begin to roll-off. It might be one to re-visit later in the year, as 2024 growth is likely to be very lacklustre with bookings declining and a full-year of accounting benefits booked in 2023. 2023 will show 50-70% growth, and then 2024 is likely to be no greater than HSD once we lap the accounting change benefits, which will likely be a rude shock for those who are blind to what’s going on here (seems to be most).

I’ll do another update in the future when I think the timing is right.