Carlisle 2Q - Thesis playing out

Margins holding in better than expected despite a worse-than-expected de-stock. Capital returns continue.

Carlisle downgraded sales for the year again on the back on extended de-stock and weather delays, much the same as was talked about last quarter. Given recent checks that I/peers had done, this was largely expected as I wrote about in my 1Q update.

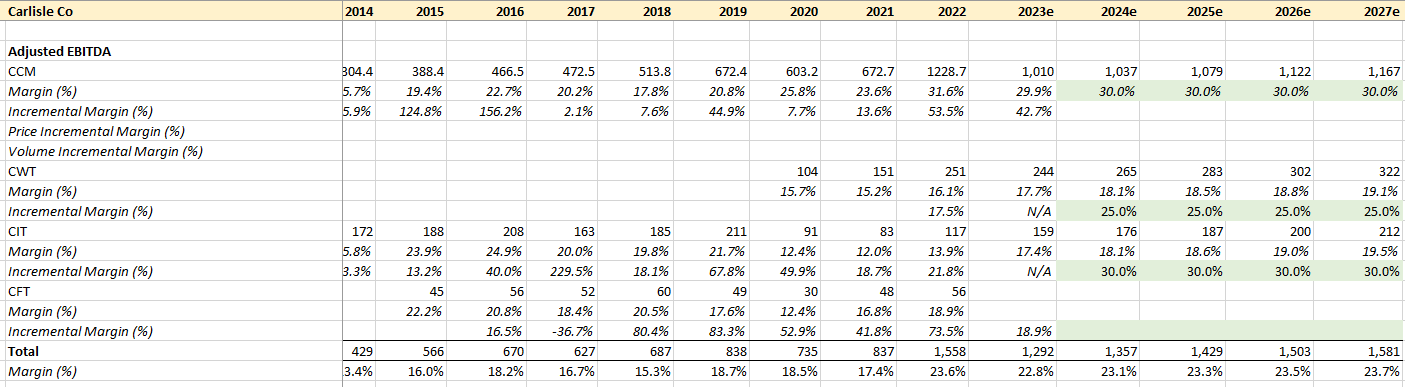

I’ve taken my EPS numbers down from $18.90 to $18.10 to reflect the lower sales, which was partially offset by and increase in CWT and CCM margins. It also reflects the impact of removing CFT EBITDA/using the proceeds to repurchase stock, which is relatively neutral from a financial perspective on the year.

That said, I’ve taken up numbers for 2024 and out based on (1) lower sales this year caused by destock means that 2024 will likely experience growth with the absence of destock alone, (2) strong margin performance at CCM and CWT has given me the confidence to underwrite 30% EBITDA margins at CCM in the medium term (I was previously being overly cautious).

That puts the stock at ~15x 2023e P/E after the recent run, which should be trough. For 2024e I’ve got ~$20 and ~$22 for 2025e. That puts the stock at ~14x 2024e and 12.5x 2025e.

I talked about the two main catalysts for CSL re-rating in my original piece as (1) proof of sustainably higher margins and (2) further portfolio rationalisation/capital returns. Both are underway, with CCM margins holding strong despite large volume declines, and the CFT sales/buyback. In 2024/5, we should get the sale of CIT and further affirmation that 30% margins are here to stay, which I think should see the stock re-rate to a high-teens multiple (16-18x P/E if fair in my view).

So, it isn’t quite the gift that it was given that part of the re-rating has occured, but if you put a 17x P/E on 2025 numbers, we get to a stock price of $375 - which is still upside of ~35% from the current price. I’m holding and will probably add a bit more here on confirmation that the thesis is working.

Paying subs can email me guastywinds@gmail.com for my updated model.

Points from call

As usual, I’m not going to summarise the result as y’all are capable of reading it yourself. Press release and earnings call can be found here.

I will just talk about a few points that I thought were important from the result.

CFT sale and return of capital - this happened intra-quarter, but it’s encouraging to see that management’s immediate response to the sale of CFT was to return cash stratight to shareholders instead of sitting on the cash and waiting for an acquisition. One of the concerns is that mgmt. incentives are not based on ROIC but instead sales and EBITDA, which risks high-priced acquisitions. Not much else really needs to be said - the financial impact was actually minimal - but signalling is positive and it’s further confirmation for the last 3-5 years that management are responsible stewards of capital.

Cyclical - the company continues to face cyclical headwinds from de-stocking and weather, but the worst seems to be done. The cpy. expects sales down low-teens this year, but 3Q will be ‘3-2%’ better than 2Q and 4Q should be up YoY given that the destocking started in 4Q22. Next year, on flat demand and absence of de-stocking, the CFO believes that sales would be up 10% (theoretically). I have modelled for sales of +2.5%. I build in some conservatism around what might happen to end-market demand and maybe a bit of price slippage. But I think we are set-up for 2023 being a trough year. If demand holds in, not only could we get the benefit of higher sales growth, but we might also see a re-stock. There is significant potential for upside suprise in 2024 and/or 2025. We need to have a really bad recession for sales to fall at CCM in 2024.

Margin Performance - really, CSL is all a margin story. Margin performance in CCM in 2Q was really quite impressive. With sales down ~15% YoY (all volume), CCM margins only declined from an all-time peak 33.3% to a still-respectable 31.2%. That’s a very impressive result for an industrial company and shows the strength of the company’s variable cost-base. It is also worth noting that we are now 3 quarters through a pretty violent de-stock - volumes in last 3 quarters have been -10%, -34% and -15% - but pricing has held in. Whilst we aren’t totally out of the woods yet on pricing, I am encouraged by the increased discipline that we’re seeing in the industry. CWT margins were also very impressive, increasing YoY from 18.5% to 22.5%. This was achieved in an environment with volumes down 20% YoY. The company continues to improve margins there post-acquisition, which is tracking ahead of the deal model, and also is seeing the benefit of its variable cost base too. Whilst it isn’t a massive needle mover, my LT margin assumptions for CWT are probably too low in light of this. I’m just going to leave the below snippet too from the call which highlights management’s confidence on margins.

CIT recovering - the company made some comments around improvements that CIT is seeing in both margins and sales. The business has undergone restructuring in recent years, and the backlog is now even higher than Pre-Covid. It is still under-earning relative to where it has been in the past. This improvement hopefully sets up the company for a sale in 2024, but we’ll have to wait and see.

Here is a high level overview of my assumptions as it stands. I think there is upside to both margins and sales growth in 2024 and beyond.