OLO was one of the most expensive IPOs in the recent era, listing at a EV/sales multiple >30x. It has since fallen to ~4x. It still looks rather expensive to me.

I am not short OLO. I am, however, short-OLO-curious. I am trying to figure out if OLO is a true platform, or a piece of middleware which is being disintermediated. This is just the start of my work (hence Part 1) - I haven’t reached a conclusion yet.. but there’s definitely a set-up here for a good short (I lay out at the end).

These are my high-level thoughts so far:

OLO was an an early mover, and in the right-place at the right time when Covid came.

Growth is now slowing. Some is cyclical, some might be structural.

Competition is intensifying and the tech stack is evolving, which may or may not be good for OLO

The payments business will drive revenue/ARPU growth but it will come with a much lower gross profit margin. The stocks is pricing in a lot of payments success.

The rise of OLO

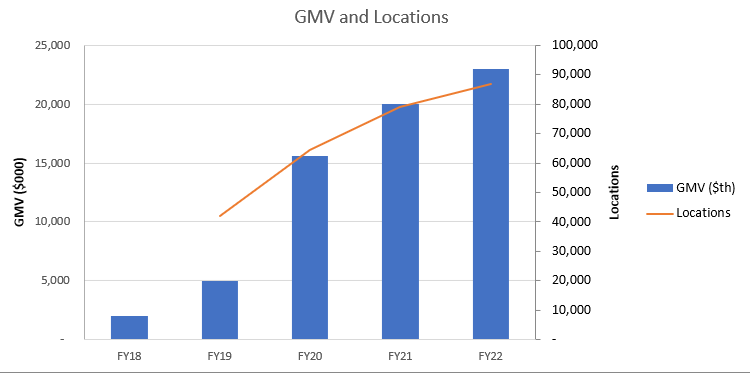

OLO was technically founded in 2005, but it hasn’t been around in its current form for that long. It was originally a SMS-based platform which was bootstrapped for a long-time in the days before cloud-software and smart phones were a thing. In 2014, it had just $100m in GMV. By 2017 it had $1bn and by 2019 >$5bn.

2020/21 was the company’s boom period, as can be seen below.

But even before Covid, OLO was growing well. The proliferation of e-commerce finally found its way to the hopstality sector, helped by online marketplaces and delivery service providers (DSPs). These 3rd parties started as a positive for the restaurants, but then became a threat with their high take-rates.

OLO rode the omni-channel wave by counter-positioning against the DSPs - somewhat similar to Shopify vs Amazon. It focussed on the enterprise market, selling to brands instead of individual locations to give brands a consistent online presence. It had some good success even before covid riding this trend with a good product and some good funding behind it.

The other phenomenon that aided OLO’s success is that the average restuarant tech stack is a white-hot mess. POS is a fragmented market. Majority of systems are still on-premise, and many large brands have franchise models, which may not have historically enforced strict standards around POS systems, meaning that franchise locations might run different systems across the portfolio.

OLO had a large suite of integrations (eco-system) which generally meant that it was better able to integrate into the disparate stack than others; a nice benefit of being a first-mover. Whilst many of the POS players didn’t have a native online ordering module back in 2020, this phenomenon od dispirate stack also made/makes it hard for the POS providers to sell online-ordering on a brand-wide basis (unless the brand has a brand-wide POS system).

Also, on-Prem POS providers have something of a reputation for not being the most tech-forward companies in the world. Being in the business of POS historically meant being in the hardware business, not the software business. This is only just now changing, very slowly.

OLO’s growth obviously accelerated through Covid - if you weren’t digital, you weren’t alive. As the leader, OLO saw a lot of this new business. It now has ~87,000 locations - nearly 30% of the enterprise restaurant market in the US. OLO was in the right place at the right time with the right product, and it did very, very well.

Despite this, trends have changed somewhat since early 2020.

Still growing, but slowing

Growth has understandably slowed in the business since covid. This is a function of (1) slowing trends post-Covid and (2) saturation of online-ordering. I also suspect that increased competition and belt-tightening are playing a role.

Locations Growth has slowed to ~10% YoY.

Ex-Wisely and Payments, which contributed ~$10m and ~$6m respectively in 2022, OLO’s core only grew at ~14%. ARPU (based on average locations, which is not a perfect measure) actually declined YoY when excluding payments and Wisely contributions.

In addition, the company’s guidance for 2023e ($215m in revs, on average cpy. has ~$5m of service revenue) would imply an increased of only 8-10% YoY for the core business depending on how you believe that Wisely will grow into 2023. Payments will contribute “in the mid- to high-teens millions for the year” according to management. That’s a significant deceleration.

The company is expecting to lose 12,500 subways next year (been disclosed), and add 6,000 locations excluding that. Subway was only on the Rails product, so had ARPU of ~1/3 or less of the typical customer. Hence, location count next year will drop by net 6,500, but revenue will increase by ~3% (if Subway was 1/3 of the ARPU of corporate average). So the company is also factoring in some decent increase in ARPU and maybe a bit higher growth in Wisely.

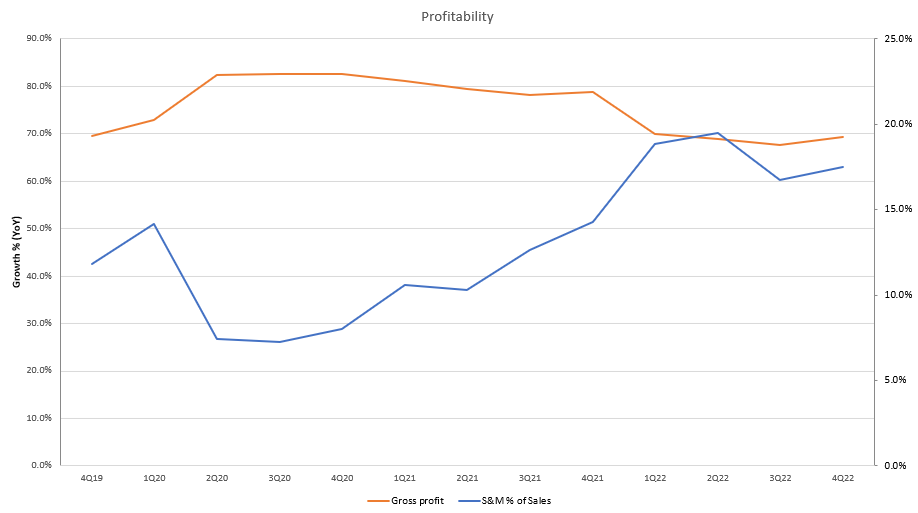

OLO’s profitability over time has also continued to decline, driven by a combination of higher sales & marketing costs + lower gross profit margins.

Acquiring customers has become a lot more expensive. In 2022, the company spent $33.5m on sales/marketing to add 8,000 locations. In 2021, it spent just ~$18m to add 14,700 locations. In 2020, it added 22,300 locations for $8.5m in spend. It is spending more and growing slower. Even Pre-Covid it was acquiring more efficiently - in 2019 it spent $6.3m to add 7,000 locations. In 2022 it spent ~5x more than 2019 to add just 14% more locations than it did in 2019.

And the non-payments ARPU growth, as we saw, has been lacklustre. The NDR tells a similar story. NDR has slowed signficantly post-covid. Some of this is the obvious post-Covid hangover of online-ordering.

The company discloses its revenues from Doordash (makes up a majority of its rails revenues), and that has been declining. In 1Q21 there was a one-off drop in Doordash revenues due to a renegotiation of the contract to much less favourable rates. Revenues from DD peaked in 4Q21 and have declined since. Part of this is explained by Subway coming off the platform. But a 107% NDR for a business which has effectively 0% gross churn is not so great.

The company has ~87,000 locations, and claims that there are ~300,000 enterprise locations. However, just the top 20 brands in the US account for ~90,000 locations. OLO only has 5 of those customers from what I can see - others are either with competitors or build their own tech stack (mostly the latter). When you consider that, the total market is much smaller, and OLO’s true addressable market share is arguably much higher.

Customer additions have become more and more incremental. In 4Q, the company appeared to add just two large customers - one, a virtual kitchen that added rails for 800 stores (rails has a low ARPU), and one Kroger, which added OLO functionality for their sushi and floral shops in 1,600 locations. In 3Q, they added a number of smaller restauarants with ~200 locations, and one with 900 locations, plus a few convenience stores.

This explains why OLO has been pushing into the “emerging enterprise” space (20-100 locations - much more competetive) and C-Stores. At next years rate of 6,000 locations, OLO will be growing at ~HSD on a locations basis. It’s nothing to balk at, but the company’s growth rate has certainly slowed. And when you consider their market share, you’d have to think that they are starting to bump up against limits in a market which should be saturated.

Consider the competition, too. The emerging enterprise/SMB space has been brutally competitive, with dozens of competitors. OLO is a clear leader in the large enterprise space, but it isn’t a monopoly. There are middleware competitors out there like ItsaCheckmate, Onosys, Otter, Deliverect, Cuboh, Mobi2Go, LunchBox, Novadine, etc. They tend to play more in the ‘emerging enterprise space’, which is ~10-100/200 locations. And then there are a bunch in SMB like Chowly and ChowNow. However, some of them have done larger deals and aren’t so small. ItsaCheckmate, for example, has >20,000 locations, including some inspire brands. Onosys has some large customers too, with >200 location brands like Jack’s and Pizza Inn.

As the largest deals run out, OLO is going to have to go fishing in the more competitive ponds, which we are already starting to see in both the brands that they are adding, and the sales expenses/new location.

Locations are slowing, and ARPU/NDR have been relatively lacklustre. Without a doubt, part of that has been a return to more in-store dining. The question is - can they re-accelerate ARPU/locations, or is there something more structural going on?

Competition is increasing and the tech-stack is evolving, rapidly

OLO’s original 3 key products were Online Ordering, Dispatch and Rails. Online ordering is a white-labelled website for ordering that syncs into the POS. Dispatch is white-labelled delivery product using the DSPs (see here). Rails is essentially a middleware layer that connects the DSPs into the POS (so that restaurants don’t have to have multiple tablets and reconclie data afterwards.)

Let’s start with its core product - Online Ordering. There are a couple of points to make.

Firstly, the online-ordering product is now a commodity. OLO’s lead in integrations has been bridged, and making an online-ordering website is not hard to do. Go check one of these things out - they’re very simple. I accept that it needs to be enterprise grade and integrated properly, sure, but there is nothing special about what they are doing. Anybody that sells software to restaurants (lots of them, by the way) has an online ordering module. Whilst most of the new cloud point-solutions are focussed on the SMB/Mid-Market, the products are more-or-less the same. Some checks I’ve done even suggest that OLO’s tech is actually worse than some competitors, given it is so old. There are 10s, if not 100s of options out there from both point solutions and POS providers.

The next point: there is a convergence occuring in the stack. Payments, POS software, back-of-house software, delivery and marketplace tech-integration, point-solutions such as online-ordering, reservations and loyalty as well as data-solutions such as CDPs and marketing (CRM) are all coming together. There has been a TON of M&A.

New players like Toast have been a big driver of this, offering a total bundled platform where the restaurant can do/see everything from one place, though the key reason is that restaurants are increasingly omni-channel. Once upon a time, you went to a counter and paid someone cash for an order, and that was it. And so the POS was just a cash register with a screen. That isn’t the case anymore, and it doesn’t make sense to silo data/software functions.

This has forced everyone in the industry to try become a platform. The old-school POS players like NCR Aloha now have a full line-up of products. Check-out Aloha essentials, for example. It took them a while - they only released the product in 2019 and only released a proper cloud product in 2022. But it’s here now. See below for example of what Aloha Essentials now gives you.

And Aloha Essentials has been growing rapidly. I only have data up to 2021 (last disclosed).

The payments players have pushed into the POS space with acquisitions too, such as Clover (owned by Fiserv through First Data deal), XPIENT (owned by Global Payments, now Heartland), BRINK (owned by PAR Tech) and FuturePOS (now SkyTab, owned by Shift4 Payments). They’ve all been hard at work beefing up their software stack.

Clover was late to online ordering, only adding it in 2020. They have progressively added products. Their line-up is now pretty comprehensive.

PAR has added loyalty/CRM (2021) and ordering (2022) to its line-up for the Brink POS platform - it is building a full platform. SkyTab also all has a comprehensive line-up - it released online ordering in 2020. This is what’s being called the unified commerce platform (PAR has a pitch for it here), and it’s a relatively new concept.

As the pandemic burst onto the scene, guests rapidly demanded new ordering modes and brands added lots of point solutions (like OLO) around their POS, continuing to build on top of an already shaky foundation. But it wasn’t about building a nice stakc, or even price - it was about survival.

Each new order channel introduced different data repositories, incompatible data silos and additional complexity. Most of the POS providers didn’t offer online ordering back then (as we can see above). For large restaurant brands running on outdated client-server technology (while also supporting a myriad of digital order channels), the situation is untenable. Even though some have moved to the cloud, many brands are running on first-gen cloud architectures that mirror the challenges of legacy client-server technologies.

Even integrating different solution providers brings only small relief for restaurants, because after the integration is done, restaurants are still left to deal with multiple technology vendors, each having its own support services, invoicing, communication, training, deployment and solution development patterns and roadmaps.

The omni-channel trend is here and it isn’t going away, with many brands for example trialing pick-up only concepts (and here) to match demands from customers around how they want to get food. As the lines blur between channels, it’s going to become increasingly important for brands to harness data in a way that is useful. The latter point is especially true as brands are fighting to build direct relationships with customers as DSPs are also vying for that relationship (and keeping their data).

Interestingly, the 2023 state of digital report from QU, which is a survey of ~30,000 restaurants, showed that focus on online order has fallen quite considerably between 2022 and 2023, which likely shows saturation. In-Fact, online ordering was a clear #1 priority in 2019-2022, and not in the top 3 for 2023.

In-fact, Cloud Pos was a clear #1. In 2019, the survey found that only ~30% of participants were Cloud v.s. on-prem. It’s crazy to think that, but it’s likely that well more than half of enterprise restraunts are still hosted on-prem.

I don’t want to draw conclusions from a single survey, but it makes sense. Everyone has online ordering now, and it would appear to be at or close to saturation point. And you can see that in OLO’s slowing numbers. Whilst OLO is still winning customers, it’s mostly winning customers from legacy solutions (mostly home-grown) as opposed to greenfields, and it’s happening at a much slower pace.

The current system of archaically stitching together point-solutions, to me, doesn’t seem sustainable, and the industry is focussing on transitioning to the cloud. It is also expensive and inefficient to have multiple of these point solutions. So were does OLO fit in all this? If my POS provider now offers online-ordering (at a significant discount to OLO) as a add-on module for cheaper than I am paying, and I am transitioning the POS to the cloud, do I still need to pay a high price for OLO?

Transitioning to the cloud is hard - I don’t want to understate that. And it is also why the disruptors have focussed on SMB. Not only for the obvious reasons but also that it requires a replacement of hardware, which is very expensive for thin-margin businesses. So it will take time. But it will happen, slowly but surely, and we can see that it’s starting. There are long-term benefits both in cost-savings and data-usage to cleaning up the stack.

OLO bulls will make two key arguments. Firstly, the legacy players’ tech still sucks. That has some merit. I can’t prove or disprove that and would need to do some checks. My sense is that Aloha it isn’t all that bad. When you look online, there are many that like Aloha. And it also has a strong presence in servicing/distribution (for larger multi-unit restaurants, integration/support is generally done by a 3rd party who needs to get trained with a specific player). Alot of what OLO offers is commodity and provided by others.

Also - yeah, if you’re running a 15 year old on-premise software programme on windows XP, it’s probably gonna suck. POS is also something that people love to hate - you either don’t think about it (because it’s working), or you hate it, because it made you embarrassed when it stopped working infront of a line of impatient customers.

The second point is that even though NCR Aloha might be able to offer online-ordering, the restaurant chain is using 5 or 6 different POS systems across the brand, so OLO is still needed to tie it all together. This has certainly helped the company grow. I actually don’t know how true it is that most tech-stacks are disparate, it’s something that OLO talks about a lot, but have never actually seen any data. It’s something I’d like to understand a bit better. In a few checks I have done in the past, it did seem common. But I just don’t really know if it’s 20% or 50% or 70% etc.

However, the latter becomes irrelevant if the industry goes through a large re-platforming at some point in the future - likely during a cloud-transition. It’s happening in the SMB space - just look at Toast, Lightspeed, TouchBistro, etc. In the past, when there were no online channels and data to be collected from credit cards, it didn’t really matter if everyone ran a different on-prem POS, as long as it could all feed data to a central accounting database. So you probably choose the POS based on whoever had more service-distributors in the area. I read anectotally on a message board somewhere that there are ‘Micros towns’ and ‘Alhoa towns.’ This has changed somewhat, and surely at some point in the future brands will see the neccesity to clean up their tech stacks.

I think that most will agree that trying to connect everything in/around the POS causes bloated, over-engineered POS systems. Constantly adding on expensive point-solutions doesn’t seem like the answer.

Beyond Online Ordering, it looks even worse for OLO. Rails is being disintermediated. Doordash, Uber Eats, etc. have been hard at work building integrations directly into POS. Subway built an integration and dropped OLO altogether across 12,500 locations. Why? Well, OLO’s revenue model is that they charge the DPSs. This is because DSPs have to pay significant upfront costs for tablets to send to their restaurants, so they are incentivised to bypass rails. This will take time as building these integrations is hard, but they’ll slowly get there. Also, they’re connected to a dozen other aggregators, too - OLO doesn’t do anything special, and some aggregators have even more integrations than OLO. Infact, OLO recently bought one (Omniovore) because it had a bunch of integrations that OLO didn’t have.

Dispatch is also being disintermediated. All of the delivery drivers have white-label delivery products and have been announcing deals either directly with brands, or with POS systems to integrate into new products. None of this is proprietary to OLO and both of these products, whilst originally innovative, are now a commodity. That’s not to say that people will switch off OLO - but it probably means that OLO doesn’t have pricing power.

So, that brings us to OLO’s dilemma: Is OLO a platform of the future, or a point solution that fixed a short-term issue? Does OLO do anything really well that can’t be replicated by others? With the tech-stack converging to a single unified platform, what is OLO’s role? Do customers care enough about OLO to keep them around at premium pricing as they reasses their stacks?

Reforming retail wrote a really interesting piece on this recently. Below is a quote from an enterprise operator.

One thing is for sure - OLO will survive in one shape or form in the future for a long time. This is a sloooow moving industry. Many of these customers are too small and under-resourced to worry too much about this stuff - OLO works, just leave it.

But to buy OLO’s stock today, you need to believe that there is still quite a signficant amount of growth ahead for the company (numbers later..). I’m just not convinced that is the case.

I need to chat to some customers and do some checks. That’ll be the focus of Part 2.

Everybody loves payments! But what are they worth?

I’d love to sit here and hang shit on OLO for being a sheep and limping into payments, but they do make one good case for borderless payments. Bascially, the idea is that because OLO has huge share in the restaurant space, they can create a borderless payment environment between all of their brands and 85m customers that interact with the brands. That means if I made an account and left my card on file when I bought Maccas, it will be there when I go to buy Five Guys next week. I’m not really a payments expert but I believe this is also a key premise behind Shop Pay (I stand to be corrected).

I don’t really know how unique that is to OLO Pay or if it can be replicated with other payment processors. Like I said, I’m not a payments expert. But I know that friction is important.

There are three reasons why I was originally skepitcal about OLO Pay. Firstly, unlike Toast, OLO serves large customers who would have the scale to achieve lower payment processing terms - there is no way that OLO will have Toast’s margins servicing customers like Dennys and Wendys. Secondly, unlike the POS which is the centre of the universe for a merchant, OLO is just an add-on. Merchants already have a payment processor - why would they change to OLO, other than if not for price (see above - maybe there is merit to that - but it’d still have to be price competitive). Thirdly, whilst the company has GMV of $23bn, much of that doesn’t neccesarily go through native payment processing. If you consider rails, for example - that order is technically executed on the OLO platform - it’s done on the Dash marketplace. It’s unclear how much of the GMV is transferrable to GPV, but it isn’t 100%.

But lets just say that, for arguments sake, OLO Pay is amazing and the large merchants are happy to pay the same price as Toast’s merchants, and OLO can make the similar margins (15% vs Toast at ~20%, but Toast has >4X GPV). Shop Pay is now at ~56% penetration, which has taken ~6 years. That is up from 43%, 49% and 54% in 2019, 2020 and 2021. It has been growing at ~5% pretty consistently.

ShopPay is probably an easier sell, because the merchants likely don’t have pre-existing payments relationships with really attractive rates (they are small). OLO really ought to be a great customer experience.

But lets just assume for a second that it is, and that the company can get to 50% penetration within 5 years and grow ARPU at 4% P.A. And then lets say that it achieves nearly the same economics as Toast on payments (240bps of interchange at 15% GP margin). And then lets say that OLO grows at 10,000 locations in 2024, and then 8,000 every year after that (remeber than next year it loses 12,500 subways, adds 6,000 others for net 6,500 loss).

As for operating expenses, it’s very hard to know how/if this company will scale. Since 2020 it has shown nothing but dis-economies of scale (likely due to competition forcing it to spend more on sales and R&D). In 2021, gross profit grew by 49% whilst operating expenses grew by 130%. In 2022, gross profits grew at 8% whilst operating expenses grew at 23%. Sales and operating expenses grew ~in-line with eachother, but gross margins came under pressure through a mix of (1) payments penetration and (2) more hiring.

So let’s say that the company, from here, grows its operating expenses at ~1/2 the rate of its software revenues (completely arbitrary but shows it can scale). It had ~$173m of operating expenses in 2022 including stock-comp but excluding some one-offs. Software revenue over this period (2022-27) increases by ~80%, so opex will grow by ~45%. This gives us the below outcome:

What I’ve outlined here is pretty much a best-case scenario for the next 5 years. OLO Pay smashes it out the park, cross-sell continues with a decent ARPU increase and locations re-accelerates from +6,000 in 2023 (+8,000 in 2022) to +10,000 in 2024 and +8,000 every year after that to grow at a really healthy rate (to the point that OLO would gobble up pretty much all of the addressable market left).

Then the business finally starts to get some scale on its cost base. It adds nearly $160m of gross profits in this scenario over 5 years, with incremental expenses of just $70m - pretty good incremental return on capital.

The outcome is pretty measely - $52m in operating income for a company with a capitalization of ~$1.2bn (Cash of ~$400mish). So call it an EV of ~$800m. So if things go really, really well, we get to a touch below 15x 2027e EBIT. That’s pretty punchy when MSFT is walking about with a ~20x EBIT multiple.

So you either gotta really believe that the company can rip a bunch of costs out and stay competitive (feels hard with the current rate of increasing competition), or that OLO Pay can penetrate well in excess of 50%. Either way, you’re paying for a lot.

Summary

This is why I hate people saying “you looked at software for a year and everything is down 80%, so must be finding so many bargains!”

No - these things still aren’t cheap. In fact most are still very expensive. This is why I am so attracted to shorting right now… there are so many stocks than can easily go a lot lower, or are likely to go sideways for a long time. OLO is still pretty much pricing in the world at the current price (god knows what it was pricing at $45), despite the potential headwinds against it.

I’m not ready to make a decision yet but there’s a set-up here for a decent short.

A good set-up here looks like:

Locations growth continues to slow.

OLO Pay penetration rates are slower than expected.

We start to see more customers leave OLO, or confirmation from the channel than people are looking hard at their stack and how they can clean it up/take out cost.

More to come in Part 2….

In my experience, it's not too common for restaurant brands to use different POS systems. Typically, you'd only see this for franchised locations in venues that require that different POS systems, like hotels or airports. Sometimes, a company that franchises many restaurant brands will have their own POS of choice, which might be different than the one any particular brand uses. The only other time I've seen it is when a brand is testing a new POS in a very limited set of locations, or when they have a concept sufficiently different from their main one, where a different POS is a better fit.

Great Research